1 Year After Bitcoin Halving: What’s Different This Time?

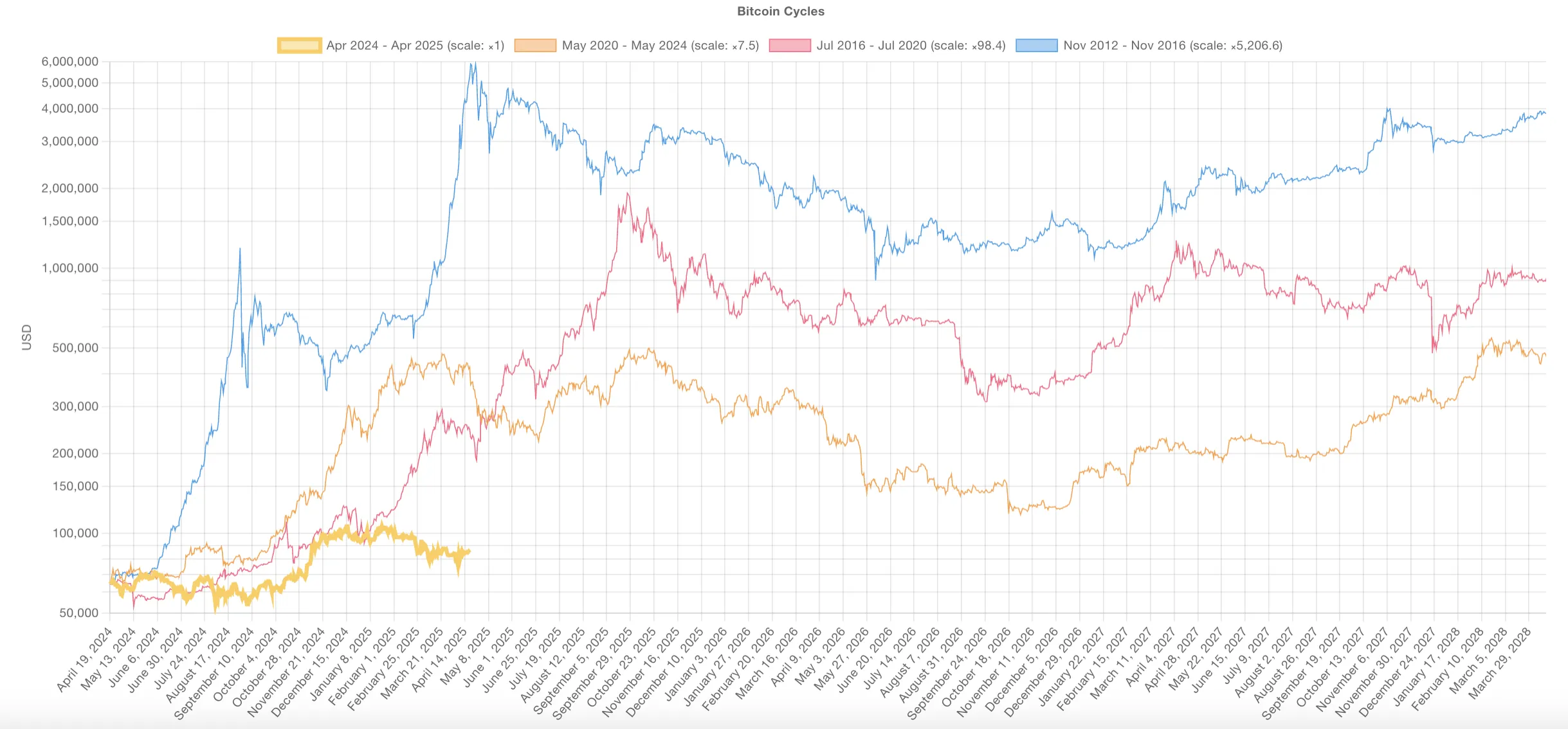

Bitcoin (BTC) is now a year after its last reduction in half, and this cycle is coming to be different from all. Unlike the previous cycles where explosive rallies followed the reduction in half, the BTC experienced a much deaf gain, up 31%, against 436% on the same period during the last cycle.

At the same time, the metrics of long-term holders such as the MVRV report report a sharp drop in unpaid profits, pointing to a maturation market with upward compression. Together, these changes suggest that Bitcoin could enter a new era, defined less by parabolic peaks and more by progressive growth and focused on the institution.

A year after the reduction of half of the bitcoin: a different cycle from any other

This Bitcoin cycle takes place significantly differently from the previous ones, signaling a potential change in the way the market reacts to events in half.

In previous cycles – notably from 2012 to 2016 and again from 2016 to 2020 – Bitcoin tended to rally aggressively around this stage. The post-launch period was often marked by a strong rise in the rise and parabolic action, largely fueled by the enthusiasm of retail and speculative demand.

The current cycle, however, has taken a different route. Instead of accelerating after the reduction in half, prices overvoltage began earlier, in October and December 2024, followed by consolidation in January 2025 and a correction at the end of February.

This front loading behavior differs strongly from historical models where hacks generally acted as the catalyst for major gatherings.

Several factors contribute to this change. Bitcoin is no longer just a speculative active ingredient focused on retail – it is increasingly considered as a maturity financial instrument. The growing involvement of institutional investors, coupled with macroeconomic pressures and structural changes on the market, has led to a more measured and complex response.

Another clear sign of this evolution is the weakening of the force of each successive cycle. The explosive gains of the first years have become more difficult to reproduce as the market capitalization of Bitcoin has increased. For example, during the 2020-2024 cycle, Bitcoin had climbed 436% a year after the reduction in half.

On the other hand, this cycle experienced a much more modest increase of 31% compared to the same period.

This change could mean that Bitcoin is entering a new chapter. The one with less wild volatility and more stable long -term growth. Half reduction may no longer be the main driver. Other forces take over: rates, liquidity and institutional money.

The game changes. And the way Bitcoin also moves.

However, it is important to note that the previous cycles also included periods of consolidation and correction before resuming their upward trend. Although this phase may seem slower or less exciting, it could always represent a healthy reset before the next movement above.

That said, the possibility remains that this cycle will continue to diverge historical models. Instead of a dramatic summit, the result can be a more prolonged and structurally supported rise – less motivated by the media, more by the fundamentals.

What MVRV long -term holder reveals on the Bitcoin maturation market

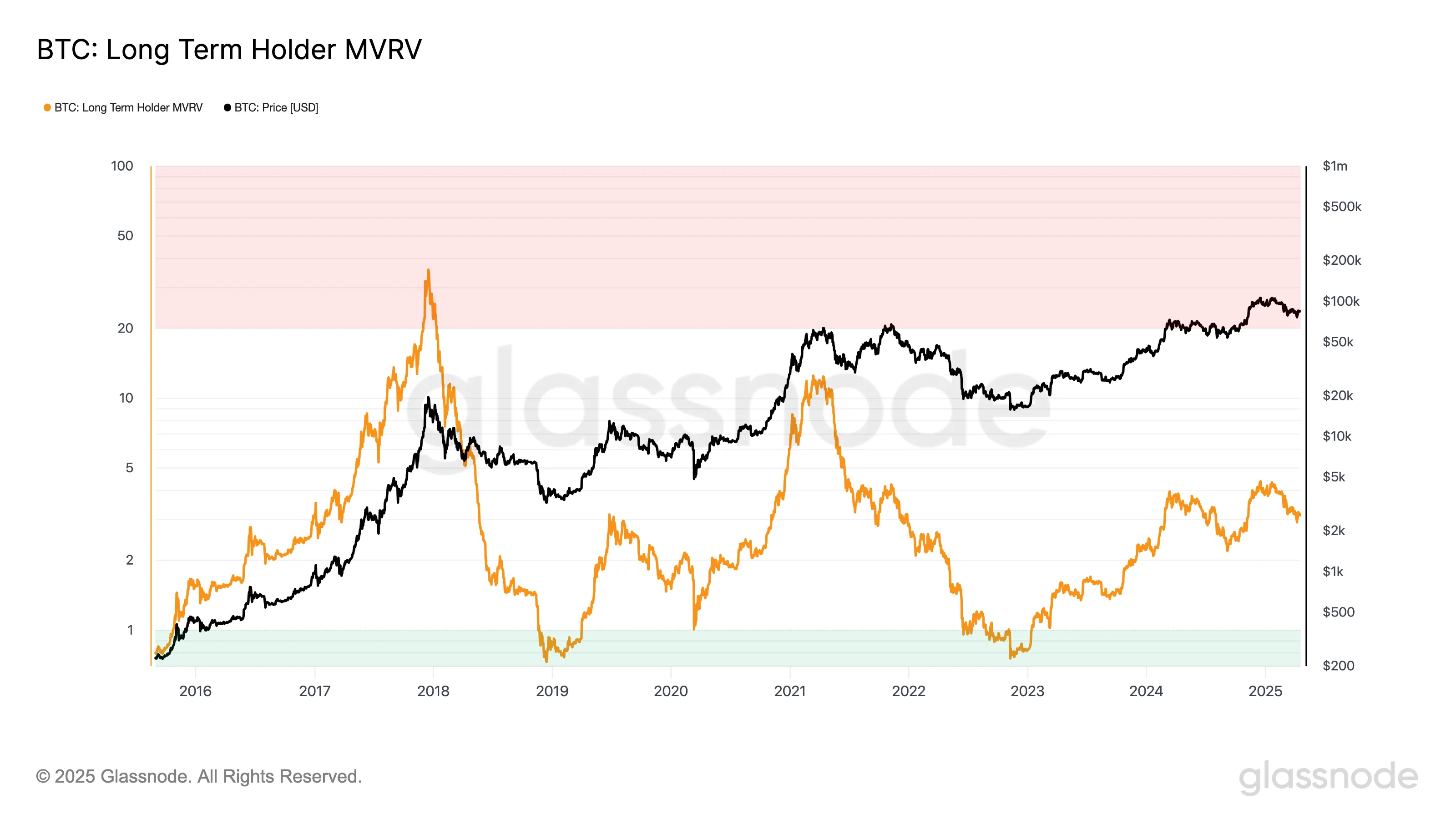

The MVRV report of the long -term holder (LTH) has always been a solid measure of unpaid profits. This shows how long -term investors are sitting before starting to sell. But over time, this number falls.

During cycle 2016-2020, the LTH MVRV culminated at 35.8. This reported massive paper benefits and highlight training. During the 2020-2024 cycle, the peak fell sharply to 12.2. This has happened even if the price of Bitcoin has reached new heights of all time.

In the current cycle, the highest LTH MVRV so far is only 4.35. It is a massive drop. This shows that long -term holders do not see the same type of earnings. The trend is clear: each cycle offers multiple smaller ones.

The explosive increase in Bitcoin is compression. The market matures.

Now, in the current cycle, the highest MVRV reading has been 4.35. This austere decline suggests that long -term holders are experiencing much lower multiple on their assets compared to previous cycles, even with a substantial price appreciation. The reason indicates a conclusion: the rise in bitcoin is compression.

It’s not just a stroke of luck. As the market matures, explosive gains are naturally more difficult to find. Multiple days of extreme profit and cycle can be discolored, replaced by more moderate growth – but potentially more stable.

A growing market capitalization means that more capital is needed to significantly move the price.

However, this is not definitive proof that this cycle has already exceeded. Previous cycles often included prolonged periods of lateral movement or modest withdrawals before new summits were reached.

Institutions playing a more important role, the accumulation phases could expand longer. Therefore, maximum profit taking can be less steep than in previous cycles.

However, if the downward trend in MVRV peaks continues, this could reinforce the idea that Bitcoin is moving away from wild and cyclical overvoltages and towards a more moderate but structured growth scheme.

The sharper gains can already be late, especially for those who enter the cycle late.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.