Solana Leads Blockchain Metrics as SOL Momentum Builds

Solana (soil) continues to show force on several fronts, maintaining an upward structure on its table of the Ichimoku clouds while gaining momentum in key measurements of the market. The Bbtrend indicator has increased again, signaling a renewed purchase pressure after a short recharging time.

The chain activity remains strong, Solana leading all the blockchains in volume dex and dominating the generation of costs thanks to the explosive growth of the parts even and the launchpad activity. With soil which is now negotiating above a level of key resistance, the path is open for more increase, although a loss of momentum could always trigger a retest of the lower supports.

Solana maintains an upward structure, but the dynamics face a key test

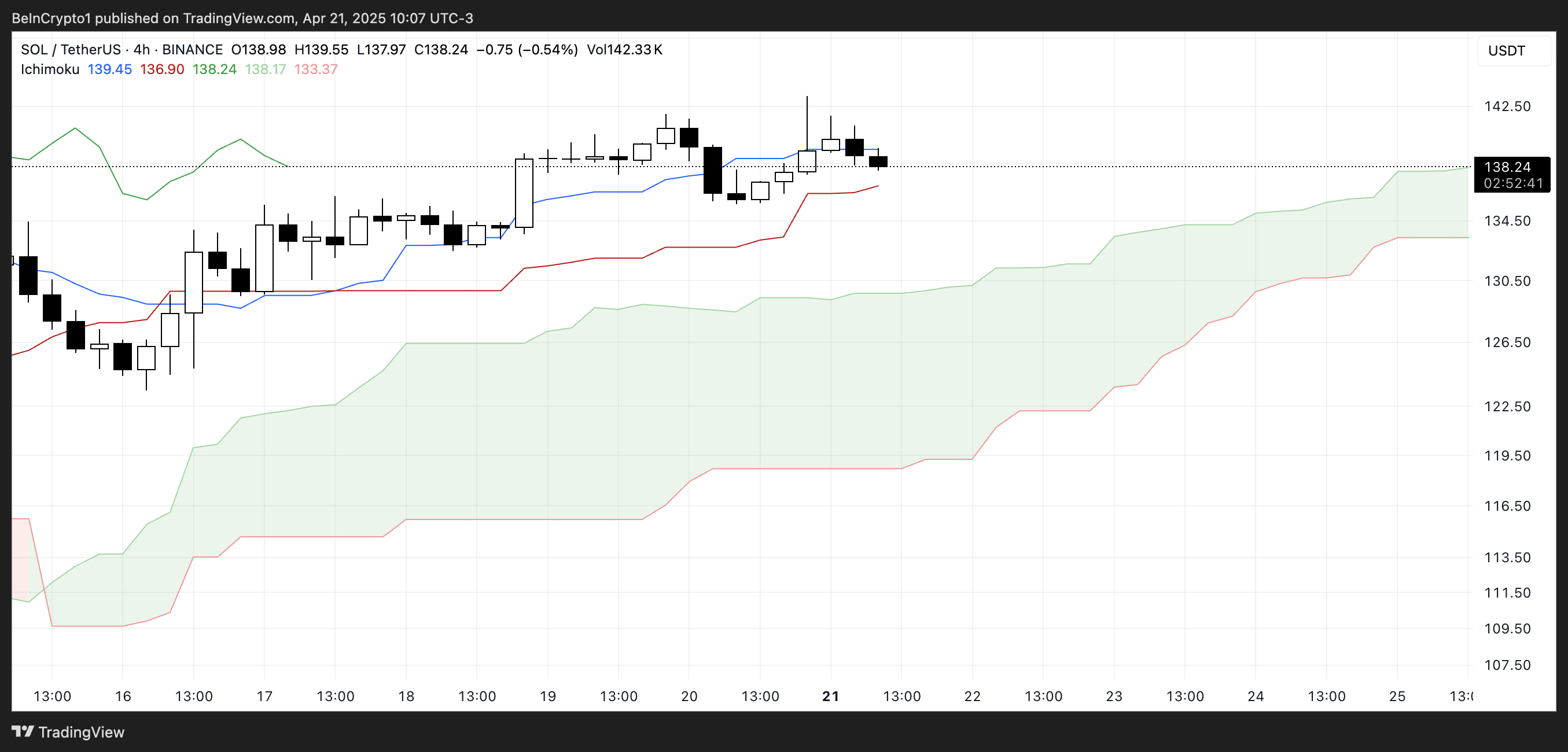

On the Ichimoku cloud table in Solana, the price is currently higher than the Kijun-Sen (red basic line) but has dropped under Tenkan-Sen (blue conversion line), signaling a weakening short-term momentum.

The tenkan-sen’s flattening and the behavior of the prices suggest a possible consolidation or the first stages of a decline. However, the price holding above the Kijun-Sen, medium-term support remains intact.

The overall structure of Ichimoku remains optimistic, with a thick and rising cloud and a range of the scope well above B-indicating a strong underlying support.

If Solana finds support for the Kijun-Sen and goes back above Tenkan-Sen, the upward trend could resume strength; Otherwise, a test of the upper limit of the cloud can follow.

Meanwhile, Bbtrend de Solana is currently at 6 years old, extending almost ten days in positive territory after having culminated at 17.5 on April 14. The recent increase of 4.26 to 6 suggests an upward impulse renewed following a short recharging period.

Bbtrend, or Bollinger Band Trend, follows the strength of the price movement based on the expansion of Bollinger Band.

Positive values such as the current a point towards an active positive trend, and if the BBTREND continues to increase, it could point out a stronger momentum and a potential for another movement upwards.

Solana dominates the volume of Dex and the generation of costs while coins stimulate the growth of the ecosystem

Solana again claimed first place among all the channels in volume dex, recording $ 15.15 billion in the last seven days. The Combined Total of Ethereum, BNB, Base and Arbitrum reached $ 22.7 billion.

In the past 24 hours only, Solana experienced $ 1.67 billion in volume, largely fueled by its ecosystem booming in money and the current launch battle between Pumpfun and Raydium. Adding to this good dynamic, Solana recently exceeded Ethereum in market capitalization.

Regarding the application costs, Solana’s momentum is just as clear. Four of the ten main applications generating costs in last week – Pumpfun, Jupiter, Jito and Meteora – are focused on Solana.

Pump leads the pack with almost $ 18 million in fees.

Solana breaks the resistance of the keys because the increase in the highest levels of higher levels, but the risks remain

Solana finally broke over his key resistance at $ 136, reversing it in a new level of support that was successfully tested yesterday.

Its EMA lines remain aligned in an upward configuration, suggesting that the upward trend is always intact.

If this momentum continues, Sol Price could target the next resistance areas at $ 147 and $ 152 – the levels which, if they are raped, open the door to a potential movement around $ 179.

The current structure promotes buyers, with higher stockings and a solid support strengthening the trend.

However, if Momentum fades, a retest of the $ 136 support is likely.

Ventilation below this level could move the feeling, exposing Solana to deeper withdrawals to $ 124 and even $ 112.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.