Kaito Airdrops Over $74 Million Amid Rise of Attention Capital in Crypto

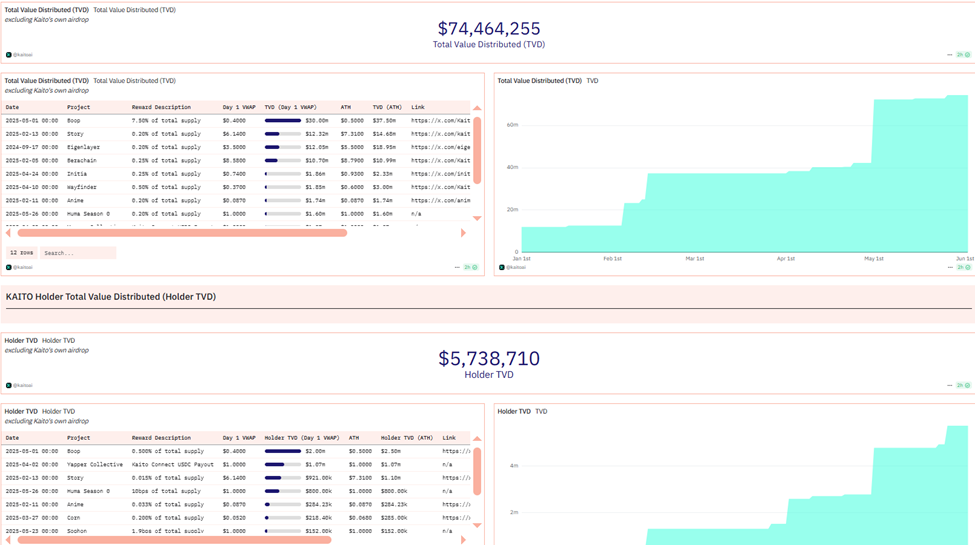

The Ai Kaito web 3 platform has quietly become one of the largest chain incentives. According to Dune Analytics data, it exceeded $ 74 million of total distributed value, broadcast to more than 5.7 million portfolio carriers.

It comes in the midst of the emergence of a new story in crypto: the capital markets of attention, a term of niche derived in a loose manner of the solara internet capital markets.

Kaito’s attention economy: air parachts, incentives and network effects

The data on Dune shows that Kaito has distributed more than $ 74 million in Airdrops to 5.7 million portfolios. Meanwhile, the platform token, Kaito, has bounced more than 150% since the beginning of May.

The main engines include increased participation and alignment of ignition on a new attention -based economy.

Meanwhile, more than 28 million Kaito tokens are now punctuated, which represents more than 10% of the supply in circulation. These platform shooters or users are looking for an additional exhibition and return through Kaito stall and agriculture programs.

The numbers position Kaito at the forefront of an emerging trend, monetizing social attention in crypto thanks to the creation of incentive content and the construction of identity.

One of Kaito’s most vocal power users is Simon dedic, CEO and partner of Moonrock Capital. In an article on X (Twitter), he credited the platform to change the way he wins and engages online.

“I have been using Kaito AI for almost a year now, and I can honestly say that it is one of the most impactful tools that I have ever adopted in crypto. Not only because it helped me to gain almost $ 200,000 to do nothing, because it has fundamentally changed my way of creating, how I get involved and where my career is heading,” said Ddic.

By connecting his X account and contributing to the Kaito “YAP” system – a social layer built around high signal comments – Dedic won a huge Kaito air platform.

He then marked him out to cultivate additional projects of projects like Wayfinder, Boop.fun and Huma Finance. Beyond the financial increase, DEDIC also underlined Kaito’s behavioral impact.

“The launch of Kaito – with yaps, rankings and visibility measures – gave me a real reason to become more coherent, intentional and thoughtful in the way I tweet.

From passive income to influence: how Kaito rewards participation

The founder of Kaito, Yu Hu, framed this movement as part of a deeper “infof” vision, arguing that attention is now a main engine of value and evaluation in the crypto.

“In an economy of attention, attention is intrinsically precious. The nuanced socket is that the value of attention depends on retention, consensus, the underlying subject (i.e. the product), quality and many other factors, “said Hu.

He also explained how Kaito’s infrastructure links attention to the action. More specifically, features such as Kaito win allow user conversion, while the next Launchpad capital is intended for capital training.

The objective is to transform the high quality content and commitment to network growth and investment opportunities.

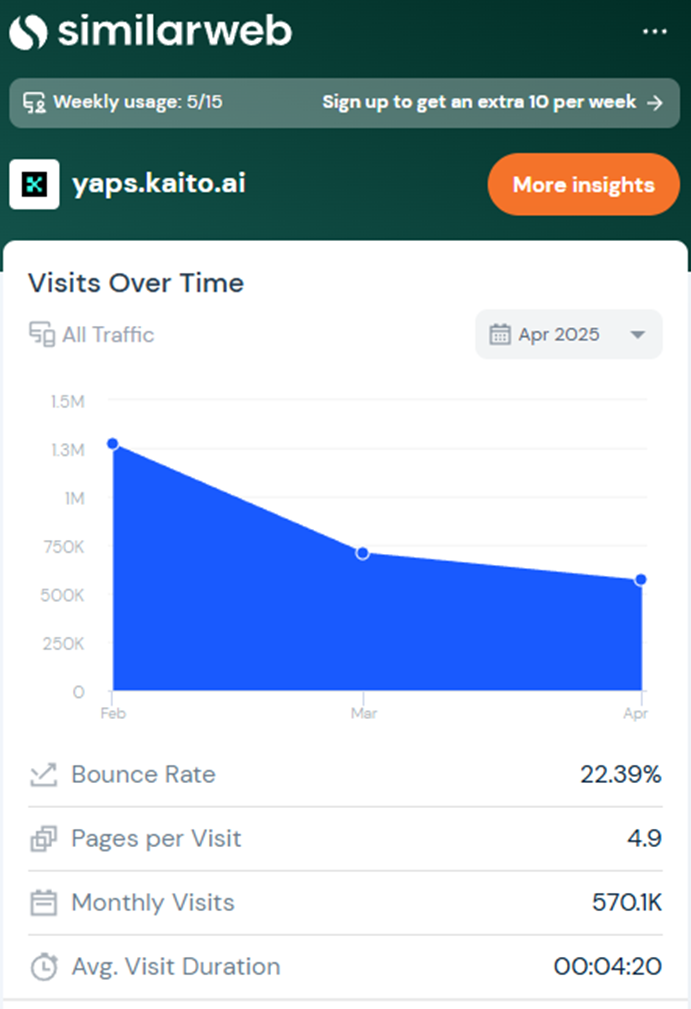

However, not all measures paint a pink image. According to similar data, Kaito traffic went from 1.3 million monthly visits in February to 570,000 in April. The 56% decline suggests that it is decreasing or changing user behavior.

In addition, with the unlocking of Kaito de Kaito on a break until August, analysts warned that the sales pressure could return later this summer.

However, as the attention becomes more and more merchant in Web3, Kaito’s growth signals a new meta on yield, chain identity, influence and long -term alignment.

The post Kaito Airdrops of more than $ 74 million in the middle of the capital of attention in crypto appeared first on Beincrypto.