3 Altcoins at Risk of Major Liquidations in the 4th Week of July

The fourth week of July marks a record moment when the total market capitalization of cryptography reaches 4 billions of dollars. Altcoin market capitalization is also on the path of recovery of its summit of all time (ATH).

In this context, several altcoins, very favored by short -term merchants using a significant lever effect, can face major liquidations.

1. XRP

According to CorciLass, the open interest of XRP – the total value of the positions open on the derivative market – reached a summit of $ 10.9 billion in July.

In particular, the funding rate has become positive and has climbed to its highest level since the start of the year. A positive financing rate occurs when the future price exceeds the cash price. This reflects a strong market optimism, because most traders expect the price to increase and open long positions.

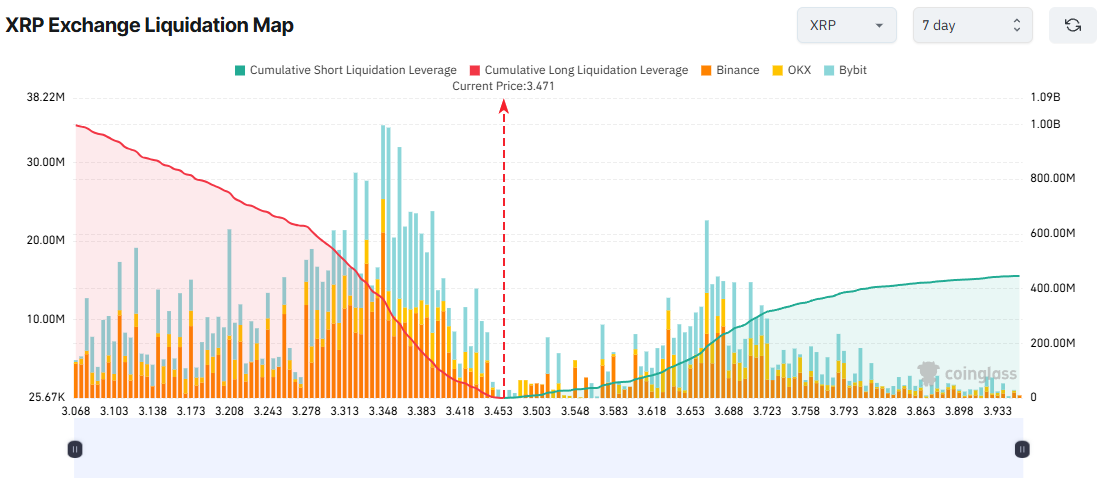

This made that the XRP liquidation card is unbalanced between long and short positions.

According to the 7 -day liquidation map, the total cumulative liquidation of long positions far exceeds that of short positions. If XRP falls at $ 3 this week, long liquidations could reach almost a billion dollars.

This concern has a base. Beincryptto recently reported warning signs of a possible short -term correction for XRP, including a drop in new investors.

However, Kaiko’s latest report shows that the depth of the 1% XRP market has reached a new annual summit of almost $ 10 million on the cash market. This places it above floor, BNB and ADA, after only ETH.

This increased depth and liquidity suggest that XRP can quickly recover if the price drops. However, quick and unexpected price swings could put derivative traders that are both long and short at significant risks.

2. DOGE

DOGE attracted high expectations to investors in July, especially since Bit Origin planned to raise $ 500 million to establish a Dogecoin treasure. In addition, several indicators suggest a possible return of the season of the pieces even alongside the current Altcoin season.

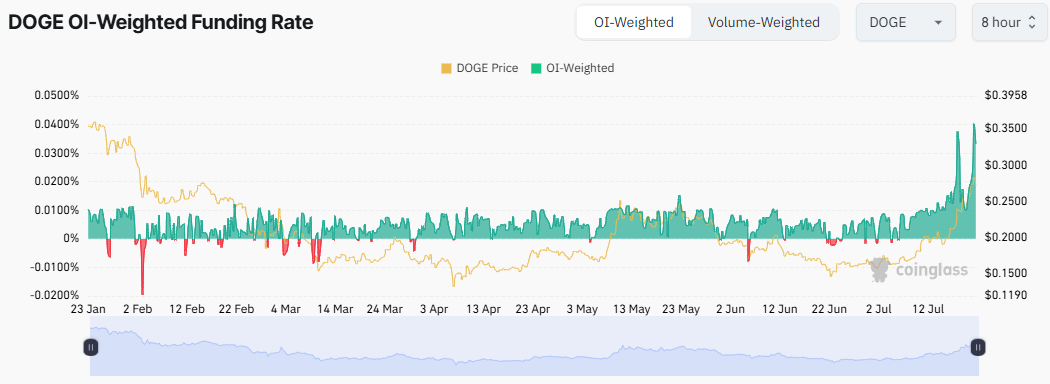

Coinglass data show that DOGE’s financing rate reached an annual summit on July 21, when the price returned to $ 0.28. Many short -term traders have opened long positions, hoping that Doge would continue to go up.

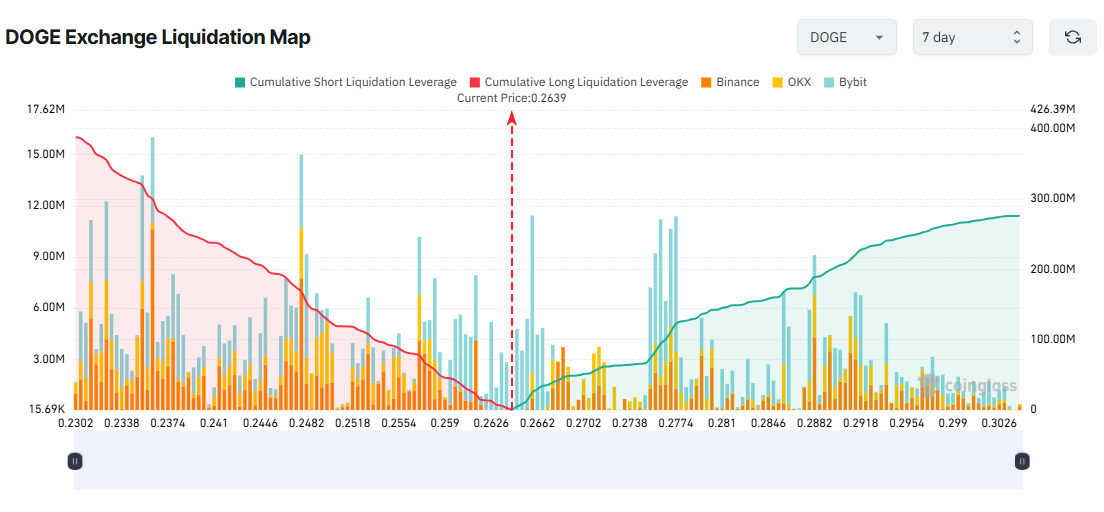

The risk of long liquidations increases as more and more merchants are using a lever effect to bet on the overvoltage of Doge prices.

Recently, Lookonchain reported that the well -known hyperliquid merchant James Wynn liquidated part of his position, for 4.45 million Doge (1.15 million dollars) after closing his long trade.

At the time of writing the editorial staff, DOGE fell from its July 0.28 summit to $ 0.266. The 7 -day liquidation card shows that if DOGE falls to $ 0.236 this week, total total cumulative liquidations could reach $ 300 million.

A recent Beincrypto report notes that long -term DOGE holders quietly remove funds, signaling potential profit.

3. ADA

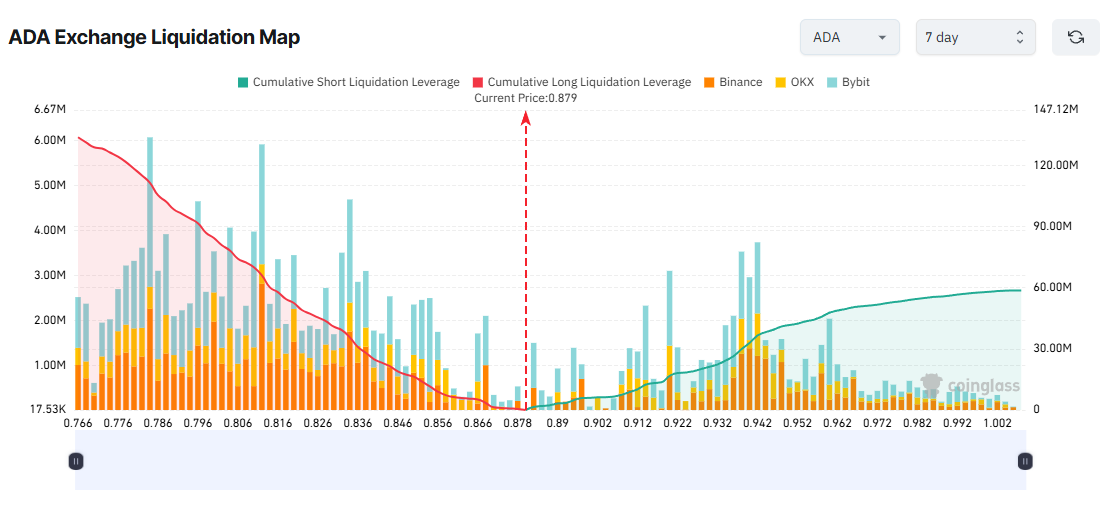

Cardano (ADA) reached a new record of all time in July, with $ 1.74 billion. This occurs while ADA enters her fifth consecutive week of price gains.

Many analysts remain optimistic, predicting that ADA could soon reach $ 1. Chain metrics such as the age consumed and the MVRV ratio suggest that the price could continue to climb in July.

According to the 7 -day liquidation card, if ADA reaches $ 1, short positions could cope with $ 58 million in cumulative liquidations. However, the downward risk is even higher. If Ada fell to $ 0.78 this week, the long accumulated liquidations could reach $ 120 million.

Is there a concern that could negatively affect the price of ADA? Maybe. News emerged that the co-founder of Cardano, Charles Hoskinson, is preparing to publicly publish an audit report, which could have an impact on the feeling of trafficking.

At the time of writing the market time, the market interest in the market continues to increase, exceeding $ 213 billion. The cryptographic derivative market has never been hotter.

“In the past 24 hours, 152,419 traders have been liquidated, with total liquidations amounting to $ 553.68 million,” Coinglass reported.

Out of more than half a liquidated dollars in the past 24 hours, more than $ 370 million came from long positions. This makes it fear that the trend continues in the fourth week of July.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.