3 Altcoins See Declining Exchange Reserves in the First Week of August

Investors often consider exchange reserve data as one of the key indicators to assess the long -term detention request. When the exchange reserves drop, the offer available for purchase becomes rare, which can help push higher prices.

Several altcoins have shown a significant drop in exchange reserves during the first week of August, as is Altcoin’s market capitalization resumed upwards.

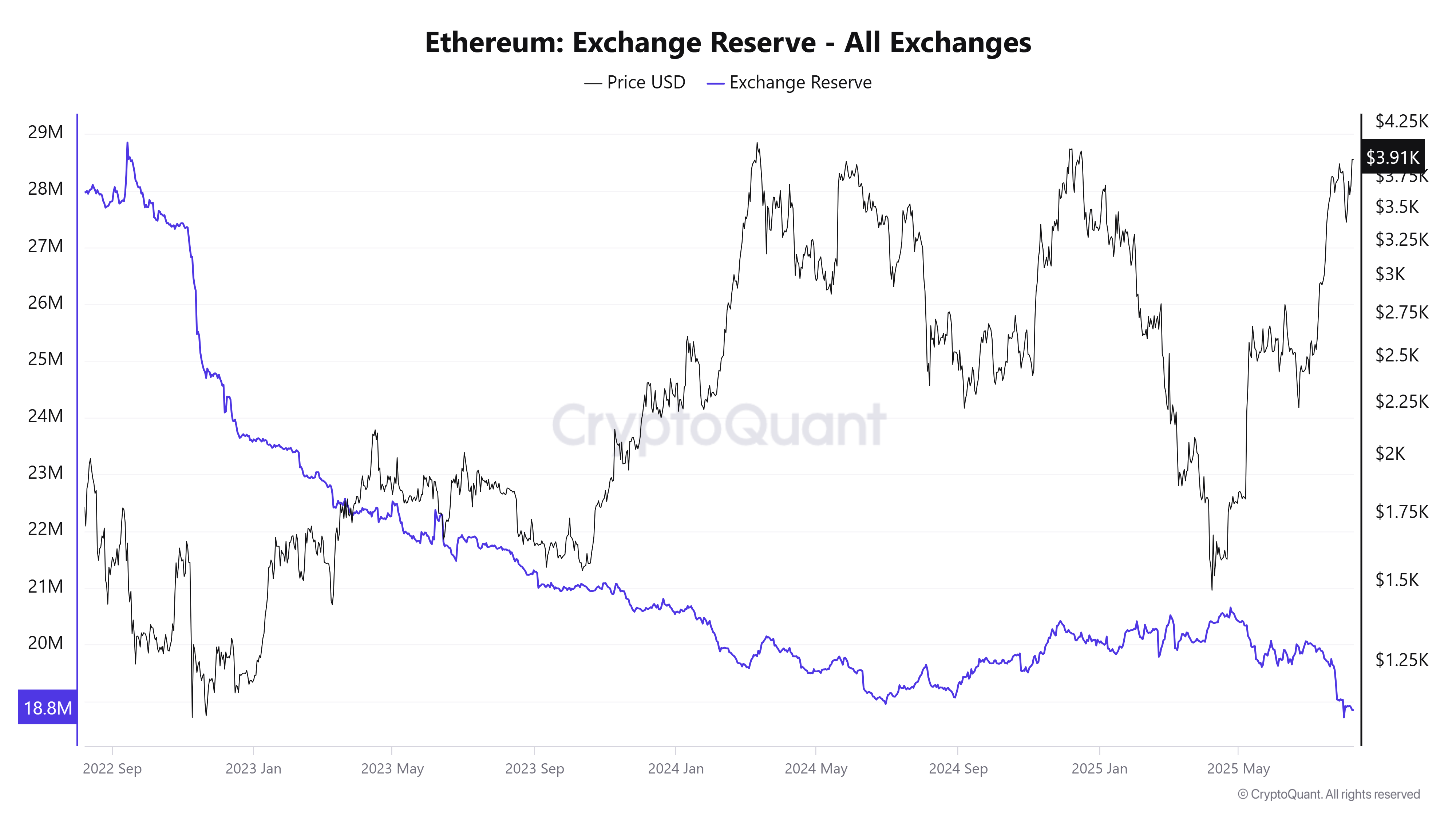

1. Ethereum (ETH)

Cryptoques’ data show that Ethereum’s exchange reserves have reached a new hollow of three years in early August, falling below 19 million ETH.

On August 8, ETH’s price approached $ 4,000. However, this increase in prices has not pushed more investors to move ETH on exchanges, which suggests that holders do not rush to make profits.

The strongest driver of ETH at the moment seems to be an institutional request. ETH reserve strategic statistics indicate that at the end of July, the total value of Ethereum strategic reserves had exceeded $ 10 billion, with 2.7 million ETH. During the first week of August, this figure increased to $ 11.8 billion with more than 3 million ETH.

This request has helped ETH withstand potential sales pressures such as large quantities of uncommented ETH and the sale of the Ethereum Foundation.

“As ethn prices increase, the exchange reserves drop.

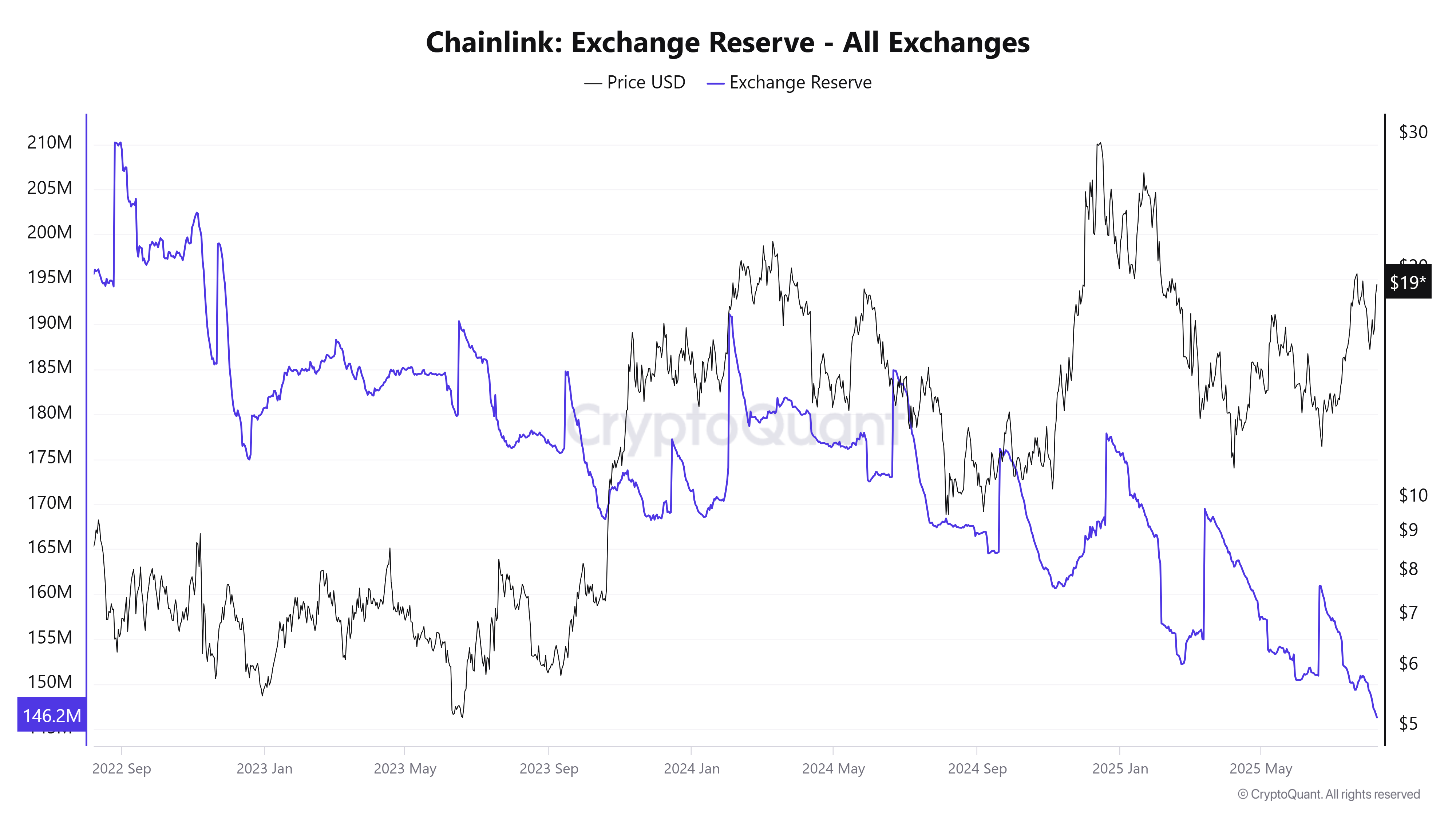

2. Chainlink (link)

Cryptoque data also shows that ChainLink’s exchange reserves (Link) have reached a new hollow in the first week of August. About 146.2 million links are available on exchanges, down 16% compared to the start of the year.

This drop in the offer of scholarships came while its price bounced 15%, from $ 15.5 to more than $ 19. This reflects a return of the long -term feeling of accumulation for Altcoin.

“Now think of the chain link reserve. Massive liaison shocks are incoming,” said Investor Quinten.

In addition, recent data on the santly show that when Link’s price increased above $ 18.40, chain data recorded a 4.2% increase in portfolios holding between $ 100,000 and $ 1 million in connection. The accumulated supply also increased by 0.67% in August only.

This coincided with the launch by Chainlink data flows (American origin in real time / ETF) on August 4 and the introduction of the ChainLink reserve on August 7, which converts the income from the protocol to purchases of links.

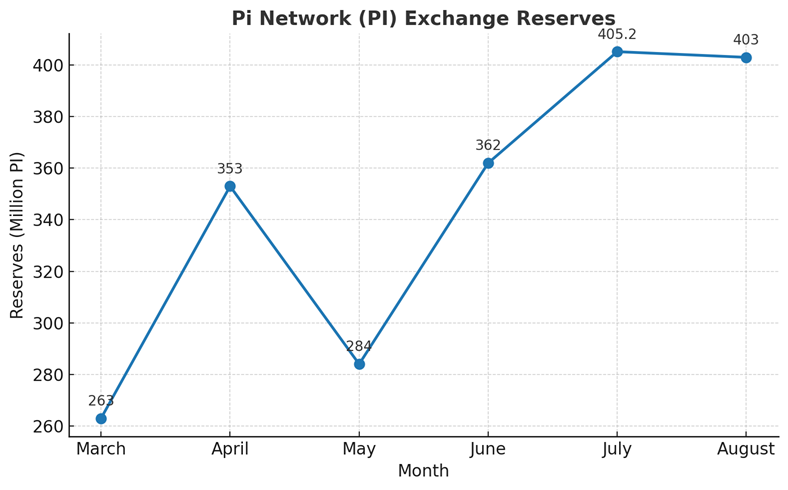

3. Pi Network (PI)

An end -of -July end of July of Beincrypto warned that the assets of the PI network (PI) on exchanges had exceeded 405 million IS. However, according to Piscan data, this figure increased slightly to 403 million IPs after the first week of August.

Although the decline is low, it is still a positive sign after months of continuous increase in the PI exchange supply.

In particular, this drop in the beginning of August of the IP on the scholarships occurred while its price fell sharply by 10% to $ 0.366 during the first week of August. This suggests that the accumulation of PI can come back, because investors are starting to see an opportunity to buy at significantly lower prices than those during the open network phase.

However, exchange data must be closely monitored, as the decline is not strong enough to draw firm conclusions.

The post 3 Altcoins see the drop in exchange reserves during the first week of August appeared first on Beincryptto.