3 Made in China Coins To Watch This Week

Bitcoin holding more than $ 120,000 and stable Ethereum nearly $ 3,000, the bullish momentum has spread to Chinese parts.

The “Made in China” cryptography index is up by almost 1% in the past 24 hours, with the most important performance like Vechain, Conflux and Qtum flashing with strong weekly gains and quarters of keys. Here is an overview of their trend configurations before the third week of July.

Vechain (veterinarian)

Vechain, a blockchain platform known for its traceability of the supply chain and its use of the company, shows signs of a trend reversal after a strong weekly gain.

Currently, a merchant more than $ 0.025, the veterinarian, the native of Vechain, manufactured in China, is still down by almost 91% on its summit of $ 0.282, but buyers seem to intervene.

During last week, the veterinarian jumped 21.5% and now faced immediate resistance at $ 0.02629. A successful escape above this level could open the way to $ 0.02769, a level where previous rally attempts were struggling.

However, the most interesting configuration lies in the divergence in training on the graph.

The RSI (relative resistance index) makes higher peaks, while the price still makes lower peaks: a model known as the bullish divergence. This indicates that although the price has not yet caught up, Momentum is gradually moving in favor of the bulls.

Upon down, $ 0.02311 is the first critical medium. But the real invalidation of this upward structure begins below $ 0.02171, the candle in small groups which initiated the current trend. If the veterinarian slips below, the bullish hypothesis would probably be canceled and the sellers could regain control.

As long as the veterinarian is more than $ 0.023 and continues to strengthen RSI force, the trend remains constructive.

Conflux (CFX)

Conflux is one of the most important public blockchains in China, designed to support decentralized high -speed applications and regulatory compliance.

The CFX coin made in China is up 40.2% last week, now trading slightly greater than 0.103, showing a large dynamic in the short term. However, there are 94% below its summit of $ 1.70, leaving a lot of space for recovery or risk.

On the graph, $ 0.1042 is the nearest resistance. A clean break above this could push CFX to $ 0.1233, with little technical resistance between the two. This price difference can act as an engine if the market dynamics hold.

Declining, multiple supports exist around $ 0.1008, $ 0.0913 and $ 0.0827. But the real upward invalidation is in less than $ 0.0827. This is the level where the structure breaks down, potentially changing the direction of the trend even in a strong Altcoin cycle.

A Haussier technical signal stands out: the 20 -day EMA (exponential mobile average) recently crossed the 50 -day EMA and widens.

It is not the usual golden cross of 50 to 200 days, but it still signals a short-term trend acceleration, especially when the angle of divergence increases like this. The tighter delay makes it a more reactive indicator, stressing how speed in the short term has become bullish.

As long as CFX is more than $ 0.1008 and this EMA difference continues to widen, the bulls can remain in charge.

Qtum (qtum)

Qtum is one of the first hybrid blockchains developed from China, mixing the Ethereum system based on the Bitcoin UTXO model. The “Made in China” blockchain medal, Qtum, has once reached a summit of $ 106.88, but today it is negotiating about $ 2.31, still decreasing by almost 98% of this historic peak. That said, Qtum won 16.8% in last week, referring to a new time.

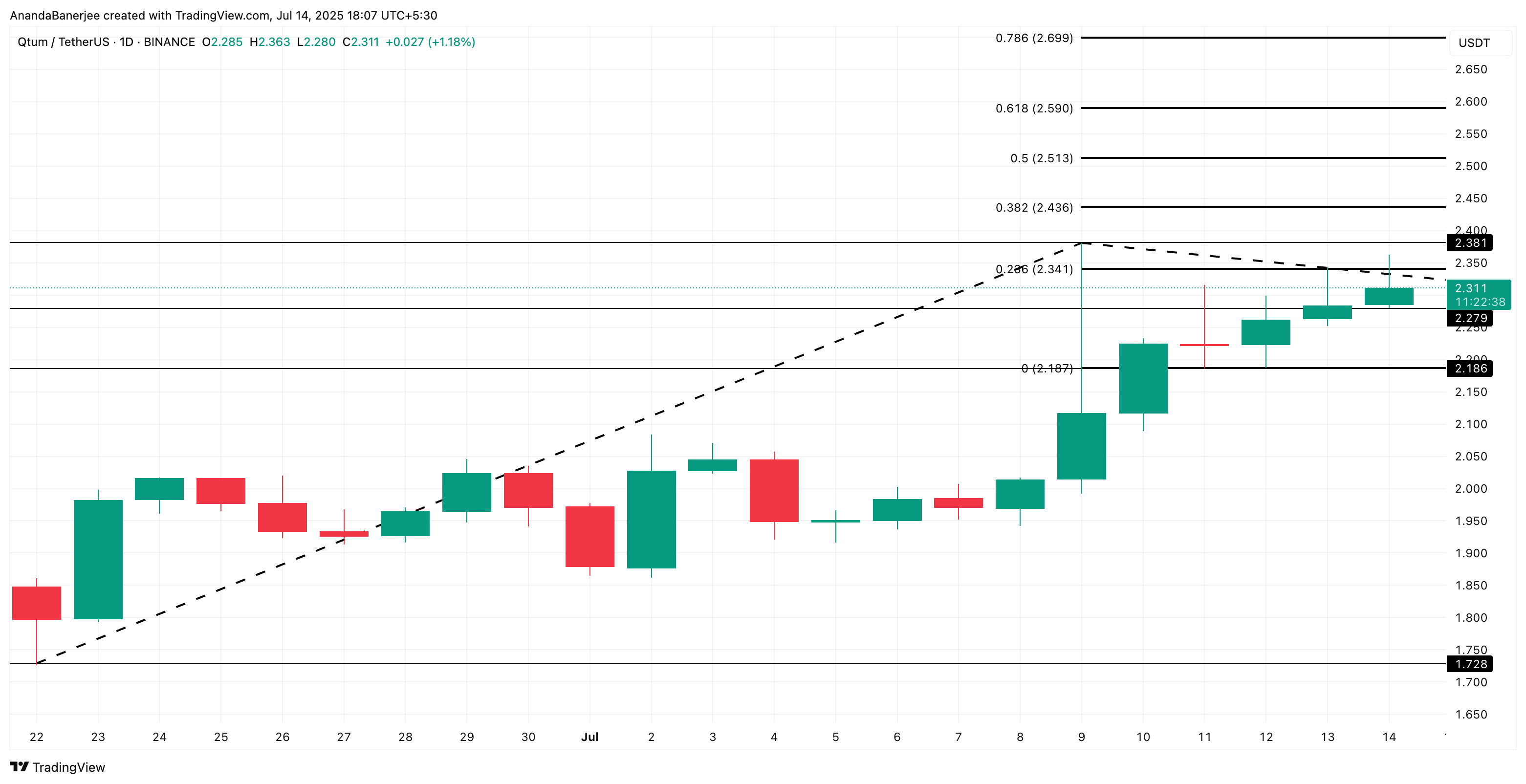

Of an extension of fibonacci based on the trends taken from the lowest June 22 of $ 1.73 at the July 9 summit of $ 2,382, then a correction at $ 2,187, several emerging increase targets.

Qtum violated the immediate resistance at $ 2,341 earlier, but was quickly confronted with a rejection and is now consolidated just more than $ 2,279, a key horizontal support level.

The trend remains intact until qtum is more than $ 2,187, the minor trace point. If the Bulls manage to pass the resistance again of $ 2,341 with a volume, the following targets become $ 2,436, followed by $ 2,513, according to the Fibonacci extension.

If the price drops by less than $ 2,187, the disabled rupture structure. And ventilation less than $ 1.728; The starting of original pulse would probably cancel the wider bullish thesis.

In short, Qtum tries to recover the strength of trends after years of underperformance. The technical configuration offers hope, but the barrier of $ 2,341 remains the key to unlock higher targets.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.