PEPE Price Crashes 50%; Death Cross and an Opportunity next

Pepe suffered a net slowdown, lowering almost 50% in last month and reaching its lowest price in three months. Investors have been faced with significant losses, because the lowering feeling seizes the market for memes parts.

Although the possibility of a new correction remains, an emerging technical model could also point out an opportunity to purchase for long -term holders.

Pepe faces a lower cycle

The exponent mobile averages (EMAS) indicate an increasing down pressure, the 200-day EMA approaching a crossing above the EMA of 50 days. This event, known as the Cross of Death, is generally a strong lowering signal.

If the crossing occurs, the sale of the momentum could intensify, moreover resulting in the price of Pepe.

Currently, the 200 -day EMA is only 8% of the training of death training. If the lowering conditions persist, Pepe could find it difficult to recover in the short term. This technical model often leads to prolonged downward trends on various assets.

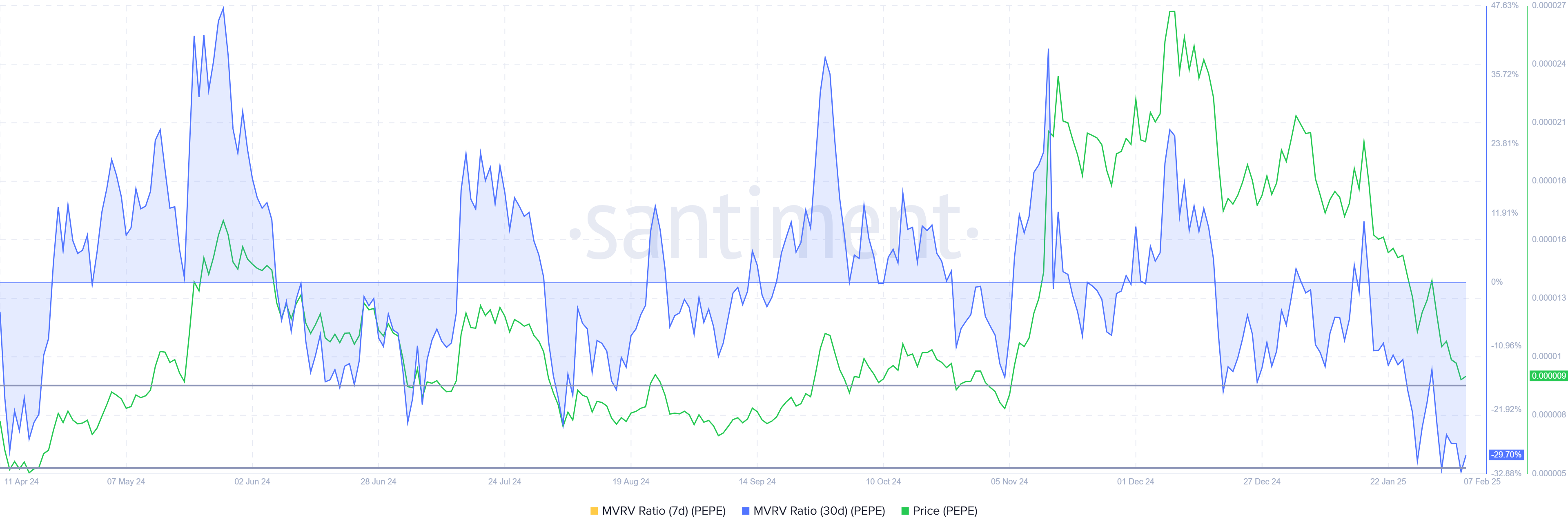

Despite the lowering signals, the PEPE market value ratio of the value (MVRV) suggests a possible change in momentum. The MVRV report reached -29%, placing Pepe in the “opportunity area”.

Historically, when this metric drops between -17% and -30%, this indicates that the sales pressure is in full exhaustion.

A negative MVRV ratio suggests that investors have unrealized losses, which makes them less likely to sell more. This can create an accumulation period when long -term holders are starting to buy at reduced prices.

If this trend follows the previous models, Pepe Price could be set up for a potential recovery.

PEPE PRICE PRIDCE: Recover losses

PEPE is currently negotiated at $ 0.00,000941, sliding below the level of critical support of $ 0.00001,000. This marks a three -month hollow for the meme medal, making it one of the least efficient assets of the month. The sustained sales pressure made it difficult for Pepe to resume the momentum upwards.

The cross of imminent death raises concerns about additional declines, potentially pushing PEPE below the level of support of 0.00000839. A drop below this threshold would probably trigger an additional sale, aggravating the losses of investors.

If the bearish momentum remains dominant, Pepe could see prolonged consolidation at lower price levels.

However, a reversal remains possible if PEPE can recover $ 0.00001,000 as a support. If the piece even returns 0.0000001146 in support, it would invalidate the lowering perspectives and would move the momentum towards recovery.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.