4 US Economic Indicators With Crypto Implications This Week

Cryptographic markets have several American economic indicators to monitor this week that could influence their portfolios.

This comes in the midst of the growing influence of American economic data on Bitcoin (BTC), which makes traders and investors to get involved.

American economic data to monitor

Investors seeking to capitalize on potential volatility can be negotiated around the following American economic data points this week.

Employment Openings in the United States (Jolts)

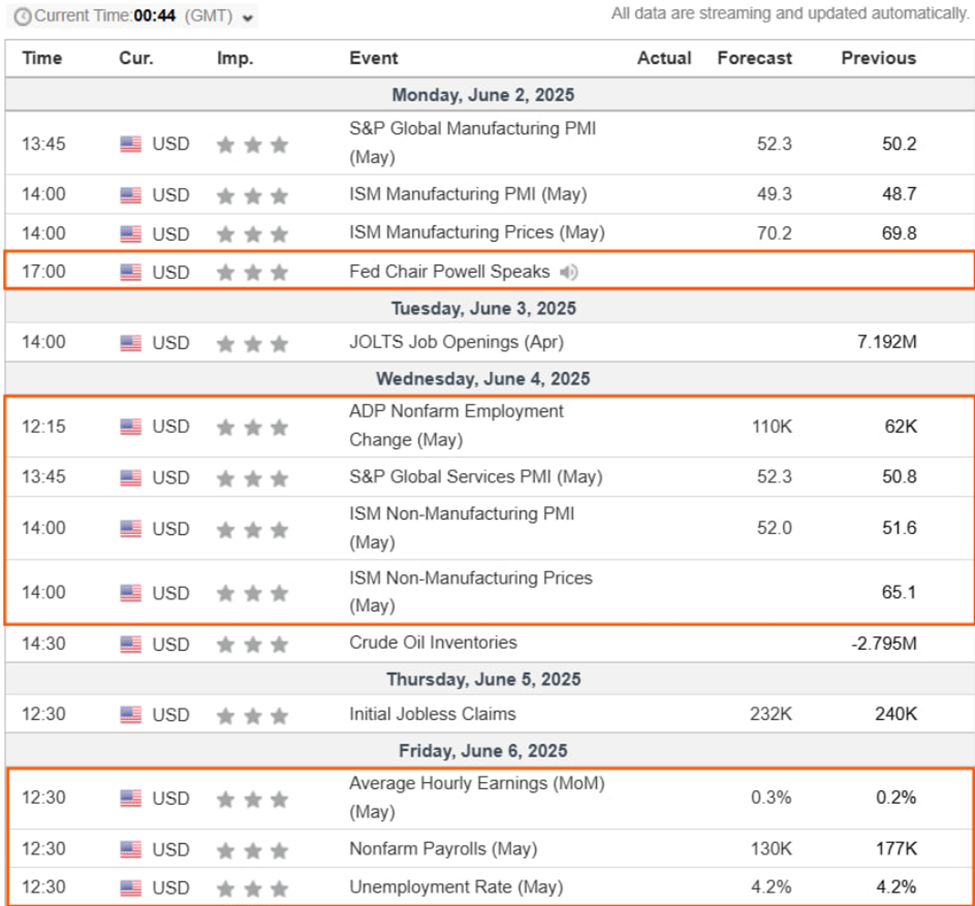

The investigation into job offers and turnover (JOLTS) for April 2025 should be published on June 3. In March, job offers fell to 7.192 million, marking the lowest level since September 2024 and falling below market expectations of 7.48 million.

This drop occurred before the full impact of the new prices of the Trump administration. According to Bloomberg analysts, economic policies have depressed hiring.

“… Employers focus on costs of costs as households become a little more kept and companies re -examine investment plans in a context of changing trade policy,” said Bloomberg.

As this American economic indicator approaches, Bitcoin traders should prepare for the impact. A continuous decrease in job offers can report a cooling labor market, which could potentially cause the Federal Reserve (Fed) to consider the softening of monetary policy.

Such a change could weaken the US dollar, making Bitcoin more attractive as an alternative asset. Conversely, if the work openings stabilize or increase, this can strengthen the expectations of continuous monetary tightening, possibly attenuating the attraction of Bitcoin.

ADP employment

Another American economic indicator to be monitored this week is the ADP employment report for May 2025, Wednesday, June 4. In April, the employment of the private sector increased by 62,000 jobs, a significant slowdown compared to the revised gain of 147,000.

For the moment, however, economists are seeing a median forecast of 112,000. An employment growth figure lower than it could point out an economic cooling, which has potentially prompted the Fed to consider relieving monetary policy.

Such a change could weaken the US dollar, making Bitcoin more attractive as a blanket against the depreciation of money.

Conversely, a stronger than expected report could reinforce the expectations of continuous monetary tightening, perhaps attenuating the Bitcoin call.

Initial unemployment complaints

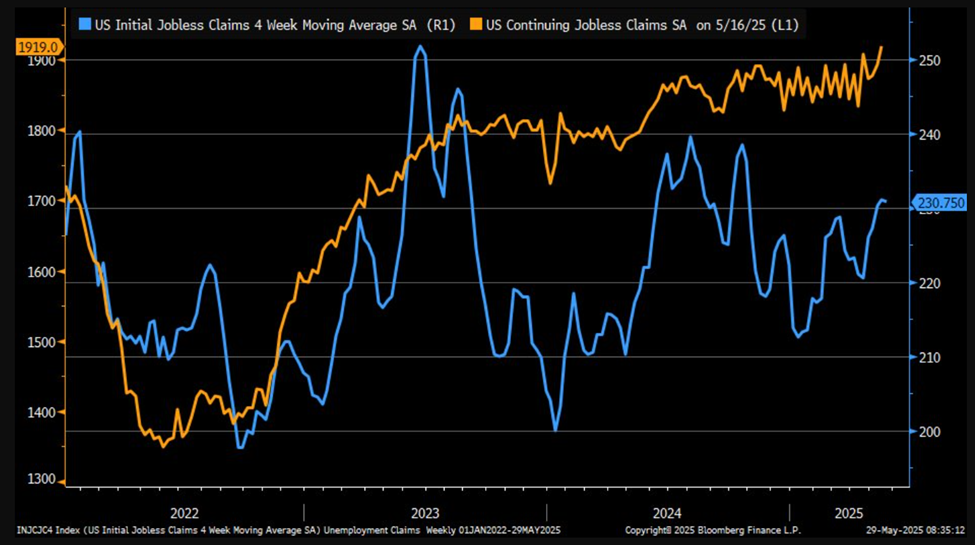

The first unemployment complaints for the week ending on May 24 have increased to 240,000, against 226,000 in the previous week and exceeding forecasts of 229,000. This has marked the highest level since November 2021, indicating a potential relaxation on the labor market.

As part of the American economic indicators to be monitored this week, the markets will see how many people have applied unemployment insurance for the week ending on May 31.

With a median forecast of 232,000, an increase in unemployment claims can report economic weakness. This would increase the probability that the Fed will adopt a more accommodating monetary position.

Such a change could lead to a lower dollar, improving the attractiveness of Bitcoin as an alternative intake. However, if the increase in complaints is considered a temporary fluctuation, the impact on bitcoin can be limited.

“The first unemployment complaints continue to increase regularly, but slowly,” observed Eric Basmajian, analyst of the economic cycle.

Non -agricultural payrolls

The US employment report, or non -agricultural payrolls (PNF) for May 2025, is expected to be published on June 6. In April, the economy added 177,000 jobs, exceeding expectations, while the unemployment rate remained stable at 4.2%.

“Economists see payroll increasing by 125,000 after employment growth in March and April exceeded projections, based on the median of a Bloomberg survey.

Economists plan to slow down employment growth at 130,000 in May, reflecting the potential economic impacts of President Trump’s rates.

Strong employment growth can lead the Fed to maintain its current monetary policy position or even consider tightening, which could strengthen the US dollar and potentially remove Bitcoin prices.

However, if the underlying economic concerns encourage Fed to adopt a more dominant approach, Bitcoin could benefit because investors are looking for other value reserves.

Analysts say that difficult employment conditions in the United States come while employers who seek to clarify the White House trade policy must gradually face frequent adjustments of deadlines and schedules.

“Increased volatility is expected – start your risk management and wait for confirmations before entering the trades,” warned MRD indicators.

To date, Bitcoin has exchanged for $ 104,858, after having increased by 0.17% in the last 24 hours.

The post 4 American economic indicators with cryptographic implications this week appeared first on Beincrypto.