Two Bitcoin Support Levels to Watch as Price Turns Bullish

Bitcoin (BTC) recently ended a two -week decreased trend, which saw its price fall to $ 100,200 before rebounding. Despite the recovery, Bitcoin always faces the sale of pressure for long -term holders (LTH), which could make it vulnerable to a potential prices correction.

The cryptography market remains volatile and the next Bitcoin price movement will depend on these factors.

Bitcoin sale is concern

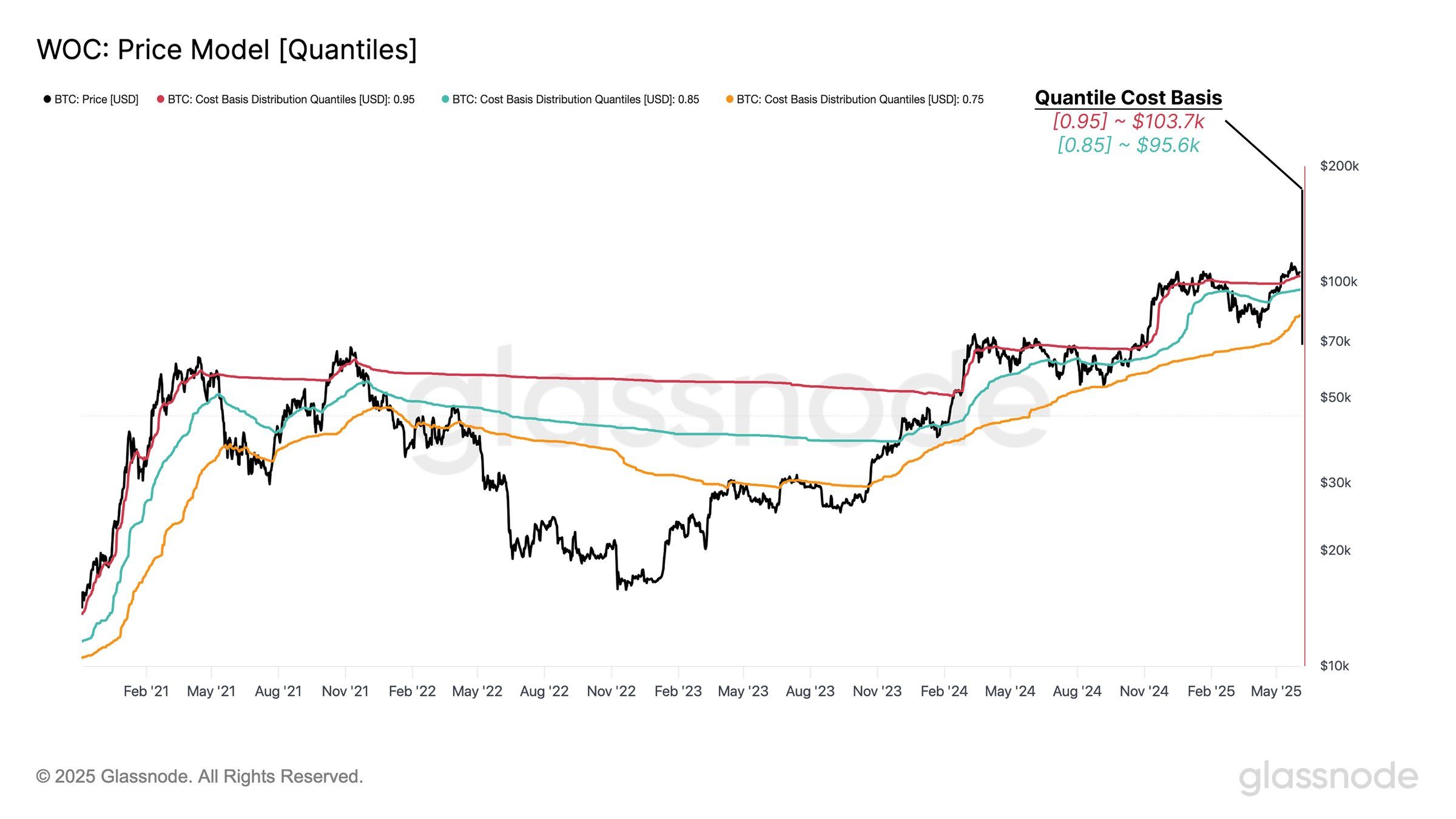

The basic quantiles of the cost of Bitcoin highlight the levels of key support which could be crucial in the short term. The 0.95 SSD (expenditure supply distribution) indicates that 95% of the Bitcoin in circulation supply was purchased below $ 103,700.

This suggests that only 5% of Bitcoin was acquired above this level, making $ 103,700 a solid support area.

In addition, another level of critical support is at $ 95,600, where the SSD of 0.85 coincides. This level represents a point to which 85% of the bitcoin in circulation has a lower acquisition price, which makes it another potential bastion for the price of Bitcoin.

If Bitcoin faces more sales pressure, these levels could serve as high barriers to a deeper drop.

Despite LTH’s sales pressure, Bitcoin’s macro Momentum suggests a long -term positive perspective.

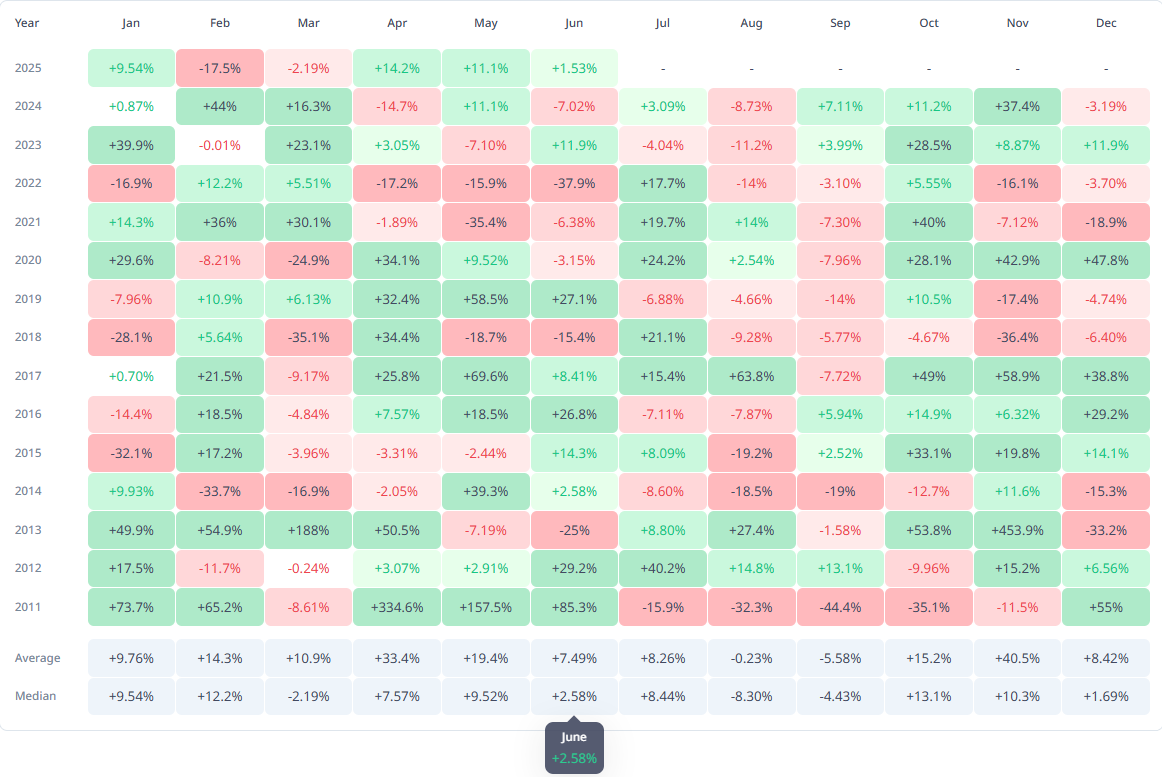

Historical monthly return data for Bitcoin show that June has generally been a positive month for assets, with a median increase of 2.58%. This indicates that although Bitcoin can face short -term corrections due to the sale, the broader trend on the market could support the recovery of prices.

The historical trend suggests that any correction with which Bitcoin faces due to the LTH sale will probably be temporary. The price of Bitcoin showing a long -term growth potential, the market could soon evolve towards a bullish feeling, especially if wider market conditions improve.

BTC Price has a support

The Bitcoin price has recently increased by 4.7% in the last three days, trading at $ 106,263. However, the cryptocurrency remains just below the resistance level of $ 106,265.

Given the current feeling of the market and the main levels of support, the factors at stake suggest that Bitcoin could undergo a short term.

If Bitcoin does not maintain the level of $ 106,265 and faces an additional sales pressure, it could go through the support of $ 105,000 and evolve around $ 103,700.

This level, as identified in the basis of quantile costs, could provide significant support. In a more lower scenario, Bitcoin could even slide towards the following support at $ 102,734.

On the other hand, if the wider market becomes optimistic and thwarts the impact of the LTH Sales, Bitcoin could exceed the resistance level of $ 106,265.

A successful violation of this level could lead Bitcoin to $ 108,000 or even more, invalidating the current downward thesis and signaling a potential price rally.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.