Will It Spark Price Volatility?

More than $ 2.5 billion in Bitcoin and Ethereum options for options are expected to expire on Friday. In addition, the markets are still in shock from American economic data this week, including IPC and IPP, but the expiration event of derivatives can increase prices today during the weekend- end?

Bitcoin (BTC) remains well below the psychological level of $ 100,000 while the influence of macroeconomic events continues to stimulate feeling.

The Bitcoin and Ethereum options expire today

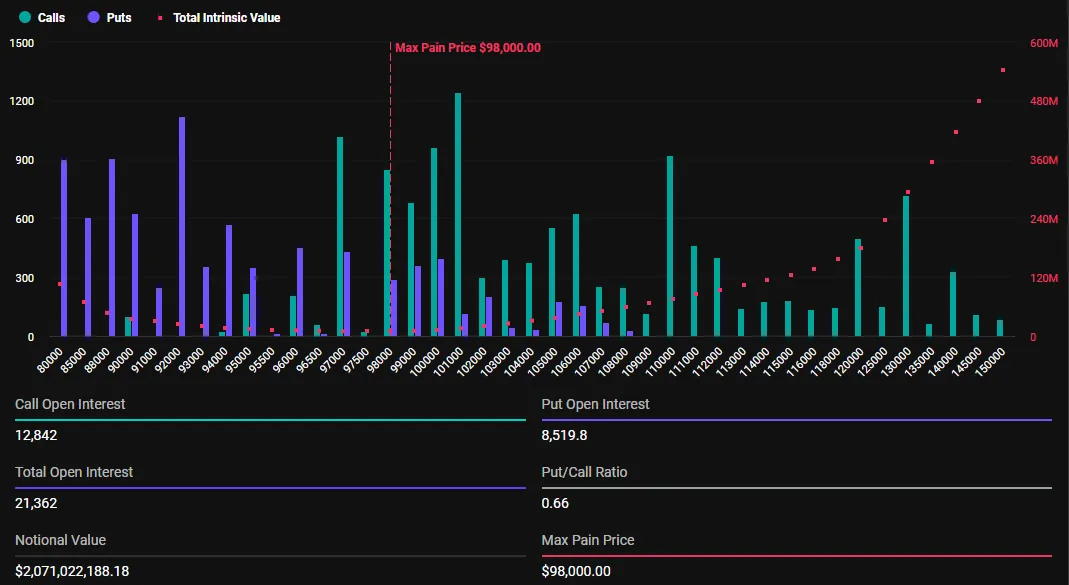

About 21,362 Bitcoin options will expire on Valentine’s Day on February 14. The notional value of the Bitcoin Options contracts for this Friday is $ 2.07 billion, according to DRIBIT data. The PUT / CALL ratio is 0.66, suggesting a prevalence of purchase options (calls) on sales options (PUT).

As Bitcoin options expire, they have maximum pain or an exercise price of $ 98,000, when the assets will result in financial losses to the greatest number of holders.

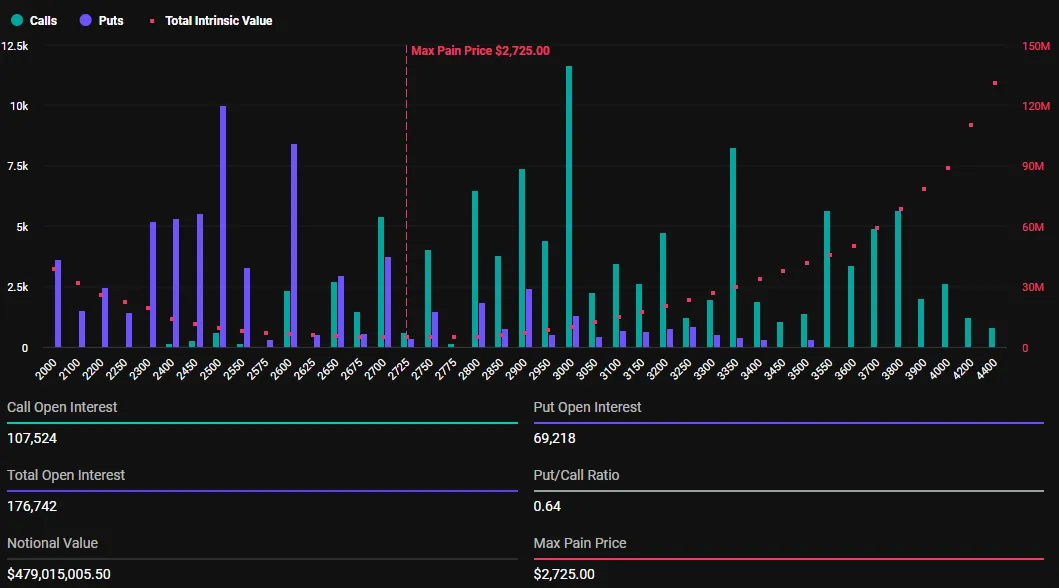

Likewise, cryptographic markets will attend the expiration of 176,742 Ethereum contracts, with a notional value of $ 479.01 million. The Put / Call ratio for these expired Ethereum options is 0.64, with maximum pain of $ 2,725.

The expiration event for this week options is much smaller than what the cryptographic markets were witnesses last week on Friday. As Beincrypto reported, around $ 3.12 billion in BTC and ETH options then expired, awarded to the prices of US President Donald Trump, which slowed down the price of bitcoin less than $ 100,000

The expiration of options could lead to price volatility, traders and investors must therefore closely monitor today’s developments. Nevertheless, the Put-Jour ratios below 1 for Bitcoin and Ethereum in the trading of options indicate optimism on the market. This suggests that more traders are betting on price increases.

The feeling of the market has maintained a low consolidation this week, commented Greeks Live, which added that implicit volatility fell to its lowest level in almost a year despite multiple positive news on the part of the US government . This indicates expected price swings that can affect pricing and trading options.

“Since BTC actually fell below the $ 100,000 mark, the options of options have systematically sold short and intermediate calls, with a significant increase in the volume of block calls for blocks but a drop in Bloc storm volume, which suggests that if the market is not upward up, it is just as panicked about the disadvantage, “said Greeks.live.

In this context, Greek analysts. Live indicate that institutions consider February as a “junk food”. This means that a period of low activity or interest in the market could have an impact on negotiation volumes and cryptography market prices.

While the options contract near the expiration at 8:00 am UTC today, the Bitcoin and Ethereum prices could discuss their respective maximum pain points. According to Beincryptto data, BTC has negotiated against $ 96,714, while ETH exchanged hands for $ 2,696.

This suggests that the prices of the BTC and the ETH could increase as intelligent money aims to move them to the level of “maximum pain”. According to the maximum pain theory, the prices of the options tend to gravitate towards the exercise prices where the greatest number of contracts, both the calls and the food, expire without value.

Price pressure on the BTC and ETH will probably lie down after 8:00 am UTC on Friday when Deribit sets the contracts. However, the scale of these expirations could still feed increased volatility on cryptographic markets.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our general conditions, our privacy policy and our warnings have been updated.