67% of XRP Trading Is on These 3 Exchanges — Is That a Risk?

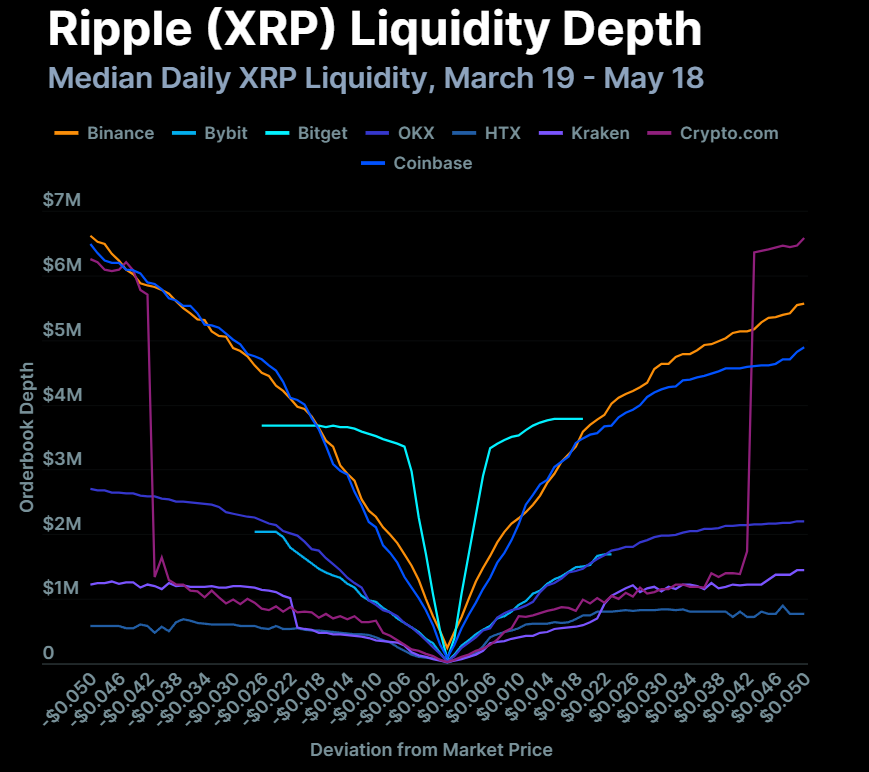

A new Coigecko report shows that XRP liquidity is strongly concentrated on only three exchanges – Bitget, Binance and Coinbase.

Together, these platforms control around 67% of all negotiation activities close to the XRP market price. This means that most purchase and sale orders for XRP are sitting on a few orders.

Coigecko’s report reveals surprising data on XRP

At first glance, it may seem effective. But that also means that XRP strongly depends on a small number of platforms to remain liquid.

If one of these exchanges faces problems or reduces support, XRP traders could cope with delays, sliding or greater spreats.

Coindecko’s analysis examined what it costs to exchange XRP in a low price price of two hundredequivalent to 1% of its price.

In this range, XRP shows on $ 15 million in available orders Out of eight exchanges. Two -thirds of this are with the first three.

Bitget leads xrp trading at tight price strips

Bitget shows the most liquidity to very low prices movements. This means that XRP is easier to exchange there if you are looking to move funds without price change.

However, Bitget’s liquidity decreases quickly as you go further from the market price.

As you reach the beach of two hundred, Binance and Coinbase almost took the volume. This strengthens how XRP is dependent on a few platforms.

Other exchanges like OKX, Bybit, Kraken and Crypto.com play a smaller role. Their XRP command books are much thinner compared to managers.

XRP follows Solana in liquidity and volume

A surprising detail in the report is that XRP is late on Solana (soil) In liquidity and the volume of negotiation – despite higher market capitalization.

Solana has around $ 20 million in depth of negotiation in a price range of $ 1, which is stronger than the $ 15 million in XRP in two hundred. Sol has also seen Almost twice as much volume as XRP during the study period.

This difference raises questions about the real quantity of commercial interests for XRP. A higher market capitalization does not always mean support for the stronger market.

In this case, Sol seems to have a more consistent demand for active merchants.

To summarize, the XRP trading activity is strong, but very concentrated. Bitget, Binance and Coinbase dominate its liquidity, leaving the asset vulnerable to risks in terms of exchange.

Compared to Solana, Ripple’s Altcoin seems less liquid and less exchanged. This could affect prices stability, especially during market stress.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.