91% Chance for Approval in 2025

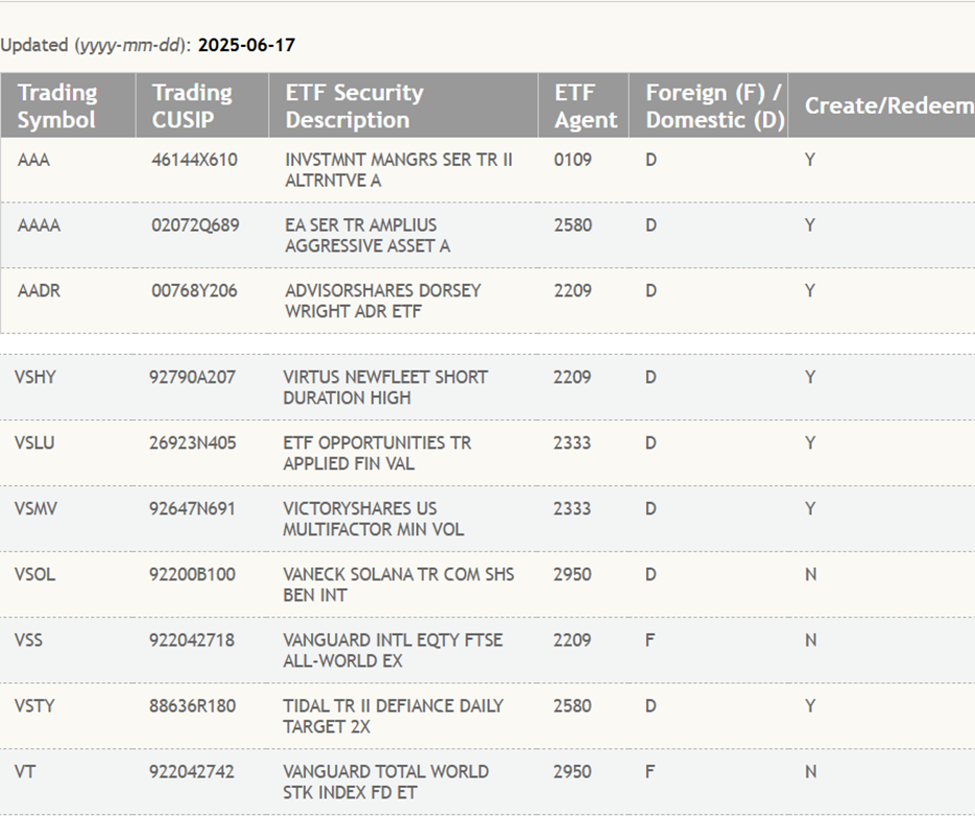

The Solana ETF offered by Vaneck (Stock market negotiated funds) is officially registered with the DTCC (Depository Trust & Clearing Corporation) under the VSOL Ticker. This marks a major step towards potential regulatory approval.

The registration indicates an increasing momentum behind the institutional adoption of Solana and brings the product closer to negotiation on American exchanges.

VSOL ETF of Vaneck approaches approval after the DTCC list

The DTCC list, in the “active and pre-launched” category, confirms that the fund is eligible for the future electronic exchange and the approval awaiting the American Sec (Securities and Exchange Commission).

It is imperative to note that VSOL de Vaneck cannot yet be created or bought. However, the company considers the list as a key element of the launch process, although it does not guarantee approval.

Analysts of Bloomberg ETF James Seyffart and Eric Balchunas believe that the dry could soon approve the fund, among others. However, this forecast depends on the deposits progressing gently.

“SEC is committed to S-1 for Solana strings and it is a very * positive sign. However, the deadlines for approvals are less certain,” noted Seyffart in a post.

Indeed, this inscription occurs shortly after the SEC asked the issuers to submit modified S-1 deposits for their ETF Solana. Analysts say that this means a continuous commitment between regulators and fund managers.

Several companies, including Bitwise, Coinshares and Franklin Templeton, have entered the race to offer ETF based in Solana. However, the SEC delayed a decision on Solana ETF by Franklin Templeton.

Vaneck previously introduced FNB Bitcoin and Ethereum Etfertures and several global funds of digital assets. It aims to offer a regulated exhibition to new generation blockchain networks like Solana.

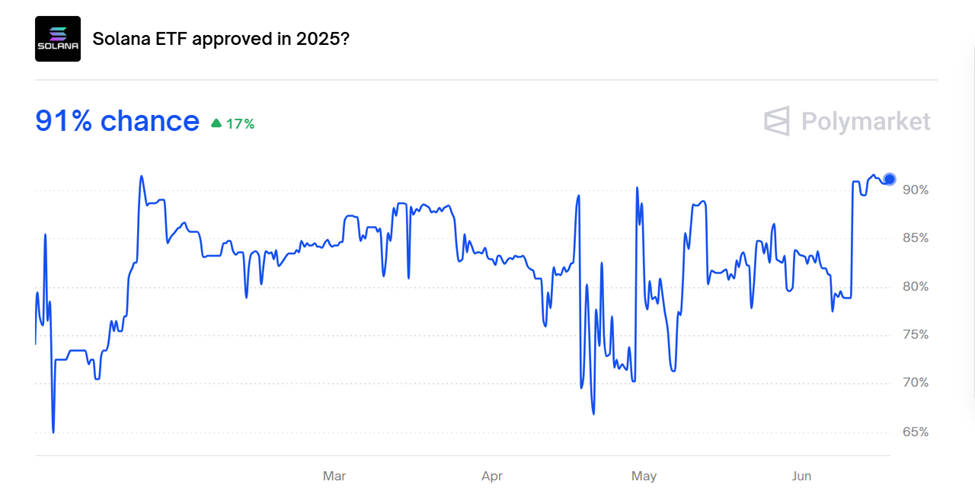

Dry engagement and polymarket ratings indicate growing confidence in Solana Etf

Although the SEC has already approved the ETF Spot for Bitcoin and Ethereum, Solana remains pending. However, optimism increases.

On the Polymarket decentralized prediction platform, traders now attribute a probability of 91% that an ETF Solara Spot is approved in 2025.

Recognition by VSOL DTCC follows a tendency to increasing institutional preparation. Earlier this year, the organization also listed Solana ETF based on future, Solz and Solt, although they remain in exchangeable status.

Beyond ETFs, the DTCC reported a more in-depth interest in blockchain infrastructure, including plans to launch a stable and token collateral platform.

The high Solana transaction rate, the ecosystem of active developers and the User DEFI and NFT User positioned it as a credible competitor for traditional financial products.

The will of the dry to hire the Solana Spot ETF and its approval from Solana’s future on the CME suggest that the network could soon become the third crypto to obtain complete ETF status in the United States.

Although Vaneck has not set up a date of official negotiation against VSOL, the appearance on the DTCC list is an important step. If it is approved, VSOL could catalyze the innovation of additional ETFs, including potentially compatible products with a thong or multi-bastard cryptography baskets.

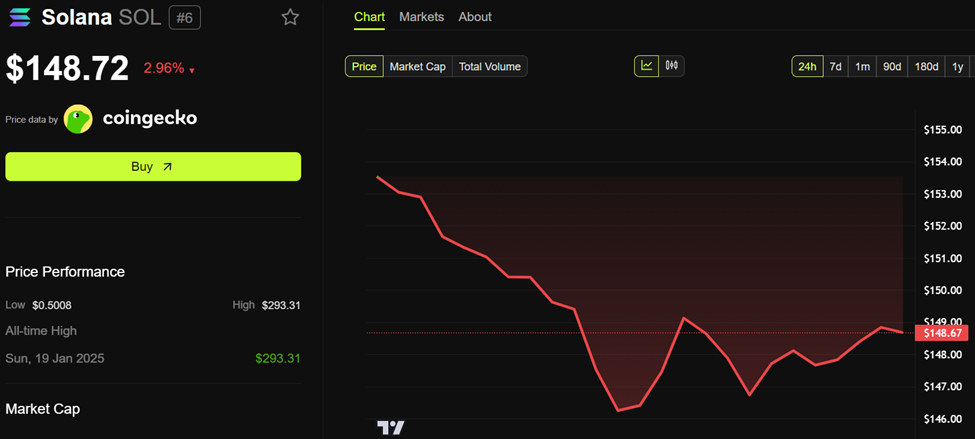

This decision could also lead to a Solana price wave. However, despite the registration of DTCC, Sol was negotiated at $ 148.72 during the drafting of this article, down almost 3% in the last 24 hours.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.