Is a Breakout Rally Coming?

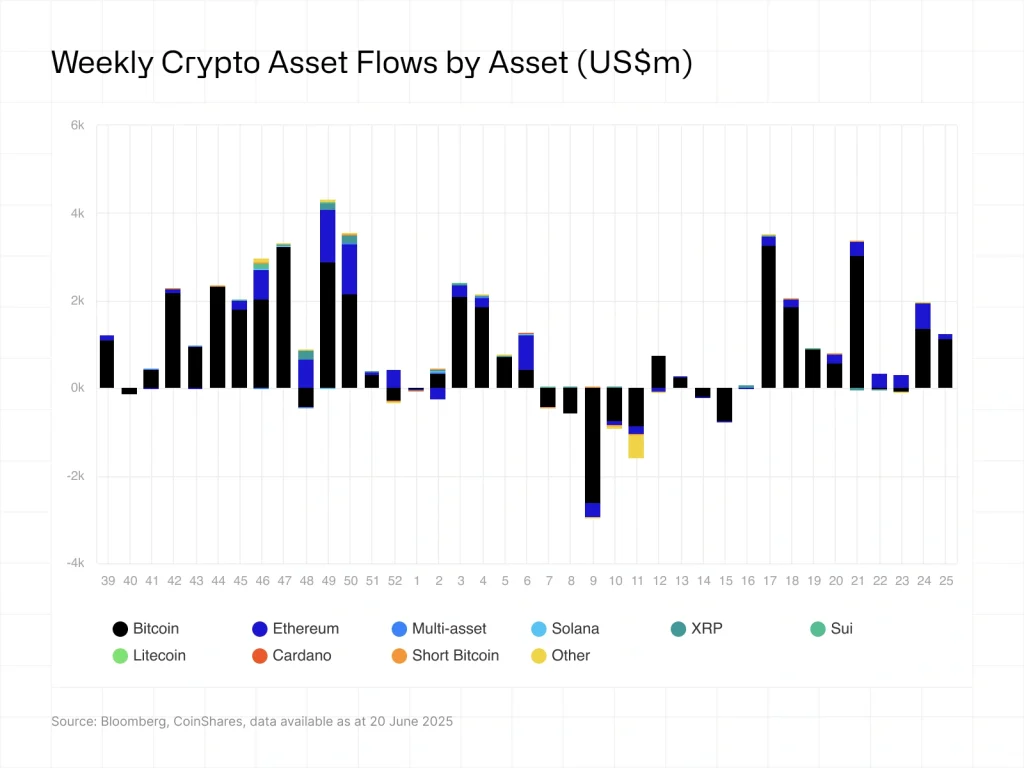

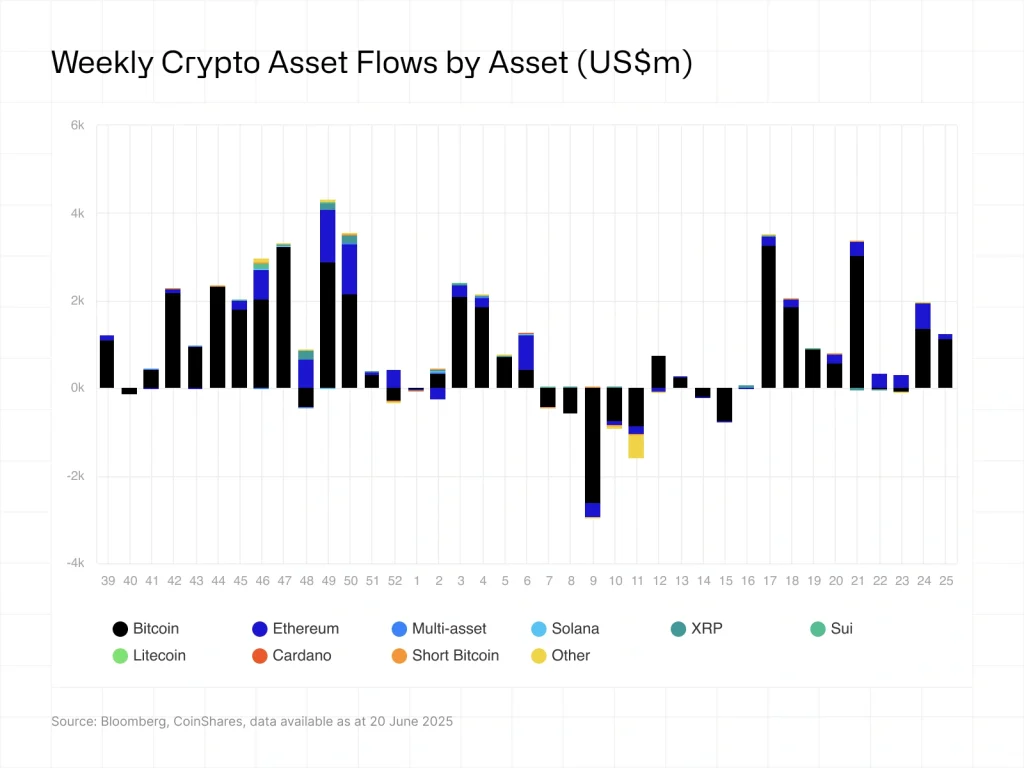

The Bitcoin request (BTC) by institutional investors has remained high in the midst of growing fears of short -term market capitulation of cryptography. According to Coinshares market data, Bitcoin’s investment product recorded the second consecutive cash for approximately $ 1.1 billion.

Consequently, BTC investment products have displayed a net monthly flow of around 2.38 billion dollars and an entry into cash year year of approximately $ 12.7 billion. The United States has carried out net cash entries of approximately $ 1.25 billion, while Hong Kong and Switzerland have respectively displayed a net cash exit of approximately $ 32.6 million and $ 7.7 million.

Is the price of bitcoin ready for a bullish escape?

Bitcoin Price rebounded more than 3% to exchange around $ 104,100 on Monday, June 24, during the American Mid-North negotiation session. The flagship piece, however, faces a large range of resistance between $ 110,000 and $ 112,000.

Within the weekly time, the BTC price formed a double potential macro coupled with a downward divergence from the relative force index (RSI).

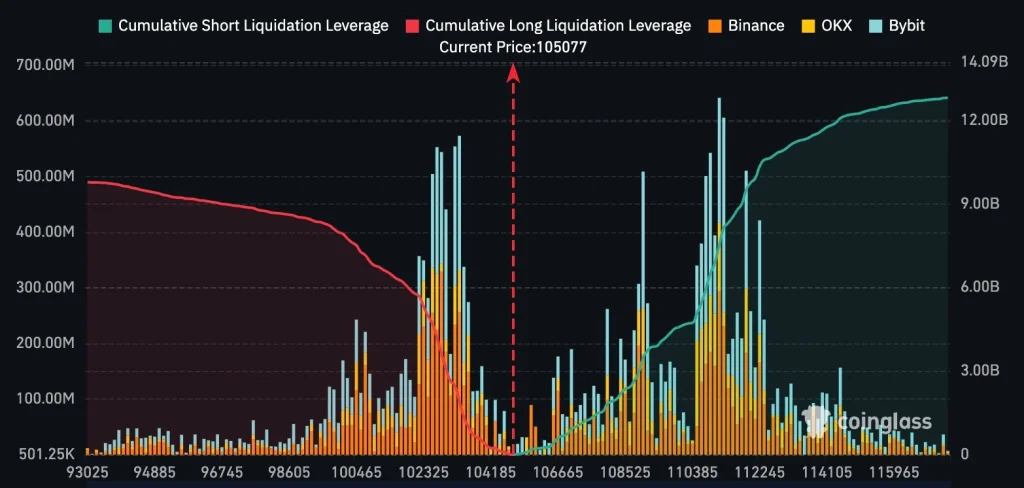

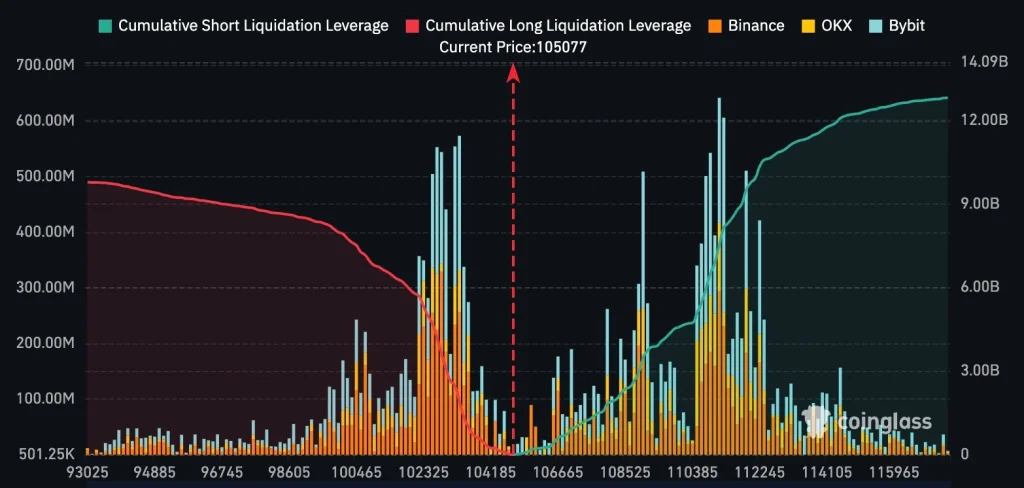

Co -Correglass market data showing more than $ 12 billion in accumulated liquidation lever effect, the BTC price faces a lower feeling in the coming weeks.

As Coinpedia reported, Crypto Benjamin Cowen analyst thinks that the wider cryptography market, led by BTC, will record lower in the coming months and will potentially establish a local hollow in August or September 2025.

From the point of view of the technical analysis, if the BTC price regularly closes less than $ 100,000 in the coming week, a sale in terms of support around $ 96,000 will be inevitable.