Bitcoin Market Fatigue Builds; Could Price Fall Below $100,000?

The Bitcoin Prize has recently rebounded, which brought it closer to the critical level of $ 108,000. Although this recovery offers hope, the key resistance remains not claimed as a support.

Adding to concerns is a notable change in investor behavior, fatigue of the signaling market, which could prepare the ground for a drop in prices less than $ 100,000.

Bitcoin profit take slows down

During the previous market cycle (2020-2022), Bitcoin investors made a total of approximately $ 550 billion in profits during several rallies, including two major waves. Quick advance towards the current cycle and the profits made have already exceeded $ 650 billion, exceeding the total of the previous cycle. This indicates that, although large gains have been made, the market can enter a cooling phase.

The latest data suggests that taking advantage has culminated, the market now in a cooling period after the third major wave of benefits. Although the gains were secured, the momentum that led the movement to the Bitcoin top seems to decline. While the profitability carried out is narrowed, the feeling of investors changes, resulting in a reduction in the purchase pressure.

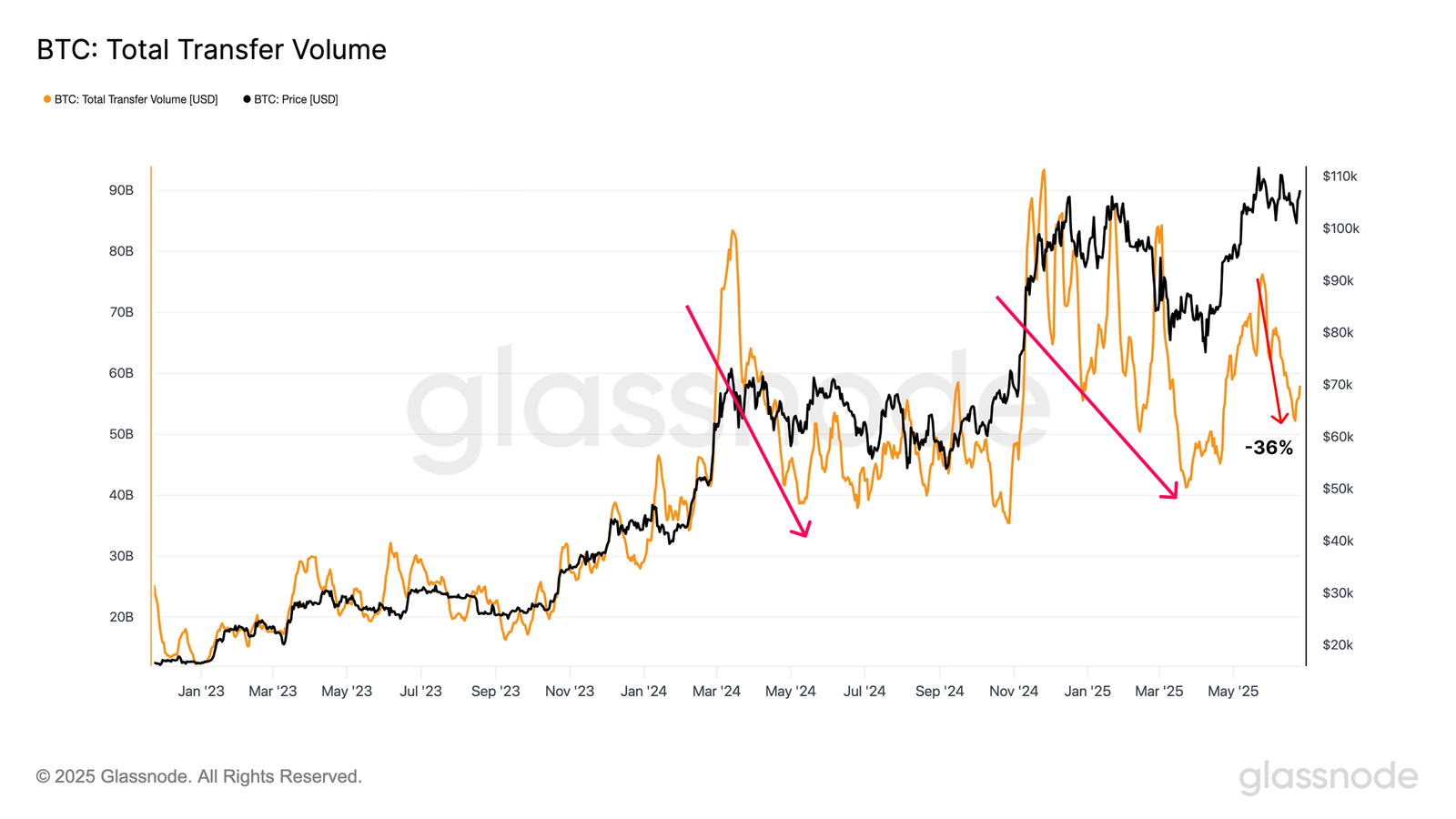

The total Bitcoin transfer volume has also shown signs of cooling. The 7-day mobile average of the chain transfer volume dropped by around 32%, going from a peak of $ 76 billion at the end of May to $ 52 billion last weekend. This drop is consistent with the larger market for cooling on the market, indicating that the bull’s bull’s momentum can lose steam.

The slowdown in the volume of transfer reflects a general loss of activity through the main Bitcoin metrics, strengthening the concept that market players adopt a prudent approach. As the market accumulates, the price of bitcoin could face downward pressure.

The price of the BTC must secure the support

The Bitcoin price is currently $ 106,907, just below $ 108,000. For BTC to continue its upward trend, it must reverse $ 108,000. This would prepare the ground for new gains, pushing Bitcoin to the bar of $ 110,000 and potentially beyond. However, the current feeling of the market remains fragile.

Given the growing signs of market fatigue and the cooling of key activity measures, a drop is more likely in the short term. If the request does not revise, the price of Bitcoin could fall below $ 105,000 and test the level of critical support of $ 100,000. Any new momentum can trigger a deeper drop.

Alternatively, if the price of Bitcoin manages to maintain above the main levels of support, the increased trend remains intact. The successful recovery of $ 108,000 because the support would erase the Bitcoin path to reach $ 110,000. A break above this level could lead to an evolution towards the top of all time of $ 111,980, maintaining the momentum towards the increase and optimism of investors.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.