4 US Economic Indicators Crypto Traders Must Watch This Weeek

This week, although it was shortened by another celebration in the United States, has several economic events with cryptographic implications.

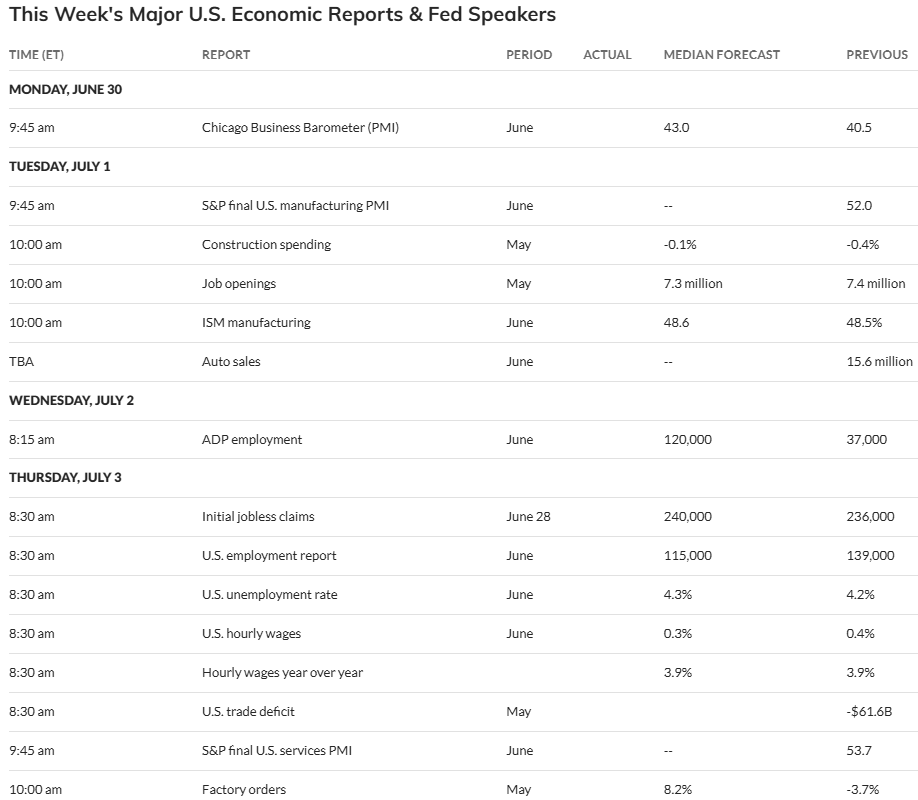

However, instead of disseminating them evenly throughout the week already shortened, these American economic indicators are mainly blocked on Tuesday and Thursday, the latter a particularly busy day. Traders can direct the macroeconomic data this week by monitoring the following events.

American economic indicators to be monitored this week

Cryptographic investors should monitor the following American economic indicators this week because they could potentially cause the volatility of Bitcoin prices (BTC).

These macro-data are particularly important because the labor market is gradually presenting itself as the next Bitcoin macro.

Shake

The American employment report starts this week’s American economic indicators with cryptographic implications. This macroeconomic data point, also qualified as a report on openings and the renewal of work (JOLTS), is published by the American Bureau of Labor Statistics (BLS).

The May report, due on Tuesday, is expected to be less than 7.4 million recorded in April. According to economists interviewed by Marketwatch, data on job offers, hires and separations in the United States could reach 7.3 million.

Despite the expected decline, a reading of 7.3 million would still be higher at the lowest of 7.192 million people recorded in March. Notwithstanding, it remains the main highlight of this week American economic indicators.

A decrease in job offers can report a cooling labor market, which could potentially cause the Federal Reserve (Fed) to consider the softening of monetary policy. Such a change could weaken the US dollar, making Bitcoin more attractive as an alternative asset.

Conversely, if the work openings stabilize or increase, this can strengthen the expectations of continuous monetary tightening, possibly attenuating the attraction of Bitcoin.

ADP employment

Another highest point among American economic indicators is the ADP employment report for June 2025 on Wednesday July 2. The employment of the private sector increased by 37,000 jobs in May, the lowest since March 2023.

However, the BLS report, which is more complete and widely considered to be the official measure, said that the employment of the private sector increased by 140,000 jobs in May 2025.

However, economists see a median forecast of 120,000 employment in the private sector. A lower employment growth figure could report economic cooling, which has potentially prompted the Fed to consider relieving monetary policy.

Such a change could weaken the US dollar, making Bitcoin more attractive as a blanket against the depreciation of money.

Conversely, a stronger than expected report could reinforce the expectations of continuous monetary tightening, perhaps attenuating the Bitcoin call.

Initial unemployment complaints

The first unemployment complaints for the week ending on June 21 reached 236,000, against 245,000 in the previous week and exceeding forecasts of 229,000.

With this reading, the number of American citizens who requested unemployment insurance for the first time came below the forecasts of 248,000 economists.

As part of the American economic indicators to look at this week, the markets will see how many people have filed unemployment insurance for the week ending on June 28.

With a median forecast of 240,000, an increase in unemployed complaints can report economic weakness. This would increase the probability that the Fed will adopt a more accommodating monetary position.

Such a change could lead to a lower dollar, improving the attractiveness of Bitcoin as an alternative intake. However, if the increase in complaints is considered a temporary fluctuation, the impact on bitcoin can be limited.

Meanwhile, analysts say that a resilient labor market, associated with sticky inflation, could allow interest rates to remain high. However, signs of a cooling work sector could temper the Fed path.

Non -agricultural payrolls

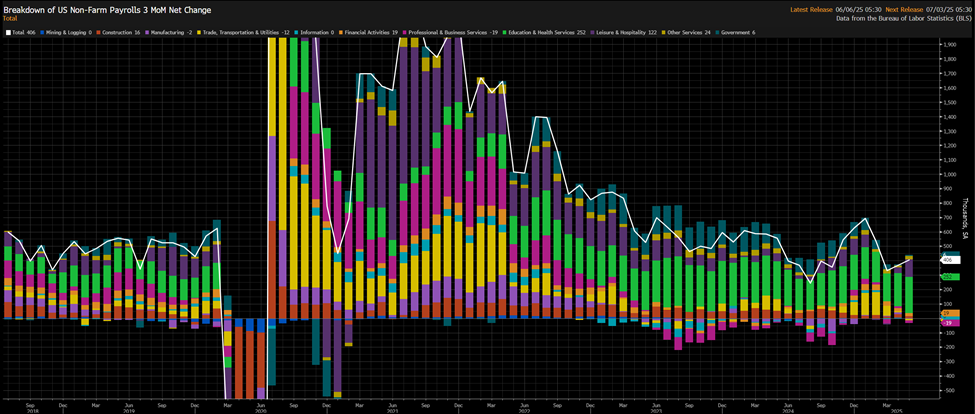

The American employment report, or non -agricultural payrolls (PNF) for June 2025, is expected to be published on July 3. The economy added 139,000 jobs in May, after adding 177,000 jobs in April.

Meanwhile, the unemployment rate remained stable at 4.2% in April and May. In particular, PNF data arrives on Thursday this time, given that Friday is a public holiday in the United States.

Marketwatch data show that economists anticipate a 4.3% increase in American unemployment rate compared to a slowdown in jobs to 115,000. This drop or slowdown reflects the potential economic impacts of President Trump’s prices.

Strong employment growth can lead the Fed to maintain its current position on monetary policy or even to consider tightening, which could strengthen the US dollar and potentially remove bitcoin. Analysts note a positive three -month trend in PNF.

However, despite the revisions, they are not sufficient to move the market and are not important enough to make a massive change in the labor market.

However, if the underlying economic concerns encourage Fed to adopt a more dominant approach, Bitcoin could benefit because investors are looking for other value reserves.

Analysts say that difficult employment conditions in the United States come while employers who seek to clarify the White House trade policy must gradually face frequent adjustments of deadlines and schedules.

To date, Bitcoin has been negotiated for $ 108,244, having increased only by 0.87% in the last 24 hours.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.