Will Bitcoin Rally in July? Experts Weigh In

July promises to be a potential launch for Bitcoin (BTC), which continues to hold above the threshold of $ 107,000.

Historical data, optimistic techniques and the growing confidence of investors converge around the story that the next stage of the bull market can be imminent.

Why July could trigger the next Bitcoin major rally in the middle of summer configuration calls

Bitcoin is negotiated with a brunt bias, holding well above the threshold of $ 107,000. To date, the crypto pioneer sold $ 107,076, up almost 50% since the first week of April.

With the flagship crypto consolidating itself in a bull flag model, an upward escape can be imminent. The flags are tight consolidation zones in the action of the prices (the flag) showing a countertenance movement which follows directly after a net directional movement (mast) in prices.

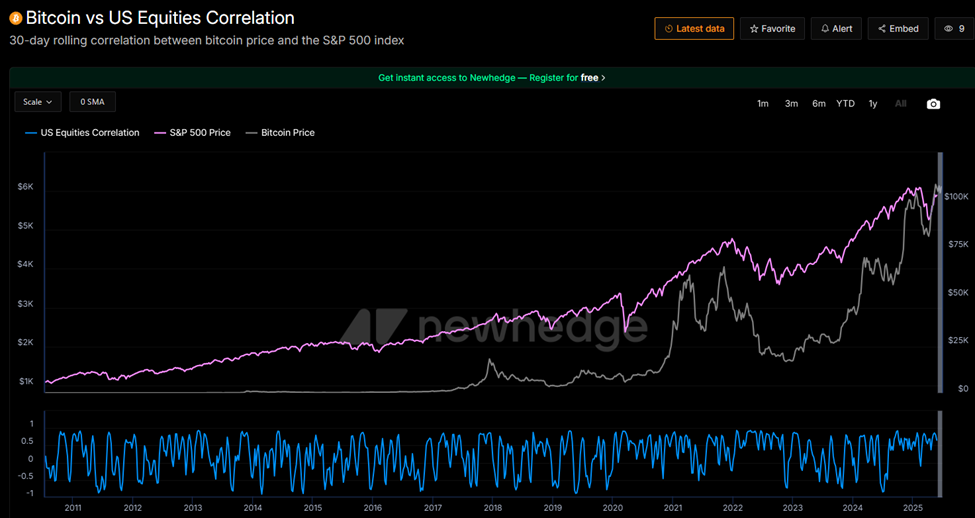

The X user (Twitter) Zerohedge recently stressed that the S&P 500 has published positive gains every July in the past ten years. This is a remarkable sequence, with an average yield of around 2.3% in the past two decades.

Notable examples include a gain of + 3.11% in July 2023 and an increase of + 1.13% in July 2024. While older decades as the 1970s and 1980s were less consistent due to macro-turbulence like the oil crisis and the 1987 crash, recent models comb in July as a historic month.

On the basis of these perspectives, the correlation of Bitcoin with the S&P 500 positions the crypto pioneer for a bullish July, if the story rhymes.

Analyst Crypto Fella also sees the upward potential, highlighting Bitcoin rolled up for a break because he follows the S&P 500. This refers to a convergence between traditional and digital markets.

“Bitcoin [is] In case of bursting and likely to correspond to the S&P for the new ATHS in July, “he noted.

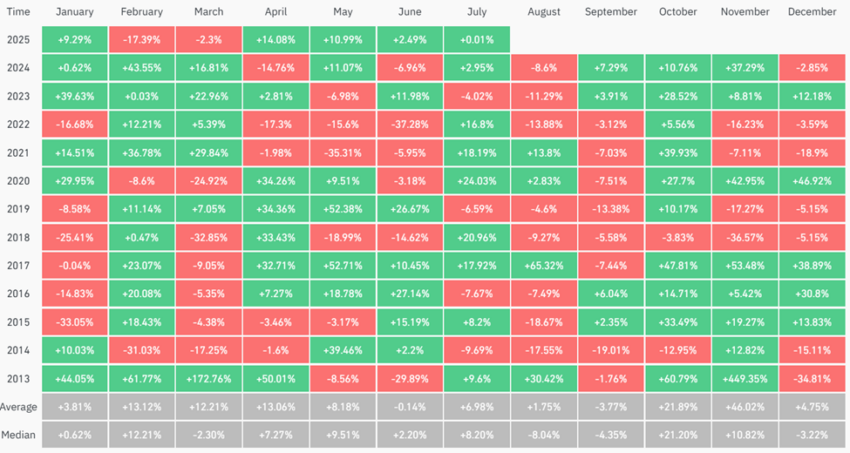

Indeed, the cryptography market echoes this seasonal rear wind, where Bitcoin has also demonstrated its strength during the summer.

“July was one of the strongest months of Bitcoin in history,” said formanite, trader and crypto analyst.

From Shakeout to Breakout: Signals from the Haussier market and Paris Alts-Season

The data and the feeling on the chain suggest that Bitcoin could again capitalize on its seasonal momentum. Beincryptto reported that stablecoin measures showing that Bitcoin rally could be far from over.

Meanwhile, the 0xNobler analyst estimates that the market is now emerging from the final phase of Shakeout and is entering a new upward trend.

In this context, the analyst highlights a possible Altcoin season, but only for “bouts low rights”. He stresses that successful merchants focus on cyclical models shaped by market psychology, regulatory changes and technological innovation.

Although past performance never guarantees future yields, the stars seem to line up for a bullish July through actions and the crypto.

If history rhymes, investors could see Bitcoin carry out the charge, followed closely by a selective Altcoin rally while the capital runs in undervalued assets.

However, investors must always conduct their own research, combining optimism with caution. Indeed

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.