Why Bitcoin’s Price Surge Isn’t “Enough” to Trigger Profit-Taking

The Bitcoin price has made a strong recovery in the past few days, exceeding the $ 108,000 mark and positioning itself closer to the summits of all previous time.

Investors seem to be patience, emphasizing the holding of their positions, but the question remains: can the dynamism of Bitcoin prices maintain itself and turn into new summits?

Bitcoin is out of sale

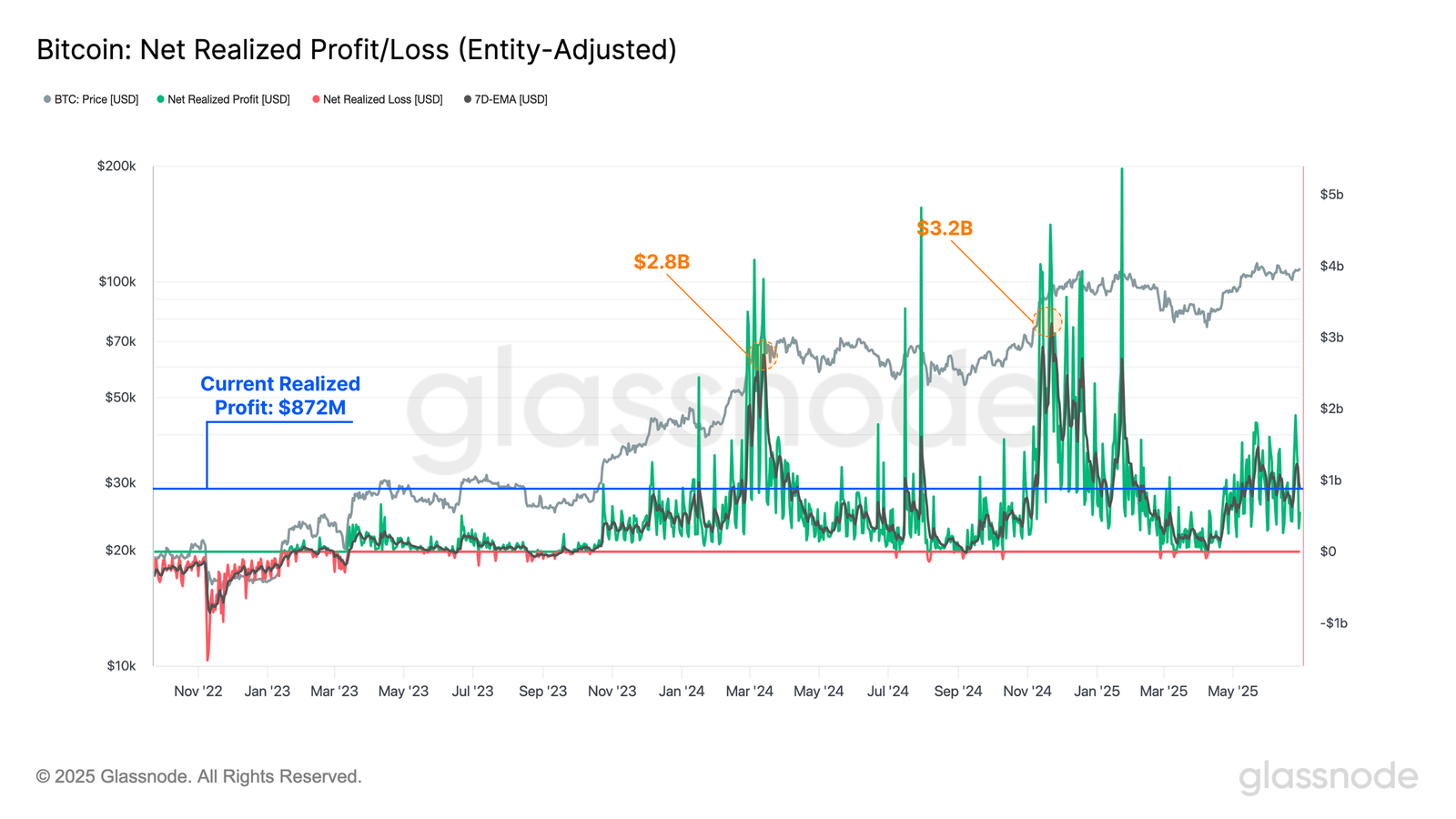

Despite the positive price movement, the profits made have remained relatively moderate in recent weeks. The current Bitcoin price is only a stone throwing of its summit of all time, but only $ 872 million in profits are made per day. This is a striking contrast with the profits made of $ 2.8 billion and $ 3.2 billion observed in previous prices overvoltages, such as prices of $ 73,000 and $ 107,000.

This mute profit suggests that investors are not forced to withdraw from current levels. The market needs a substantial increase or a drop in triggering a change of feeling, pushing investors to take more decisive actions concerning their assets.

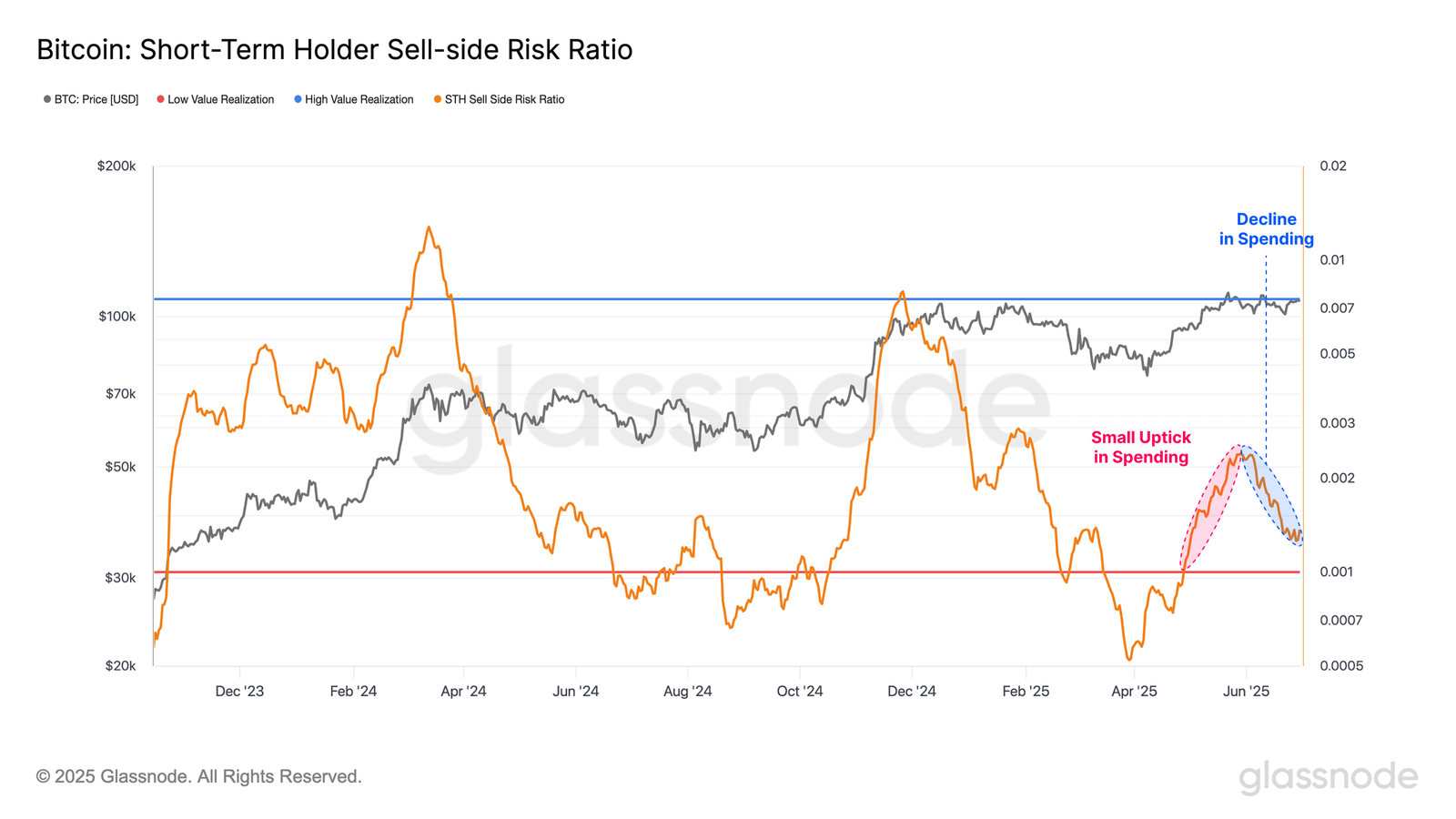

In addition, the feeling of the market reflects a cautious approach to investors. The risk ratio on the sales side, which follows the number of short -term holders selling their bitcoin, saw an increase in May but has since decreased.

This indicates a reduction in sales pressure, because the price of Bitcoin remains in a range which is not attractive enough for short -term holders to sell.

However, the fact that short -term holders are not quick to sell signals that the current Bitcoin value is not convincing enough to go out. If the price continues to increase, it is possible that more investors feel encouraged to hold or accumulate more, contributing to a global feeling of positive market.

The price of the BTC aims to increase more

Bitcoin is traded at $ 108,948, very close to the resistance violation of $ 109,476. This barrier marks the last obstacle before reaching the coveted range of $ 110,000. A clear break through this resistance would probably open the Bitcoin path to test new heights, $ 110,000 being the next important step.

Maintaining the current momentum is essential for Bitcoin exceeds $ 110,000 and ends up returning it to support. If this happens, the Crypto King could regularly go to its summit of $ 111,980, which is less than 3% compared to the current price. However, this will require a strong bullish momentum and investors’ confidence to maintain this upward trajectory.

If unforeseen circumstances lead to macroais clues, Bitcoin could face a potential downside. Rejection to $ 109,476 could reduce the price below $ 108,000, revisiting the support to $ 105,585. Such a drop would invalidate current upper perspectives and could point out a more extensive consolidation phase for Bitcoin.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.