Why INJ Daily Active Addresses Soar 1,700%

Injective (INJ), a blockchain of layer 1 for stocks, active active ingredients and active ingredients (RWA), experienced a dramatic peak in daily active addresses (DAAS) in July.

Although the INJ token has dropped 80% of its top of all time (ATH), the network resurgence revives optimism. What stimulates this sudden growth? This article explores key factors behind overvoltage.

The rebounds of the injective network in 2025, Daas has reached the highest since December 2023

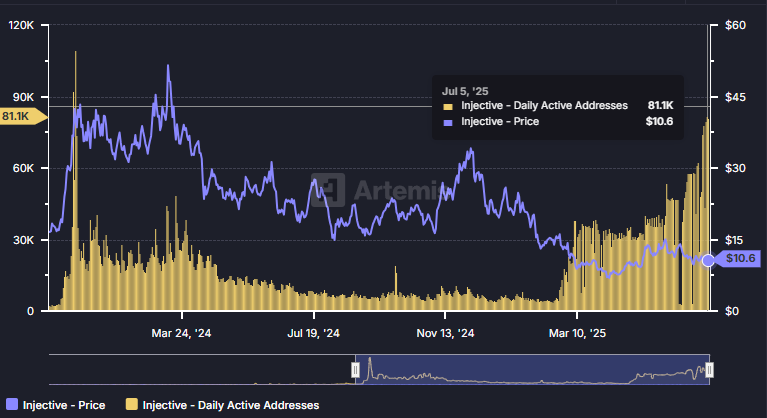

Artemis Analytics data show that the daily active active addresses of INJ are argued from 4,500 at the beginning of 2025 to more than 81,000 in July, an increase of more than 1,700%.

This has marked the highest level since December 2023, when the price of the INJ increased from $ 1.25 to more than $ 50.

Consequently, many investors speculate that the renewed activity of the network could report a new price rally for INJ in 2025.

“Injor in the daily active addresses pumped + 1,500% to 82,500 in 6 months. The injective increases exponentially and this is only the beginning,” said Lennaert Snyder.

The increase in DAA seems to have started after February 17. Injective has deployed an upgrade of the major protocol known as the Nivara upgrade on this date. The community approved it with great participation, and it had to improve network performance, attracting more users and developers.

In July, Daas doubled compared to the means of T2. A major engine behind this growth was the launch by injective of its Ethereum Virtual Machine Public Test test (EVM).

On July 3, 2025, Injective announced the deployment of Testnet. It allows developers to build and execute compatible decentralized applications Ethereum (DAPP) directly on the blockchain of layer 1 of injective.

Is the injective (INJ) undervalued?

In 2025, Injective accelerated its 5x tokens burning rate after the launch of the INJ 3.0. The weekly mechanism for protocol revenue burns has reduced token supply and introduces deflationary pressure. However, it has not yet resumed a recovery in prices in the middle of the current Altcoin winter.

Despite the development of projects and strong metrics on the chain exceeding the 2024 levels, INJ is still 80% below its $ 52 ATH. According to Beincryptto data, Insjose at around $ 10.5, down 60% of an up to date.

Some investors now believe that INJ is seriously undervalued.

“Inject Inject is massively underestimated. If you have been careful: the main developers, partners and launches are matched behind the scenes, preparing for a wave of deployment of products that could give everything to date,” said Cryptobusy investor.

In the midst of the interest of the growing exchange in token actions and assets, the injective could reappear as a layer of layer 1 leader for the tokenization of active worlds – a winning space of institutional traction and in increasing detail.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.