Bitcoin Could Vanish Faster Than the Epstein List

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee and read the growing presence of Bitcoin (BTC) which, according to Max Keizer, makes it a direct challenge for the foundations of the power of the state.

Crypto News of the Day: Centralized Bitcoin Holdings under the threat of government repression

While governments rush to contain what they cannot control, Max Keizer warns that centralized Bitcoin holders could be the first targets of a future wave of repression of digital assets.

By centralized, the Bitcoin pioneer refers to the BTC held by ETFs (negotiated funds on the stock market) and business treasury bills, as indicated in our recent American publication new crypto.

Keizer’s remarks follow Bram Kanstein’s declaration that Bitcoin cash companies that really include BTC will be a force of nature in finance.

The calling on the new companies of Wall Street Top by 2035, the starter expert and founding coach said that Bitcoin becomes perpetual if he dominates Wall Street. But Keizer finds this about it.

In a declaration in Beincrypto, Max Keizer warned against the growing dependence of centralized guards for the storage of bitcoin.

While Bitcoin gradually disputes the authority of traditional financial institutions, Keizer suggests that a state -run by the state is not likely, it is inevitable.

The latest warning comes in the midst of an increasing institutional adoption of Bitcoin, including explosive growth in the FNB Spot classified in the United States and the participation of public companies such as Microstrategy (now strategy).

Although this has helped to stimulate demand and strengthen prices’ action, Keizer maintains that Bitcoin owned by intermediaries remains vulnerable.

“People do not fully appreciate how subversive Bitcoin is and that it is a carpet that draws central banks and nation states,” he said.

In addition, Keizer warns that even if Bitcoin makes it possible to self-control financial, holders who do not take care of their assets may lose them entirely.

“The world is about to crash and break in a billion self-open parts. But the state will go after all Bitcoin held by intermediaries like ETF, Bitcoin cash companies and guards,” added Keizer.

Why institutional bitcoin holders could trigger state repression

Keizer believes that the battle lines are formed between decentralized individual sovereignty and centralized financial control, Defi and Tradfi.

It portrays the accumulation during Bitcoin by companies such as microstrategy not as a passive investment strategy, but as a form of economic war.

“MSTR and its clones are engaged in a massive attack on the State and the USD; Bitcoin above,” said Keizer.

However, in his opinion, this attack will not remain unanswered. By establishing parallels with the distributes of the government spent on the property of gold and private life, he predicts that the regulators will quickly move once the pressure.

“Keep in mind, the state will reproduce and any non -guardian bitcoin is vulnerable to confiscation and your bitcoin could disappear more quickly than the Epstein list,” said Max Keizer.

While many consider the approval of ETFs and institutional participation as signs of traditional adoption, Keizer suggests that this framing lacks the greater geopolitical and ideological implications of the rise of bitcoin.

For him, the only way to really “own” bitcoin is to hold it personally without intermediaries, guards or corporate packaging.

Overall, Keizer’s warnings fall to the norm which, in the eyes of the State, the power is more in control than in the property.

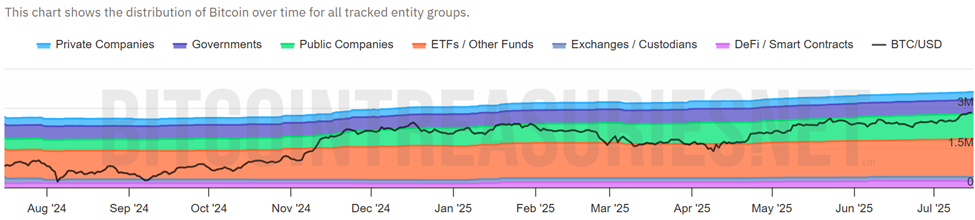

Graphic of the day

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

Presentation of the actions of the crypto-actions

| Business | At the end of July 15 | Preview before the market |

| Strategy (MSTR) | $ 442.31 | $ 448.88 (+ 1.49%) |

| Coinbase Global (Coin) | $ 388.02 | $ 389.73 (+ 0.44%) |

| Galaxy Digital Holdings (GLXY) | $ 20.86 | $ 21.21 (+ 1.68%) |

| Mara Holdings (Mara) | $ 18.76 | $ 19.22 (+ 2.45%) |

| Riot platforms (riot) | $ 12.10 | $ 12.34 (+ 1.98%) |

| Core Scientific (Corz) | $ 13.76 | $ 13.80 (+ 0.29%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.