Bitcoin Slips to $98,000 Amid Market Sell-Off and Declining Activity

Bitcoin fell below the $ 100,000 threshold, because the wider experiences of the cryptography market increased volatility.

This slowdown coincides with a significant drop in transaction activity on the Bitcoin network, bringing the volume of memory pool (MEMPOOL) to its lowest level since March 2024.

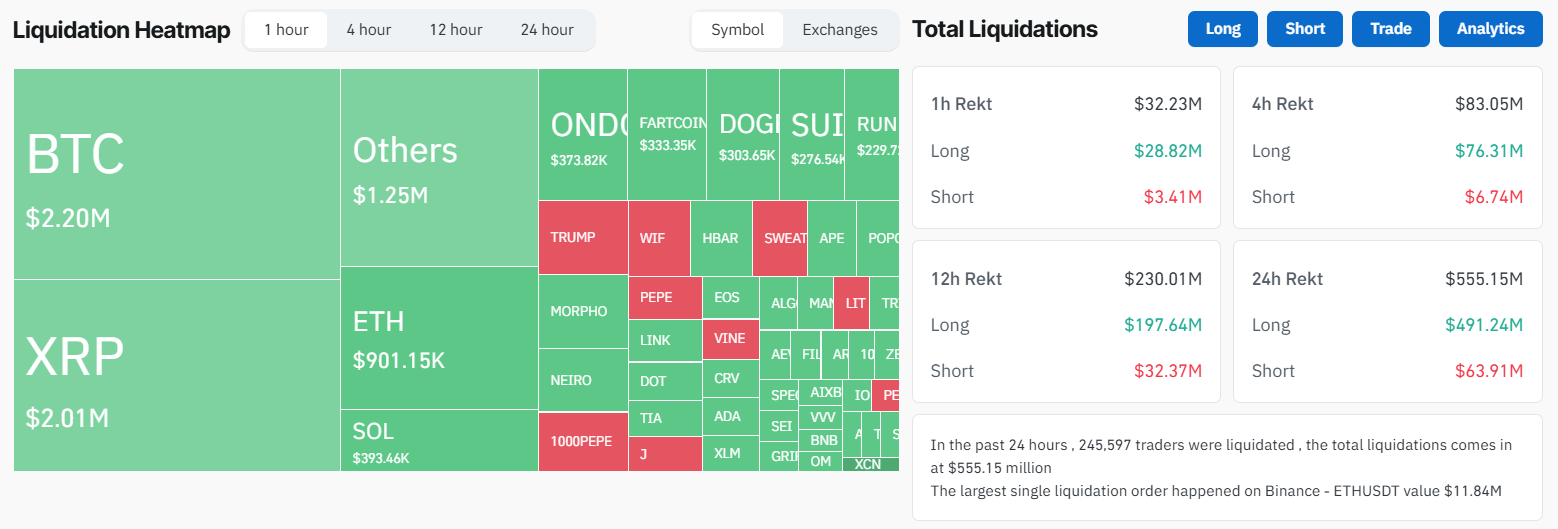

The slowdown in the market erases more than $ 500 million in liquidations

In the past 24 hours, Bitcoin fell below $ 100,000, allowing more than 4% of its value and briefly affected $ 98,000. Beincryptto data indicate that Bitcoin initially reached a culmination at $ 102,000 before succumbing to the sale pressure.

The decline follows broader instability in the market, the total market capitalization of cryptography losing 5% of its value. Other major cryptocurrencies have also been faced with a sharp decline. Ethereum, Solana and BNB each recorded losses greater than 7%.

Increased volatility has sparked a wave of liquidation, destroying more than $ 555 million in lever -effect positions, according to Coinglass. More than 239,000 merchants were faced with forced liquidations, with long traders – these bets on price increases – suffering from the heaviest losses, amounting to $ 491 million.

Short merchants, anticipating price reductions, lost around $ 63 million.

The turmoil follows the decision of US President Donald Trump to apply strict prices on the main business partners, including Canada.

The administration claims that this decision is designed to curb the flow of undocumented immigrants and illicit substances in the United States. However, prices have raised concerns about inflationary pressure on American consumers.

In response, Canadian Prime Minister Justin Trudeau announced reprisal measures, imposing prices of 25% at $ 106 billion in American imports.

The first cycle of withdrawals, targeting $ 30 billion in goods, will take effect immediately, with an additional $ 125 billion of priced prices in the coming weeks.

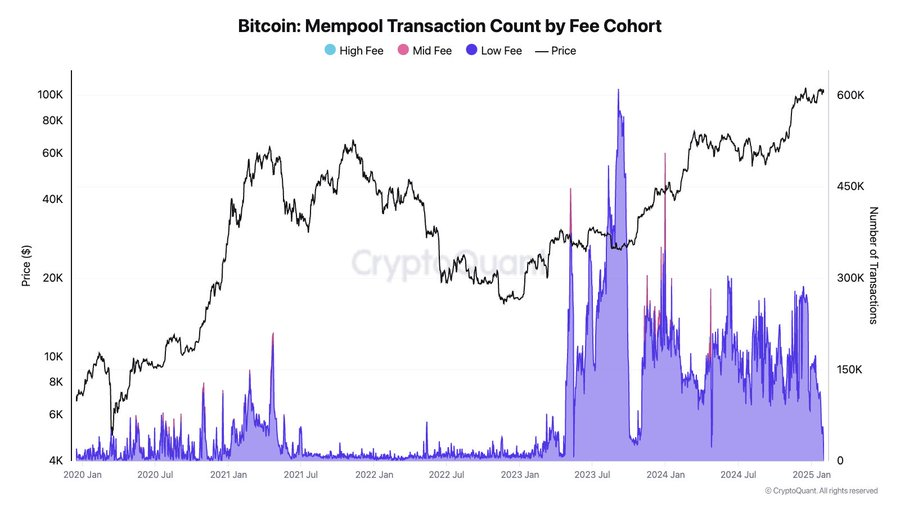

The Bitcoin network sees a sharp drop in transactions

Beyond the turbulence of the market, the activity of the Bitcoin network has decreased considerably, with the mempool – the waiting area of unconfirmed transactions – displaying a notable reduction in volume.

On February 1, cryptobrant data show that mempool is almost empty, indicating a steep drop in the volume of transactions. The data also reflect that the Bitcoin transaction costs fell to 1 SAT / VB, the reduced signaling of the block space request.

This marks the lowest level of transaction activity since March 2024.

This trend raises concerns about the use of Bitcoin as a means of exchange, some analysts suggest that the growing perception of the BTC as a digital Or can discourage transactional use.

Bart Mol, host of the Podcast Radio Satoshi, criticized the change of story, declaring that the celebration of an empty mempool overlooks the potential risks for the fundamental role of Bitcoin. He compared it to the “wood rot” in the foundation of a house, warning that a lack of transaction activity could undermine the main Bitcoin functionality.

“Bitcoins celebrate that Mempool is authorized is one of the most delayed things that I have seen for a while. The story of digital gold slowly destroys the bases of Bitcoin, such as wood rot in the foundation of a house, “wrote Mol.

Indeed, Mol’s comment lines up with the growing adoption of Bitcoin as a reserve ratio. Several companies and governments have started to consider Bitcoin for their treasury bills. These stories strengthen the position of the token as a long -term value store rather than transactional money.

However, the continuous drop in activity on the chain raises questions about the long-term usefulness of bitcoin beyond the digital gold reserve.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.