How Much Bitcoin Does US Government Hold?

A successful request from the Freedom of Information Act (FoIA) has confirmed that US Marshals Service currently only has 28,988 Bitcoin (BTC).

It is far from the largely supposed figure of 200,000+ BTC, confirmation triggering a political reaction in the midst of urgent issues on the long -term bitcoin strategy of America.

The US government has criticized for the sale of strategic bitcoin holdings

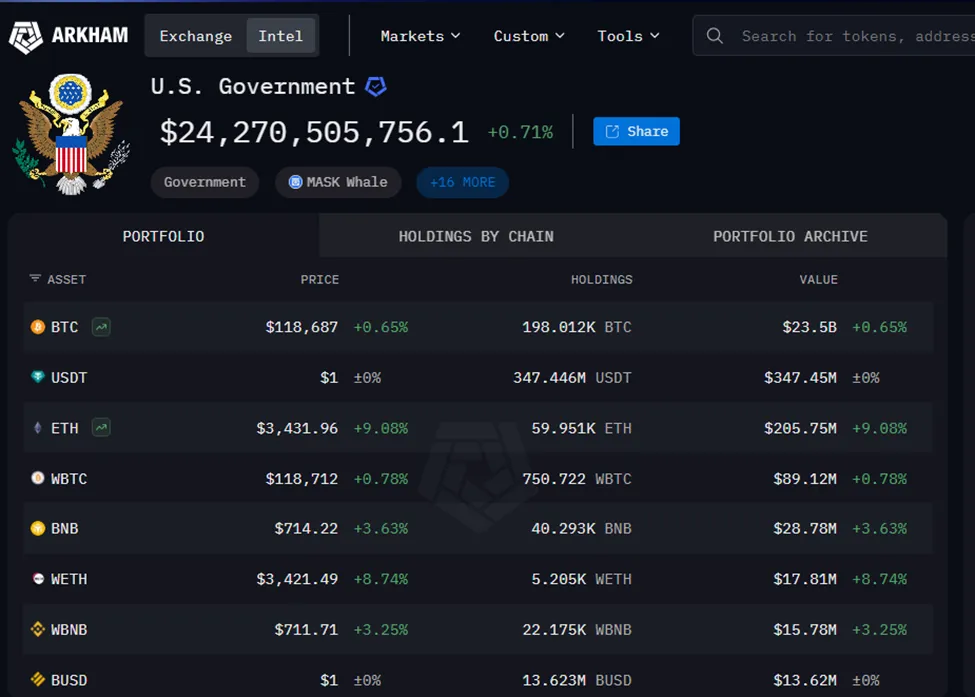

When writing these lines, Bitcoin was negotiated at $ 118,493, up 0.2% in the last 24 hours. Government assets are estimated at around $ 3.43 billion at these rates. This is much lower than $ 23.5 billion that the Blockchain analysis company estimated Arkham Intelligence.

The data, confirmed via the foia by crypto advocate and the researcher L0LA L33TZ, dispute the previous reports and hypotheses according to which the United States had maintained a substantial reserve of Bitcoin seized, often sold at auction after pensions of the law on the Darknet markets and fraud operations.

The Foia request dates back to March 2025, US Marshals Service responded in July. The answer included detailed Bitcoin Holdings accounting – 28 988.35643016 BTC, to be exact – but no mention of recent large scale auctions.

This suggests that these pieces reflect the current complete inventory of the agency, on July 17, 2025.

Bitcoin defenders and politicians approach the impact of the market with strategic issues

The leaders of the cryptographic industry and the pro-bitcoin legislators were quick to react. One of the supporters of Washington’s most frank cryptos, senator Cynthia Lummis, criticized the government, calling them to a strategic error.

The disclosure also rekindled a light but revealing challenge emitted by the CEO of Bitcoin magazine, David Bailey, in March.

The Crypto executive had publicly offered a reward of $ 10,000 to any journalist who could obtain official confirmation of the US BTC holdings.

Bitcoin negotiating around new heights, some market analysts consider sale as inadvertently. Ran Neuner, a crowd of cryptographic jokes, said that Bitcoin’s retirement belonging to the government could remove a major source of sales pressure.

“If the United States has sold most of its bitcoin and the price is still $ 120,000, can you imagine what is going on now that they don’t sell?” Neuner pointed out.

The remark addresses the feeling that fewer coins in the hands of the government could mean greater market freedom, in particular liquidation events triggered by the State.

However, the broader concern persists. With other countries such as El Salvador doubling Bitcoin and institutions such as Japan Metaplanet portfolios, criticisms say that the United States neglects a geopolitical opportunity.

The transparency of the foia is welcome, but the absence of a coordinated Bitcoin strategic reserve policy could cost America economically and technologically in the years to come. Countries like Bulgaria can already look back with regret after having sold 213,500 BTC in 2017, enough to erase its national debt by 2025.

Calls for greater monitoring and reinvestment potentially resonate now through Capitol Hill and Crypto X (Twitter).

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.