HBAR Traders Face $46 Million Liquidation Risk – Here’s Why

Hbar Price is in the middle of a strong upward trend, trading at $ 0.27 after a seven -day stellar rally. With a bullish momentum, the Altcoin approaches the bar of $ 0.30, a level that we do not see in five months.

However, although prices are increasing, historical indicators suggest that a decline can be imminent. Traders and investors should carefully walk while potential losses surfed in technical graphics.

Hbar merchants may have trouble

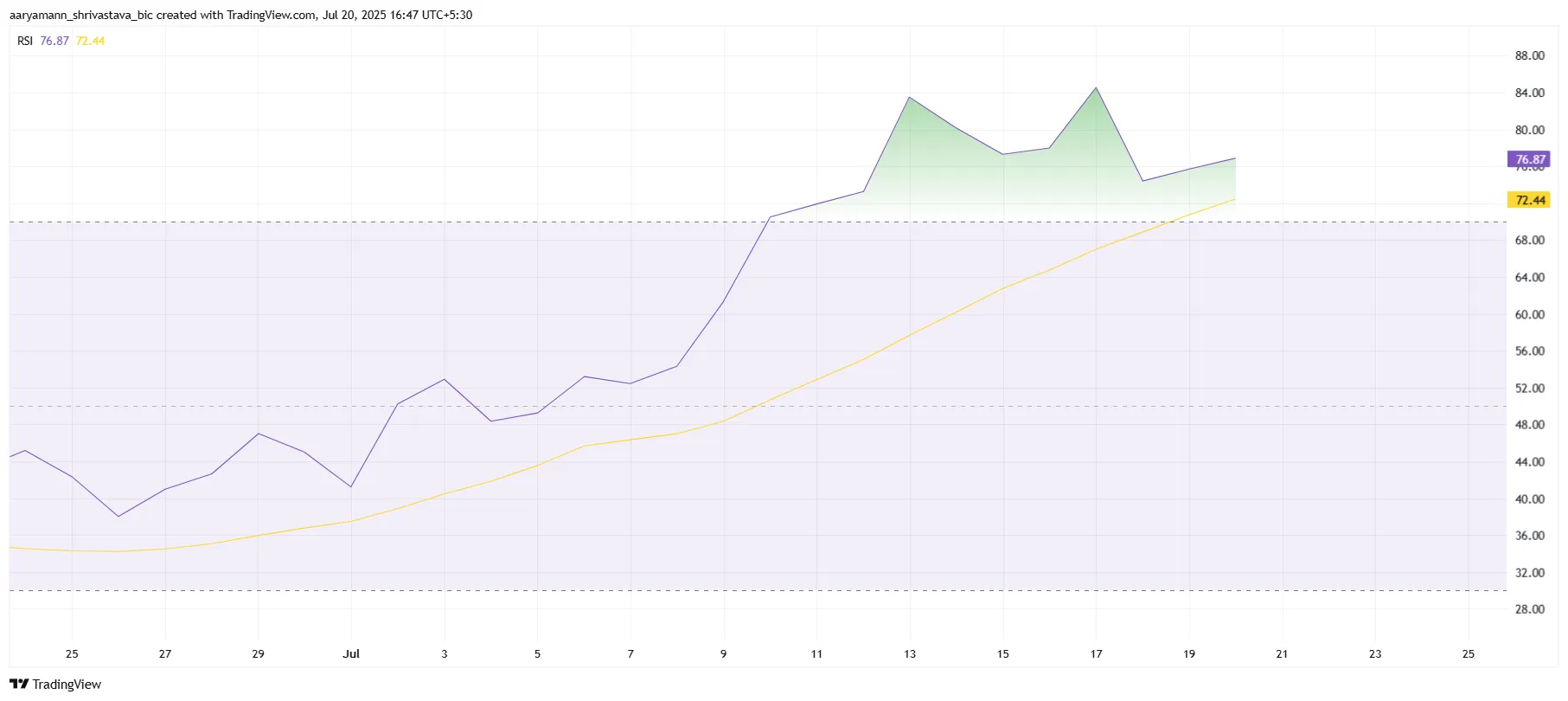

The relative resistance index (RSI) for Hbar remained above 70.0 in last week, reporting over-racket conditions. Historically, when the active ingredients enter this area, price charging time tends to follow.

Until now, the rally has been supported by a positive feeling on the wider market of cryptography, but Hbar may soon feel the pressure of profit.

Although the momentum is positive, the indicators flash prudence. Excessive areas often lead to corrections, especially when merchants decide to obtain gains. If history is repeated, Hbar can follow the same model and feel a short -term drop, affecting its ascending trajectory.

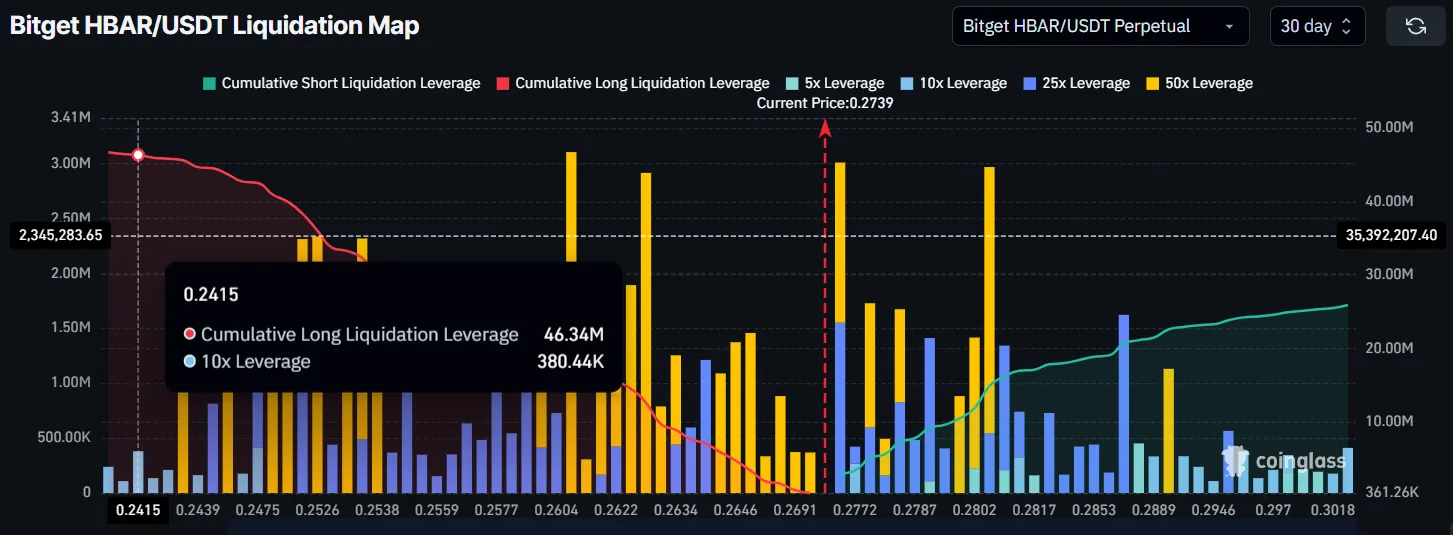

Zoom out, the wider momentum has another concern. The liquidation cards show a group of long potential liquidations just below the current price range.

If Hbar drops to $ 0.24, the data suggests that it could trigger up to $ 46 million long liquidations. This would probably result in an acceleration of losses while leverage traders leave their positions.

Such a waterfall could create a sale pressure that prevails over the bullish feeling, which makes recovery more difficult. If this scenario takes place, market confidence could be shaken, many retreating retail investors. This macro configuration gualed caution despite the current price force.

Can the Hbar price increase?

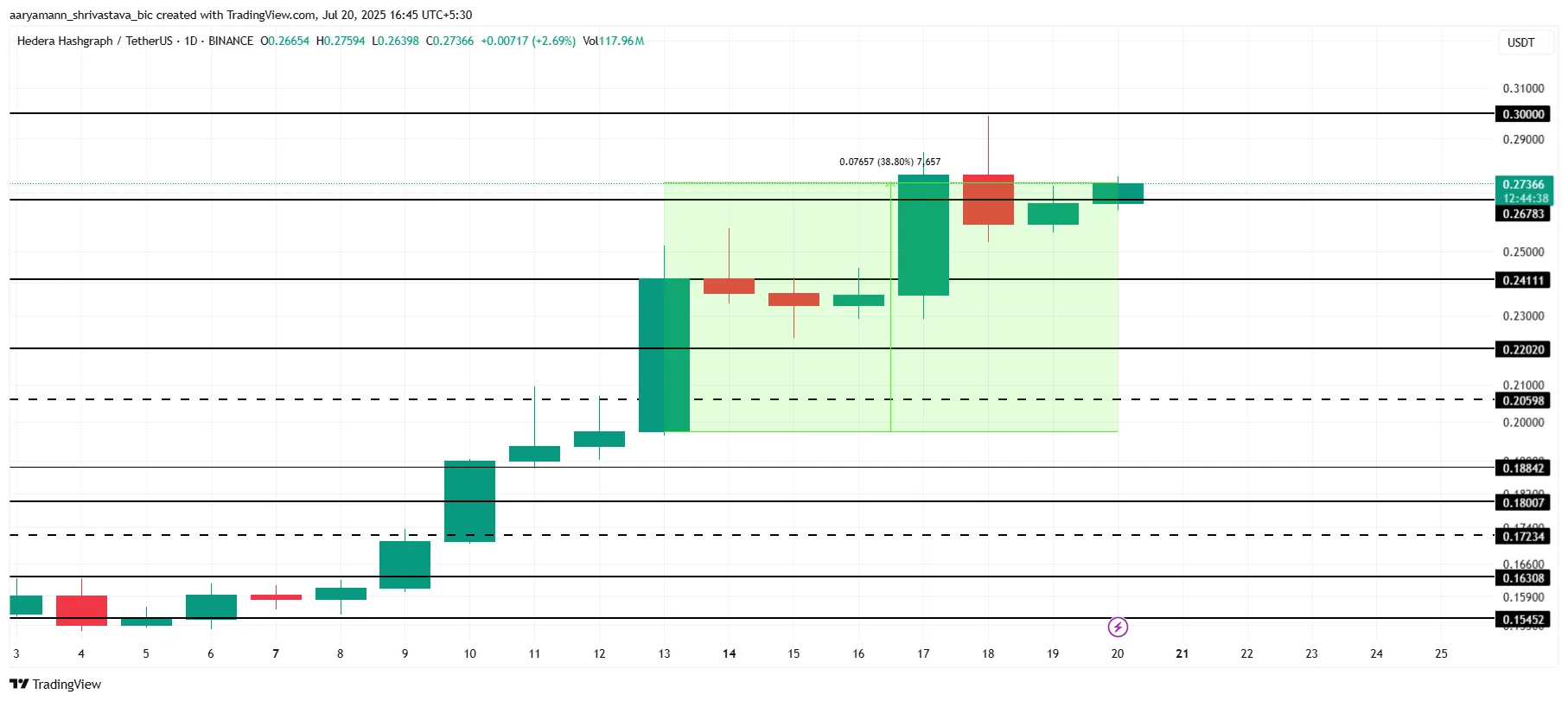

Hbar is currently trying to confirm $ 0.26 as a solid level of support. In case of success, this would give Altcoin the basic bottom to climb more. A stable socket above this brand could push Hbar to the psychological bar of $ 0.30, extending its five-month sequence.

However, if the exaggerated risk materializes, Altcoin could fall to $ 0.24, triggering a liquidation event. This could send Hbar to tumble at $ 0.22, destroying recent gains and shaking short -term confidence in the rally.

Alternatively, if the upper market clues of the market persist, Hbar can bounce back to $ 0.26 and recover the level of $ 0.30. This would invalidate the lowering prospects and continue to get on the daily graphic.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.