Causes $7.5 Billion Panic Selling

Bitcoin has recently shown signs of rounding reason, marked by a drop of 6.4% in the last 24 hours. This model was validated when BTC fell at $ 90,000 in an intra-day hollow, triggering the sale of panic.

Despite the market reaction, a key cohort suggests that this drop may be short -lived.

Bitcoin Investors Panic

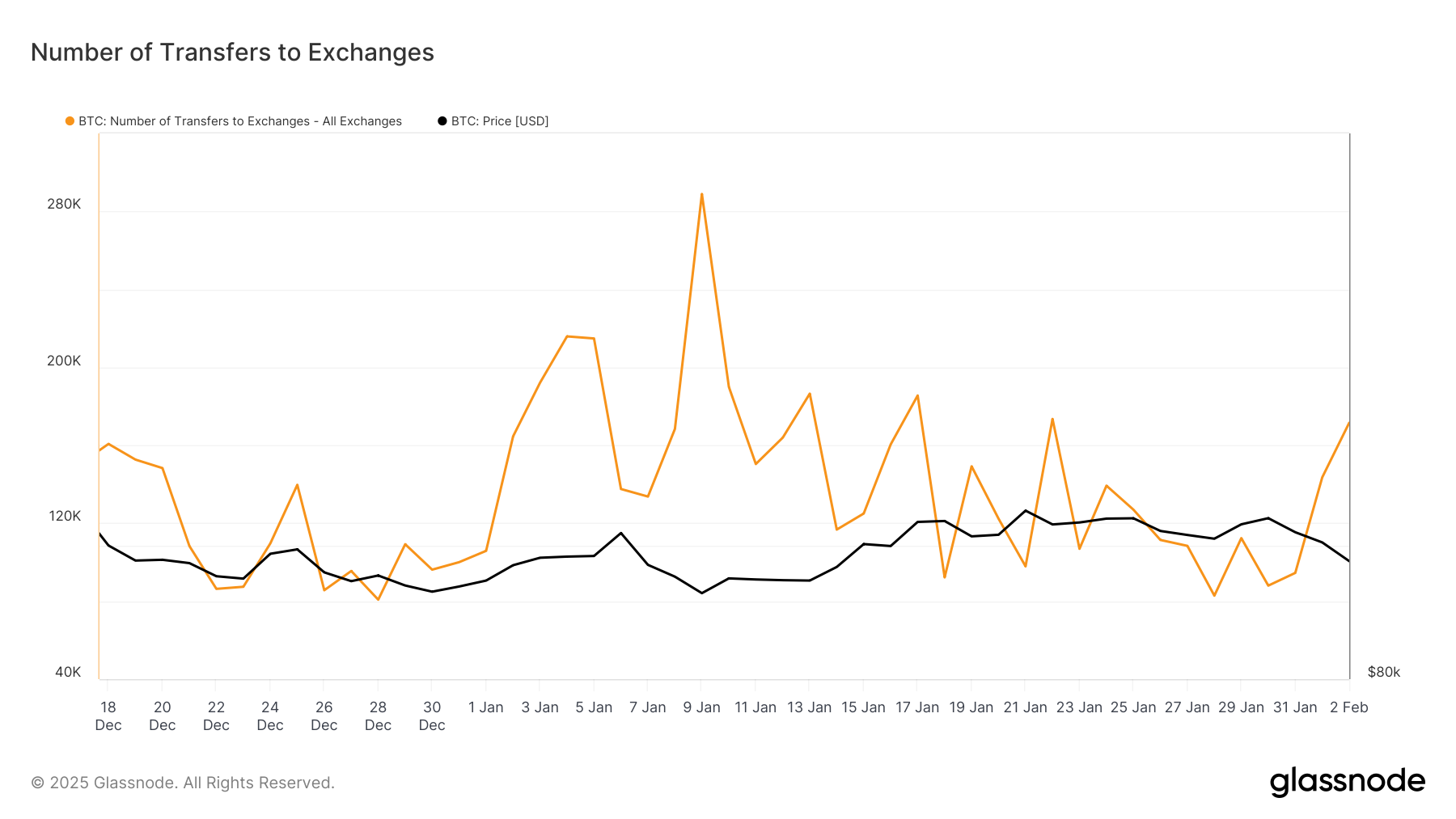

Over the past two days, Bitcoin Deposit deposits have experienced a sharp increase, with more than 80,000 BTC, worth around 7.5 billion dollars, have increased to exchanges. This increase is often considered an imminent sales sign, as investors are looking for liquidity during market slowdowns.

However, this large BTC movement could simply reflect the sale of panic rather than a long -term change in the feeling of the market. Investors tend to move assets to exchanges in times of uncertainty, but this behavior is not always an indication of a sustained downward trend.

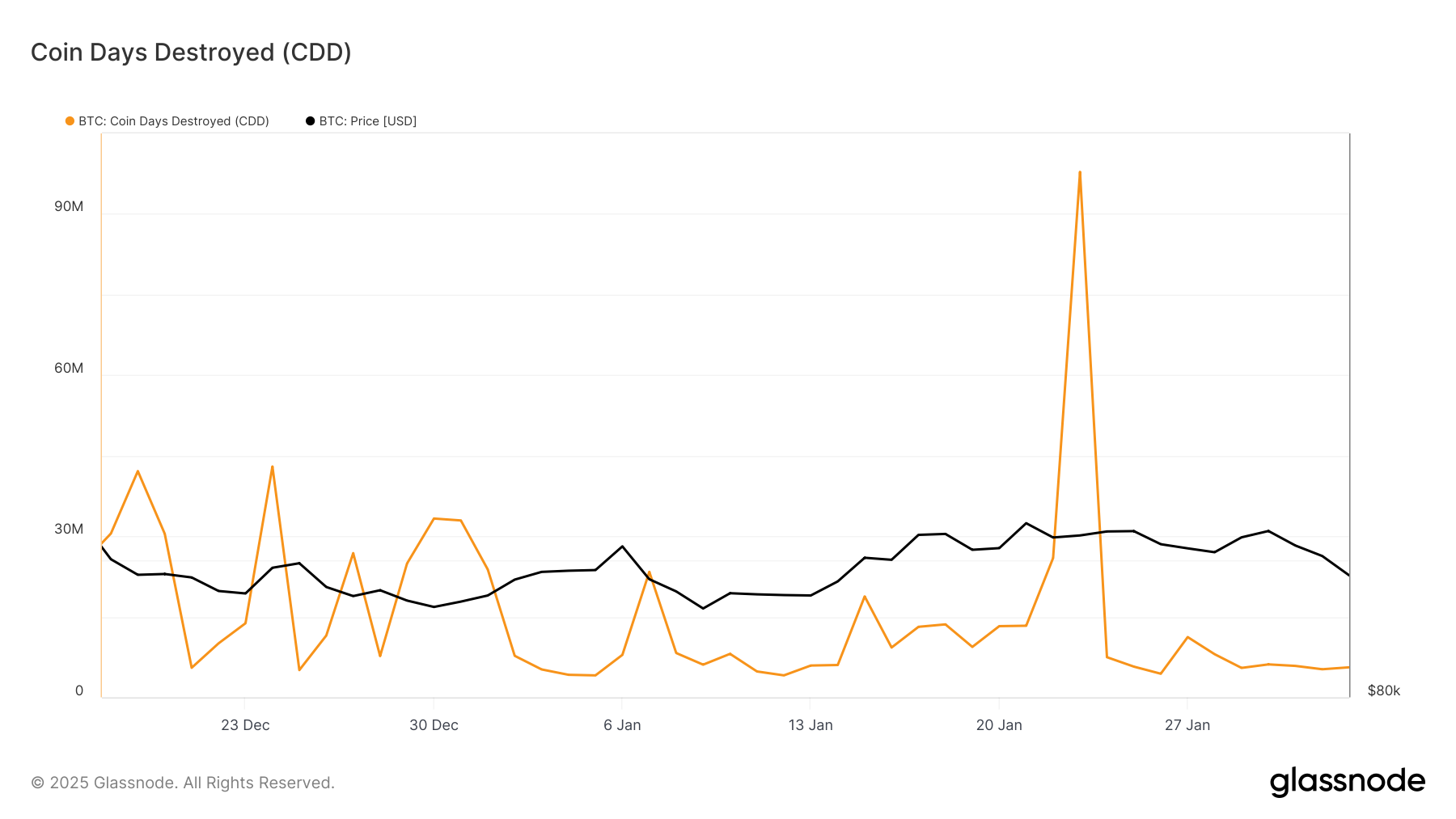

The metric of the destroyed coin (CDD), which follows the movement of long -term coins, gives an overview of the feeling of the market. CDD peaks are generally associated with market sales. Interestingly, despite a sharp drop in bitcoin at $ 90,000, long -term holders (LTH) remained largely inactive.

This resilience suggests that LTHs are confident in the recovery, indicating that short -term volatility on the market may not dissuade them. LTH’s inactivity indicates that they hold firmly, and this decline can simply be a temporary blip rather than the start of a long -term lower phase.

Price prediction BTC: delay a drop

Bitcoin has formed a rounded motif, but it may be that it can go into a cup and a reverse handle pattern. The lowering momentum is not currently as intense as it could be, offering BTC a chance to bounce back support at $ 93,625.

If Bitcoin rebounds successfully, it could increase to $ 100,000 after violating $ 95,668. This would mark a critical resumption and would probably see a return of trust in investors. However, if the lowering model persists, Bitcoin can see a new drop at $ 92,005 in the short term.

A successful violation and reversal of the resistance of $ 100,000 to support would invalidate the lowering prospects. This could potentially trigger an increase at $ 105,000, marking a resumption of recent losses.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.