Bitcoin Price Nears ATH as Two Signals Hint More Upside

Bitcoin Price jumped almost 7% in last week, a clear decision even for the Crypto OG. The rhythm of the rally makes comparisons with the last push before its level of all time on July 14 (ATH) at $ 122,838.

However, a more in -depth examination on chain and technical indicators shows that this time, market conditions are significantly different and potentially more favorable for another step.

Sopr suggests that this rally has room to breathe

The production ratio of production spent in the short term (SOPR) measures if the parts move on the chain are sold to profit or loss. When short -term SOPR increases too much, it signals an aggressive profit, often preceding local peaks.

The short -term holder SOPR is more logical in this analysis, because during aggressive price peaks, the short -term cohort is often the first to start selling.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

During the peak of July 14, SOPR increased at overheated levels between 1.03 and 1.05, a red flag that the Bitcoin price rally was exhausted. Today, SOPR is 1.00, showing that the profits are made less aggressively. This alludes to a healthier market structure and a rally that has not yet reached saturation.

Purchase / Sale of Taker and RSI ratio point to high demand

The cash flow flows confirm the upward nuance. The purchase / sale ratio of takers, a gauge to know if the aggressive market buys or sells dominate, went from a neutral 1.02 on August 10 to 1.14, its highest reading since early July.

This shows that buyers intervene with conviction, controlled sellers.

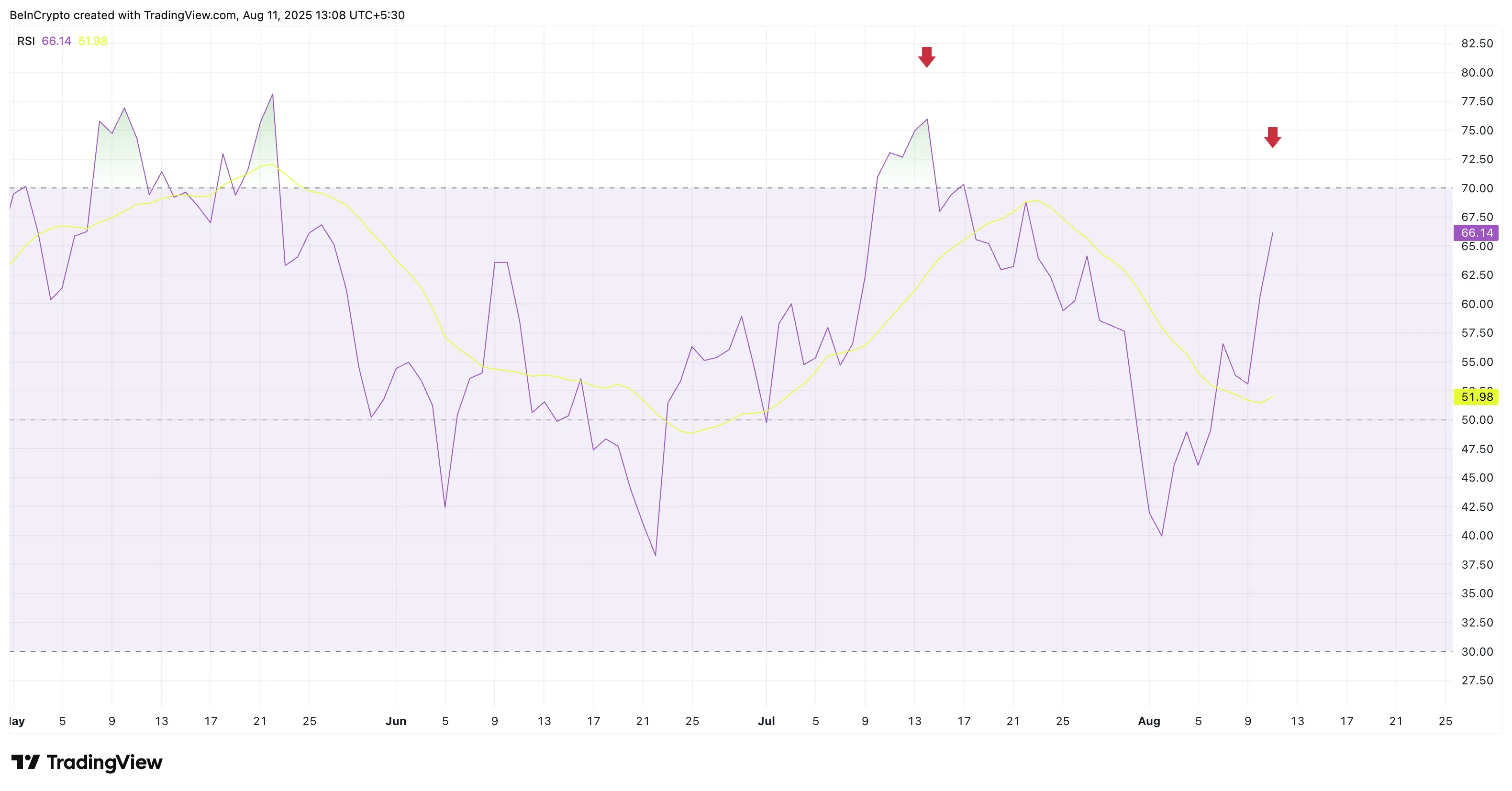

The relative resistance index (RSI) supports it. On July 14, RSI was in the exaggerated territory above 75, limiting the increase more. From now on, RSI is nearly 66 because the price is only 0.6% south of all time, well below the over -defusion thresholds, which gives the price of bitcoin more “leg space” before technical exhaustion.

RSI (relative resistance index) is a momentum indicator which measures the speed and size of recent price movements on a scale of 0 to 100: above 70 can report excessive exaggeration, below 30 occurring.

These measures suggest that the rally could extend beyond the current resistance zone. SOPR shows that this rally is not yet increased by a sharp reduction in profits. The recent jump in the purchase / sale of takers’ ratio, coupled with an RSI which is always comfortably below the over-eating territory, suggests that buyers have both the intention and the technical space to push the rally further.

Bitcoin Price Action Eyes Breakout beyond the top of all time

On the daily graphic, Bitcoin always moves in a well -defined ascending channel. The price is pressed compared to the Fibonacci level 1.0 of $ 123,230; The same area that capped the July 14 rally. A clean break here could target $ 130,231.

The key supports to be monitored are $ 120,806 (FIB 0.786) and $ 118,903 (FIB 0.618). Being above these levels would maintain the intact rupture thesis, while closing below could wedge the momentum.

If the upward metrics take place and the break erases $ 123,200 with a volume, the traders could see new heights forming faster than the last time, perhaps higher than what the market is currently in the process of raising. However, a drop of less than $ 118,900 will overcome the short -term optimistic trend.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.