Chainlink Price Drops to $17 Breaking Key Support, What’s Next?

Chainlink price action has taken a sharp bearish turn over the past 24 hours, sweeping the crypto landscape with uncertainty. The asset collapsed below the pivotal support of $17, while the overall market capitalization fell by 5.65% and trading volumes soared. The decline comes from strong institutional selling amplified by a near doubling of volume and the loss of critical technical levels.

However, some positive developments shine through the gloom, such as Virtune’s recent adoption of Chainlink’s proof of reserve technology. And ONDO’s integration of LINK as the official oracle for tokenized securities. The path ahead is characterized by volatility and defining price levels that could decide the asset’s next trajectory.

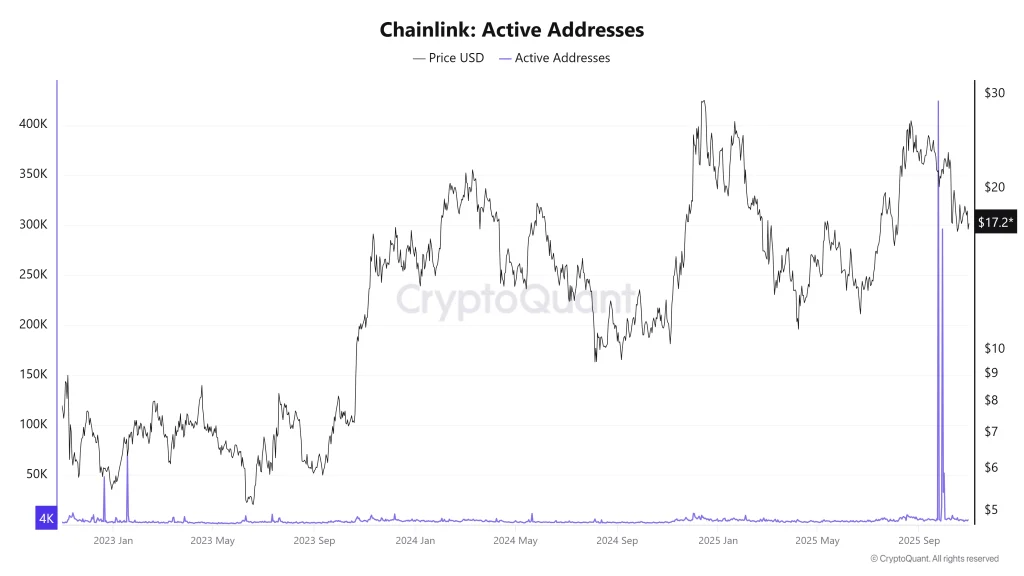

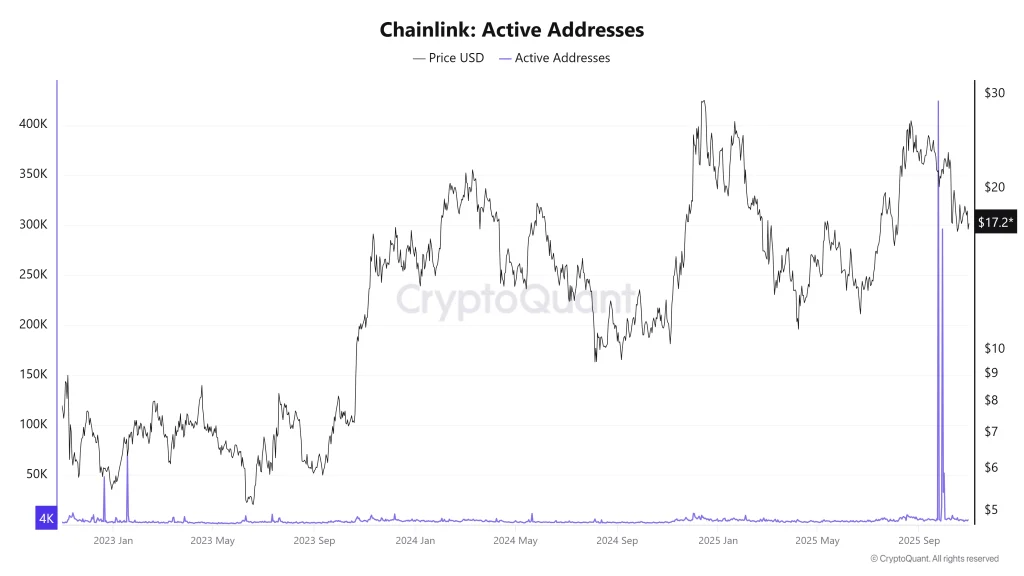

Chainlink Active Addresses

Over the past few sessions, according to CryptoQuant, the number of active addresses for Chainlink has increased sharply. Although the bulk of price movements have been negative, rising addresses often align with increased on-chain activity and signal a potential inflection point for volatility.

It should be noted that, historically, large increases in active addresses can precede either strong rallies or continued downward pressure as trading intensifies. This latest surge is notable in a context of strong sales with volume almost doubling. This further suggests that market participants are repositioning themselves for further fluctuations.

LINK Price analysis

Chainlink’s short-term price outlook is determined by clear technical signals and support and resistance levels. LINK price is currently trading at $17.19, down 5.62% on the day and 2.81% over the past week. It broke through both a multi-week descending trendline and the crucial 50% Fibonacci zone near $16.92. Successively, the loss of these levels led traders to exit their positions as previous uptrends were invalidated.

Digging deeper into the technicals, the RSI at 38.99 cements the bearish momentum, although LINK has yet to reach true oversold territory. Immediate support stands at $16.50. If the selling persists, the next possible low is $15.33. Conversely, resistance is now established at $17.20, which is a new pivot point after the breakout.

FAQs

Chainlink price fell due to heavy institutional selling, the loss of key technical support, and a general sense of risk aversion driven by Bitcoin’s correction.

Current support levels lie at $16.50 and $15.33, while resistance stands at $17.20.

Spikes in active addresses signal an increase in on-chain activity and volatility, which could precede either a rebound or a deeper decline, depending on how traders react to the new momentum.

Trust CoinPedia:

CoinPedia has been providing accurate and timely updates on cryptocurrencies and blockchain since 2017. All content is created by our expert panel of analysts and journalists, following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, Trustworthiness). Each article is checked against reputable sources to ensure accuracy, transparency and reliability. Our review policy ensures unbiased reviews when recommending exchanges, platforms or tools. We strive to provide timely updates on everything crypto and blockchain related, from startups to industry majors.

Investment Disclaimer:

All opinions and ideas shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the writer nor the publication takes responsibility for your financial choices.

Sponsored and advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are clearly marked and our editorial content remains entirely independent from our advertising partners.