MicroStrategy Might Announce a Big Bitcoin Purchase Soon

The strategy, formerly known as microstrategy, can be preparing for another important purchase of Bitcoin.

Speculations around this decision intensified after the company’s co -founder, Michael Saylor, dropped a subtle index on social networks.

Buzz on the Saylor Bitcoin tracker market

On February 23, Saylor shared a Bitcoin tracker on X (formerly Twitter), a decision that historically preceded major acquisitions. His cryptic message suggested that recent Bitcoin transactions are not yet reflected in the tracker.

“I don’t think it reflects what I did last week,” wrote Saylor on X.

Given its history of sharing similar graphics before the major Bitcoin acquisitions, the cryptographic community quickly supposed that the company was preparing for another purchase.

“Michael Saylor has again displayed his BTC purchase tracker, which means that the strategy will announce another big purchase of Bitcoin tomorrow,” said Nikolaus Hoffman.

Meanwhile, some speculate that the strategy can allocate up to $ 2 billion for Bitcoin, aligning its recent decision to collect funds through convertible obligations.

These obligations, which have no interest but can be converted into the company’s shares, should mature in March 2030 and will serve as superior obligations.

This capital increase is part of the “plan 21/21” of strategy, which aims to guarantee $ 42 billion for BTC investments. The company seeks to raise $ 21 billion thanks to equity sales and an additional $ 21 billion via fixed income securities.

Formerly a company focused on software, the strategy has become the largest Bitcoin business holder. Its pivot has considerably increased the interests of investors, which obtained its stock a place in the Nasdaq-100.

The last Bitcoin acquisition of the company took place on February 10, when it bought 7,633 BTC for $ 742.4 million. Currently, the strategy holds 478,740 BTC, worth around 47 billion dollars, with a global investment of $ 31.1 billion.

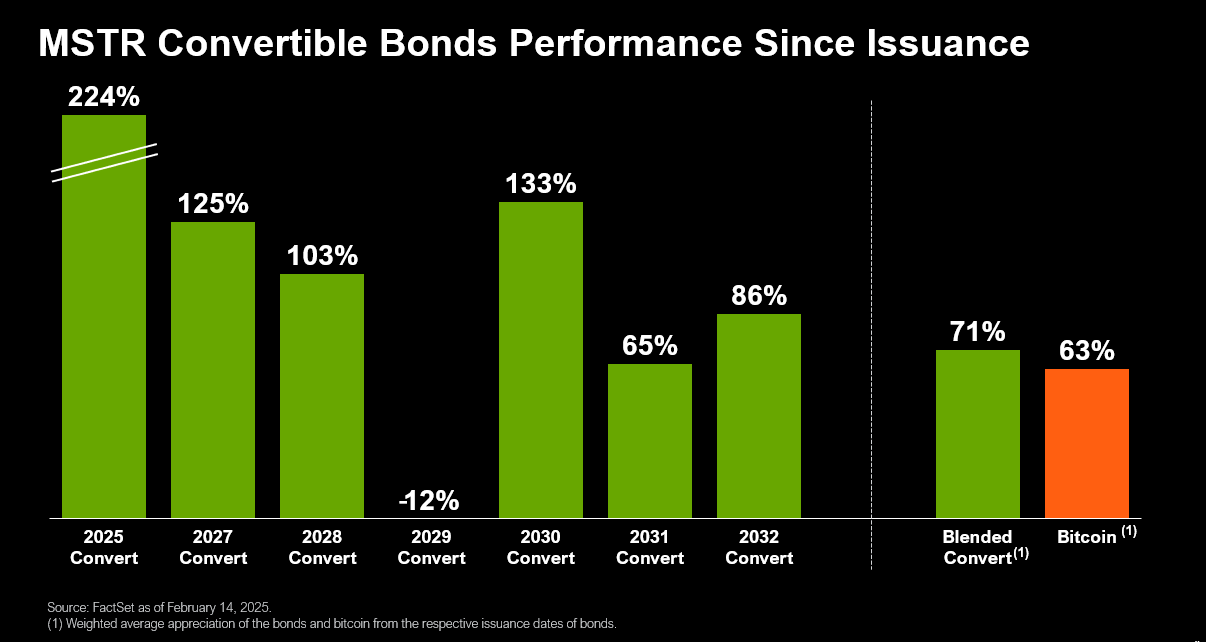

Meanwhile, the company recently stressed that its MSTR convertible obligations have returned 71% since the program, surpassing Bitcoin itself.

In addition, the aggressive approach to the BTC-First strategy has inspired other companies to follow the plunge. According to Hodl15 Capital, more than 70 companies listed on the world have now added Bitcoin to their reserves, influenced by Saylor’s strategy.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our general conditions, our privacy policy and our warnings have been updated.