Ethereum (ETH) Flashing Sell-off Signal, $2,850 Next Target?

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is issuing a sell signal, hinting at a notable price decline in the coming days. Over the past three days, sentiment across the cryptocurrency landscape has shifted noticeably toward the bearish side, leading to a substantial price decline.

Ethereum (ETH) Technical Analysis and Upcoming Levels

However, this price decline is expected to continue as ETH has formed a bearish price action on the daily time frame. According to expert technical analysis, ETH broke out of a head-and-shoulders downtrend and broke through a crucial support level at $3,250.

This break in the bearish price action has pushed traders into short positions, which could influence the price of ETH in the coming days. Historical data indicates that $3,250 has been a significant support level for ETH over the past three months, consistently providing a floor whenever market sentiment turned bearish.

However, this time the altcoin failed to maintain this level. Based on recent price action, if ETH closes a daily candle below the $3,200 level, there is a strong possibility of an 11% decline, taking it to the support level of 2 $850.

On-chain bearish actions

This bearish outlook has prompted traders to take short positions, as reported by on-chain analytics firm Coinglass. Currently, the ETH long/short ratio stands at 0.884, indicating strong bearish sentiment among traders. Additionally, the data reveals that at press time, 53.07% of top traders are holding short positions, while 46.93% are holding long positions.

Main liquidation levels

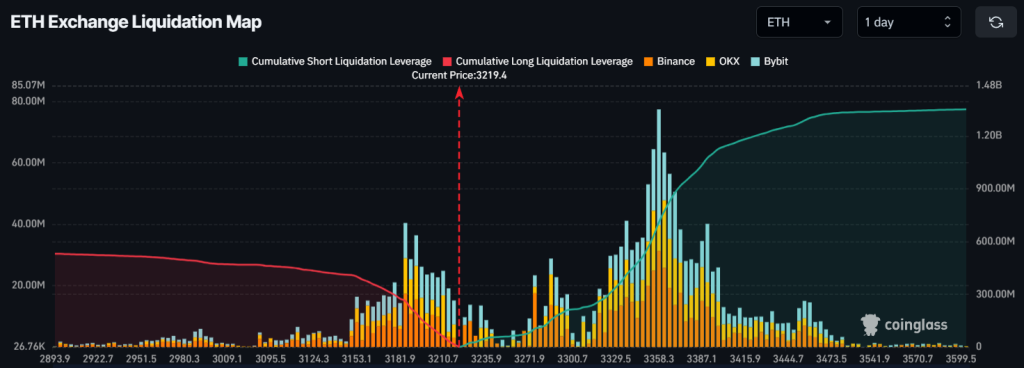

Additionally, the main liquidation zones are at the $3,185.5 low and $3,361.9 high level, with traders heavily overleveraged at these levels, as revealed by the ETH exchange liquidation map .

If the current sentiment remains unchanged and the price falls to the $3,185.5 level, nearly $261.01 million of long positions will be liquidated. Conversely, if the sentiment changes and the price rises to the $3,361.9 level, approximately $708.16 million worth of short positions will be liquidated.

This data reveals that short positions created by sellers are more than double the long positions held by buyers, signaling strong bearish sentiment.

Current Price Dynamics

Currently, ETH is trading near $3,225, having seen a price drop of over 1.65% in the last 24 hours. However, during the same period, its trading volume fell by 29%, indicating reduced participation from traders and investors.