How Retail Investors Can Capitalize

The StableCoin market has experienced a sharp increase in recent months. Its total market capitalization has increased by 90% since the end of 2023, exceeding the threshold of $ 230 billion.

While Stablecoins play an increasingly vital role in global finance, experts identify the key means for retail investors to capitalize on this growing trend.

How retail investors can take advantage of the stable boom

Patrick Scott, an expert in decentralized finance (DEFI), described three primary strategies for investors who seek to benefit from the boom of Stablescoin.

“There are 3 ways to play the boom of stables: 1) chains Stabbed are emitted in 2) Stablecoin 3 emitters) Deficols protocols are used in stable-cobs,” said Scott.

According to Scott, the best opportunities reside in the investment in block chains that house stablescoins, specifically exploring projects that emit stablescoins with investable tokens and participation in Defi protocols where Stablecoins are actively used.

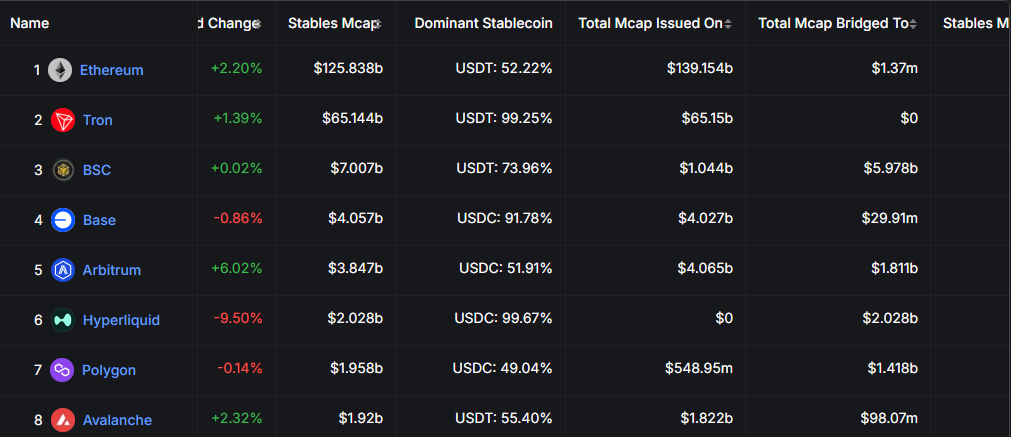

A major element of the Stablecoin ecosystem is the fundamental blockchains that facilitate their emission and their operation. Ethereum (ETH) and Tron currently lead the market concerning the offer of Stablecoin.

Ethereum welcomes around $ 126 billion in stablescoins, while Tron (TRX) follows with $ 65 billion. The two networks have reached heights of all time in the circulation of stablescoin.

Tron’s growth has been more consistent, driven by its widespread adoption of peer transactions (P2P), in particular in developing regions.

While the adoption of the stable reserve continues to increase, invest in native tokens like ETH and TRX could offer lucrative opportunities for investors who are looking for an exposure of the StableCoin market.

“… In a few years, it will be obvious with hindsight that the best way to invest in the boom of the stablescoin to come was simply to buy ETH where the most stable and will be settled and finally a key beneficiary of the economic activity that emerges around them,” added Dcinvestor.

In particular, the main transmitters of Stablecoin, Tether and Circle, remain by hand and do not offer direct investment opportunities. However, other emerging projects have viable alternatives. Stablecoins such as Ethena (USDE), USDY (Ondo), Honey (Berachain) and Crvusd (Courbe) provide governance or utility tokens that allow investors to participate in their growth.

These tokens are often available with advantages such as voting rights or income sharing mechanisms. Such incentives allow retail investors to take advantage as the Stablescoin sector is developing.

Increasing look of stablecoins in deffi

Stablecoins play a crucial role in the Defi ecosystem, serving as a principal means of liquidity, loan and generation of elements. The main protocols DEFI with a strong integration of Stablecoin include Aave, Morpho, Fluid, Pendle and Curve.

Investors can engage with these platforms by providing liquidity or participating in loan and loan activities. Based on transaction costs and interest rates, they could gain attractive yields.

The increase in the adoption of stablescoin did not go unnoticed, several major financial players entering space, including Bank of America. Fidelity Investments would have developed its stablecoin within the framework of a broader initiative to extend its offers of digital assets.

In addition, Wyoming has taken a pioneer stage by launching its stable supported by the State, Wyst. Likewise, World Liberty Financial, a company linked to the Trump family, officially introduced USD1. The vouchers of the American government and the cash equivalents will fully support this stablecoin.

Despite optimism surrounding the stablecoins, concerns have emerged concerning potential risks. More specifically, the possibility of a financial crisis is similar to the Bank Run 2008 scenario. If investors rush to buy their stablecoins during market instability, issuers may be forced to liquidate their reserve assets. This could trigger broader disturbances in the financial system.

Regulatory efforts, including proposals such as engineering and stable acts, aim to mitigate these risks by applying stricter surveillance and forcing issuers to maintain fully supported reserves.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.