Short, Mid and Long Term Scenarios Revealed

The XRP graph shows that it is better than many other altcoins and at the time of the press, XRP is up more than 1% and is negotiated at $ 2.16. On the Crypto Thinking Podcast, Caleb Franzen, founder of Cubic Analytics, gave a detailed analysis of what is happening with XRP and where he could go into the short, the middle and the long term.

Short -term prospects (a few weeks to months):

Currently, XRP is loud above its 200-day average mobile cloud, which is between $ 1.76 and $ 1.80. This is the key because it shows XRP resilience even when the larger cryptography market is fragile. Although price action is not super increased, the fact that XRP remains above this level is a good sign.

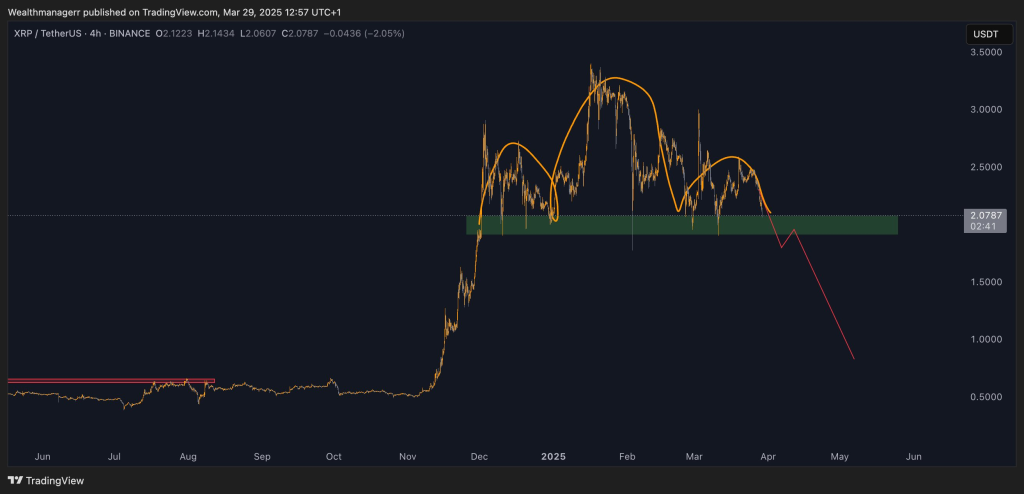

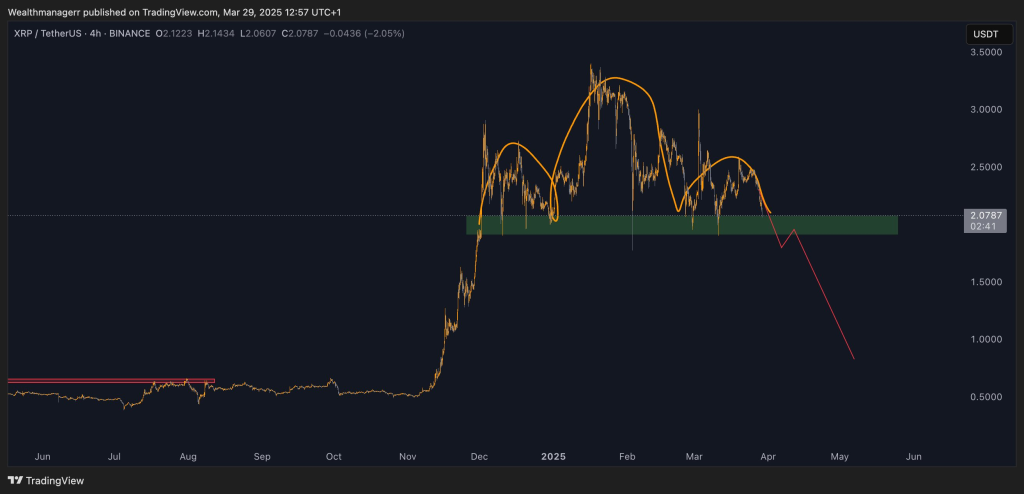

(Source: @WealthManagerrr)

Some graphics even refer to a possible pattern of “head and shoulders”, which could mean a withdrawal. But as long as XRP is above this $ 1.76 support, this is not all bad news.

Perspectives halfway through (6 to 12 following months):

Then, the relative force of XRP stands out compared to other altcoins. While many pieces are negotiated below their 200 days averages, XRP holds the field. This could mean a possible escape if the global market improves. If XRP manages to break above the keys resistance levels, we could see a price wave around $ 3 or more. However, the prudent mood of the market means that we will have to see strong bruise signs before becoming too optimistic.

Long-term perspectives (1 to 2 years and beyond):

For the long term, the history of XRP is linked to regulatory developments and the broader adoption of cryptography. If the market becomes bullish again, XRP could set up this wave. Analysts are watching closely for signs of a sustained trend above the average of 200 days, which could lead to a new bull race. In the best of cases, XRP could reach $ 5 or more, but it depends on the positive conditions of the market and the potential regulatory clarity.