Time To Buy Ethereum? Crypto Whale Buys $5.92 Million of ETH

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is poised for massive bullish momentum as it has formed a bullish price action pattern on the daily time frame. Over the past few hours, the sentiment in the cryptocurrency market has completely changed, with the price moving from bearish to bullish momentum.

Crypto Whale Buying $5.92 ETH

Before the US market opened, ETH was witnessing a slight price decline, but that completely changed when the price rose from the $3,190 level to the $3,445 level in six hours. This massive bullish momentum has caught the attention of crypto enthusiasts, leading to substantial accumulation.

Today, January 15, 2025, Lookonchain, a blockchain-based transaction tracker, posted a message on X (formerly Twitter) stating that a newly created wallet withdrew a significant amount of 1,799 ETH from Binance worth $5.92 million. In such market conditions, the withdrawal of an asset is considered a purchase and signals a new acquisition, making it an ideal buying opportunity.

Current Price Dynamics

This recent accumulation, upcoming political events, and the SEC’s recent plans regarding ongoing cases have caused ETH prices to rise significantly. Currently, ETH is trading near $3,460 and has seen a price increase of over 8.2% in the last 24 hours. Moreover, during the same period, the participation of traders and investors jumped by 15% compared to the previous day.

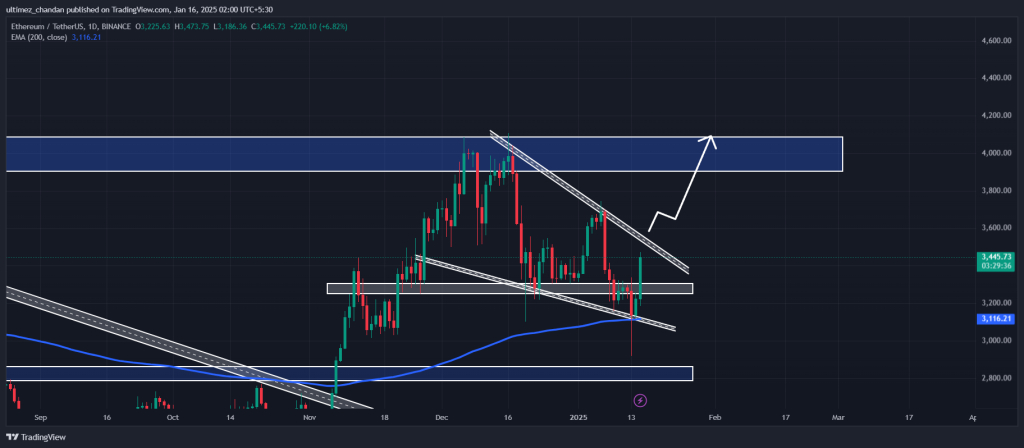

Ethereum (ETH) technical analysis and upcoming level

According to expert technical analysis, ETH is back above the crucial support level and is on the verge of breaking the descending wedge price action pattern on its daily timeframe.

Based on recent price action and historical momentum, if ETH breaks the trend and closes a daily candle above the $3,600 level, it is highly possible that it could surge 15% to reaching the $4,000 level in the future.

On the positive side, ETH’s Relative Strength Index (RSI) is still below the overbought zone, indicating that the asset still has enough room to reach its intended target.