Ethereum Price Climbs, But Key Indicators Still Flash Bearish

Ethereum (ETH) has dropped more than 7% in the last 24 hours despite the 90 -day Trump price break. The main technical indicators suggest that a complete reversal of the trend could be unlikely in the short term.

The Bbtrend remains strongly negative and the accumulation of whales blocked, both signaling caution. Combined with an immobile EMA structure, Ethereum may need a stronger purchase pressure wave before you can get out of its current decrease trend.

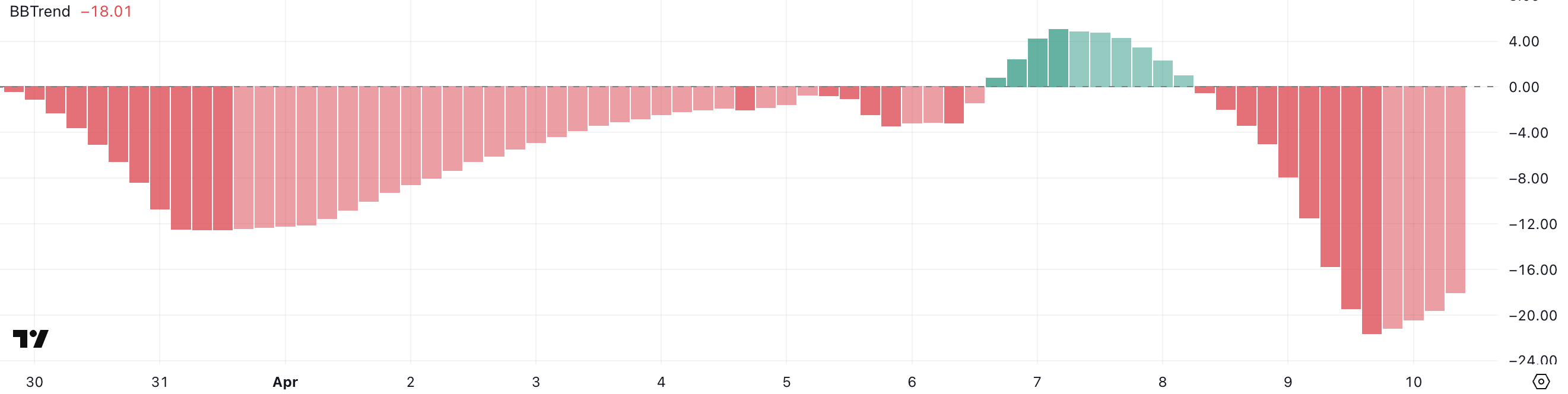

Eth Bbtrend is strongly negative but bigger than yesterday

Ethereum’s Bbtrend indicator has improved slightly, currently reading -18, against -21.59 just before the announcement of Trump’s price break.

This change suggests that the lowering momentum can start to fade, although it always signals generally dropping. The BBTREND (Trend based on the band) is an indicator based on volatility which helps to assess the force and the direction of a trend using the relationship between the price and Bollinger strips.

The values higher than zero indicate a bullish impulse, while the negative values indicate lower – more zero -zoing trends, the stronger the directional conviction.

Bbtrend d’eth has remained in negative territory since April 8, reflecting a sustained weakness of recent sessions. Although the recent increase may refer to early stabilization, the current value of -18 suggests that Ethereum has not yet reversed the wider trend.

For bullish confirmation, ETH should repel bbtrend to a neutral or positive territory, ideally supported by volume and a strong price action.

Until then, the graph points to a market still in correction mode but with some signs of reversal possible to come.

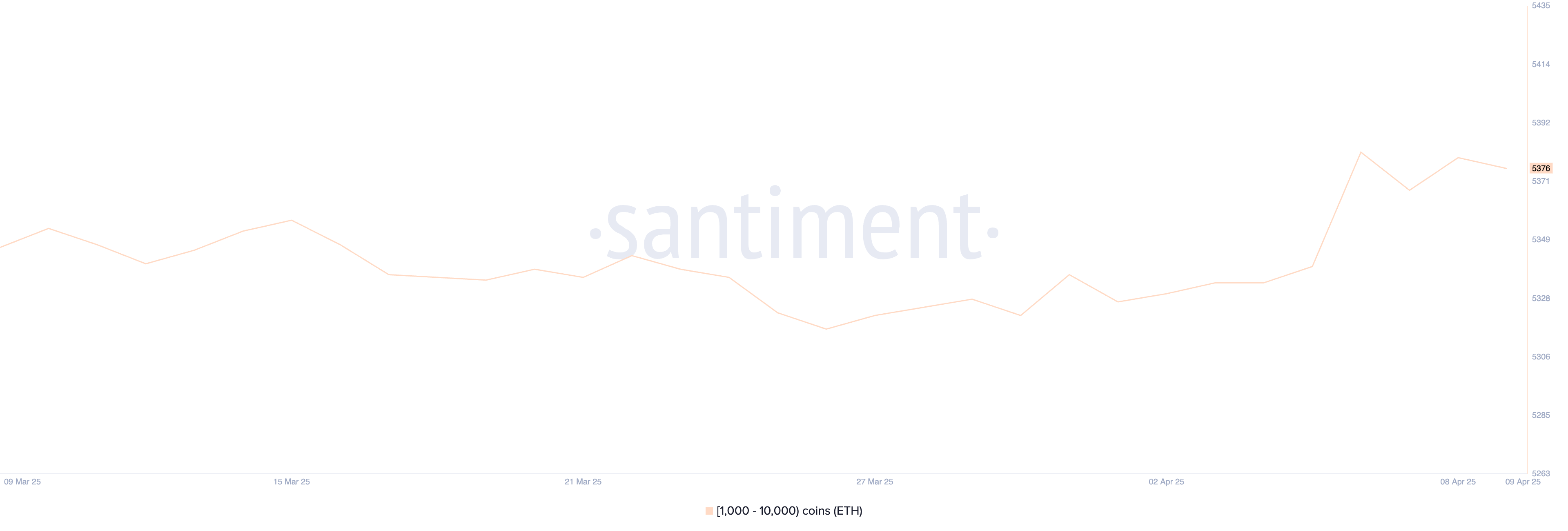

Whales still do not accumulate

The number of Ethereum whales – portfolios holding between 1,000 and 10,000 ETH – Rose from 5,340 to 5,382 between April 5 and 6, marking a brief increase in accumulation.

However, the metric has since stabilized and is currently at 5,376, showing few changes in recent days.

The follow -up of the activity of whales is essential because these major holders often have the influence of moving the markets, by launching large purchases during the dips or by selling force to make profits.

The recent stabilization of whale numbers suggests an approach to waiting for the main holders. After a brief point of accumulation, the whales seem to hold their positions rather than buying or selling aggressively.

This could mean that confidence is coming back but not yet strong enough to fuel a major escape.

So that Ethereum can see an impetus higher than the increase, a renewed increase in the accumulation of whales would be a positive signal, indicating a growing conviction of the largest players on the market.

Is the current Ethereum overvoltage just temporary?

Despite the recent rebound in Ethereum after Trump’s price break, its EMA structure remains down, with short -term mobile averages always positioned below the longer term.

This delayed alignment generally reflects the continuous pressure of the decline, even during rescue rallies.

When it is seen alongside other indicators – such as the still negative Bbtrend and the accumulation of stagnant whales – it becomes clear that Ethereum needs a much more purchase volume to move on to a confirmed rise trend.

If this bullish pressure emerges, The price of Ethereum could aim to test the resistance at $ 1,749, and a break could open the way to $ 1,954 and even $ 2,104. This could be motivated by macro developments, such as the recent approval of the dry of the negotiation options on ETF ETF of BlackRock.

However, if the momentum fades, the price may enter another correction phase.

The key support is at $ 1,412, and if this level fails, the ETH could slip below $ 1,400 and potentially review the territory of less than $ 1,300.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.