Bitcoin Long-Term Holders Fuel Surge, Could BTC Hit $85,000?

The main bitcoin has had a turbulent in recent weeks, with its price problems encouraged to many short -term investors – often called “hand on paper” – to get out of the market.

However, in the midst of price volatility, the long-term holders of the medal (LTH) remain resolved and show no signs of backup when they try to push the BTC over $ 85,000. How long can they achieve this?

Long -term Bitcoin holders go from sale to stack

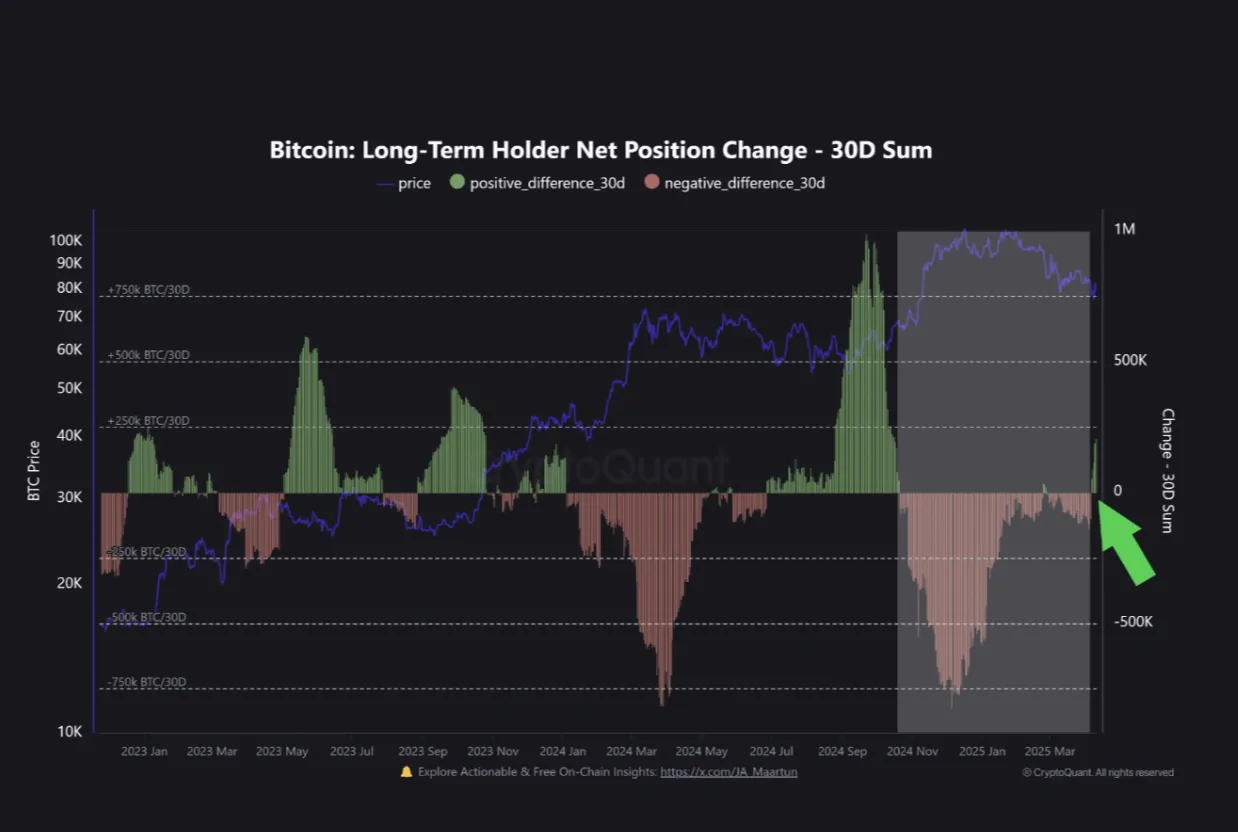

In a recent report, cryptocurrency analyst Burak Kesmeci has evaluated the long -term change in the long -term holder of the BTC (sum 30D) and has noted that since April 6, metric has become positive, showing an impetus greater than the increase. As a result, Kesmeci wrote, BTC increased by around 12%.

The long -term clear change in the BTC follows the purchasing and sale behavior of LTHs (those who have held their assets for at least 155 days) to measure the change in the number of documents held by these investors over a specific period.

When its value is positive, it indicates that LTHs do not sell and remain optimistic about the performance of future BTC prices. Conversely, when it becomes negative, this suggests that these holders sell or distribute their parts, often in response to market pressures, which is a lower signal.

According to Kesmeci, the long -term BTC (sum 30D) net position of the long -term holder turning positive is notable. This metric had remained below zero since October last week, indicating that the LTHs regularly sold their BTC.

The Sellofs reached their lowest point on December 5, which caused a 32% drop in the BTC price and marking the peak of a 6 -month distribution period per LTH.

However, this trend has changed since April 6. The metric is now above zero and is in an upward trend. Speaking about what it means, Kemesci added:

“Although it is too early to say definitively, the growing positive momentum in this metric could be a sign that long -term conviction returns to the market.”

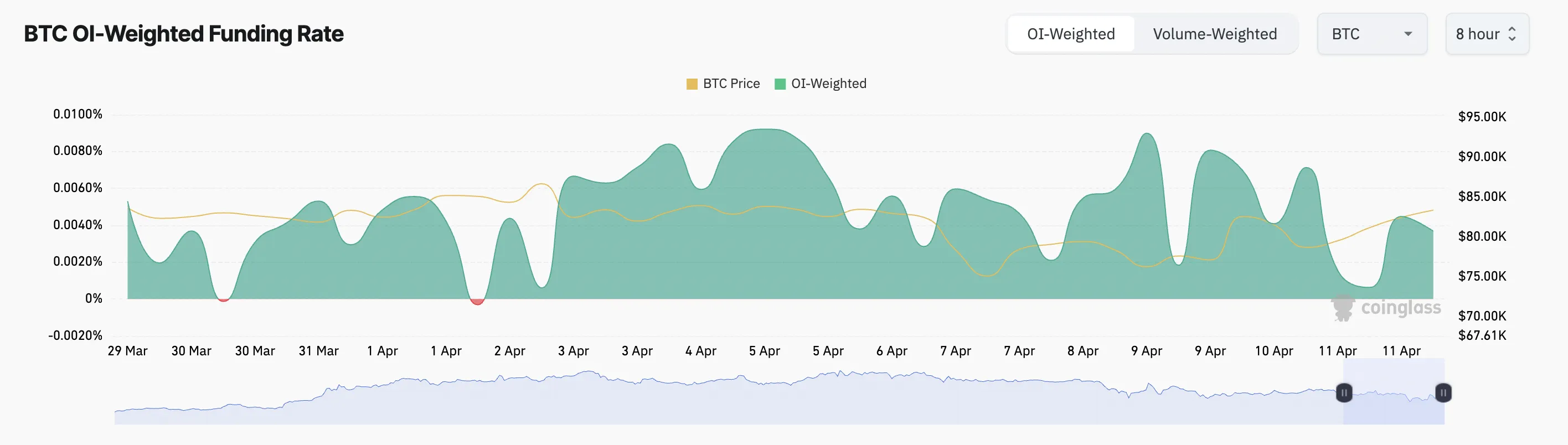

In addition, the BTC financing rate has remained positive in the midst of its price problems, confirming the upward prospects above. At the time of the press, it is 0.0037%.

The financing rate is the periodic payment exchanged between long and short traders in perpetual term markets. It is designed to maintain the long-term price near the cash price of the underlying assets.

When it is positive like this, long traders pay for short-term merchants. This indicates a feeling of bullish market, because more and more traders are betting on the price of the BTC to climb.

Long -term holders have prepared the land for $ 87,000

The increase in the accumulation of BTC LTHS pushed the price of the part above the key resistance to $ 81,863. At the time of the press, the King play is negotiated at $ 83,665.

While the market reacts to these prolonged purchase pressures with LTHs, the price of the part can be ready for a large rally in the near future.

If retail merchants follow the step and increase their requests for parts, BTC could exceed $ 85,000 to $ 87,730.

However, if the accumulation tendency ends and these LTHs start to sell to gains, BTC could resume its drop, fall below $ 81,863 and drop to $ 74,389.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.