XRP Hits $130 Billion Market Cap as Bullish Momentum Grows

XRP is again extending, climbing almost 6% in last week and pushing its market capitalization over $ 130 billion for the first time since March 27.

The RSI of Altcoin entered the exaggerated territory for the first time in more than a month, its configuration of the cloud of Ichimoku remains optimistic, and its EMA lines have formed consecutive golden crosses. With traders who envisage both targets in small groups and key support areas, XRP enters a pivotal moment which could define its next major movement.

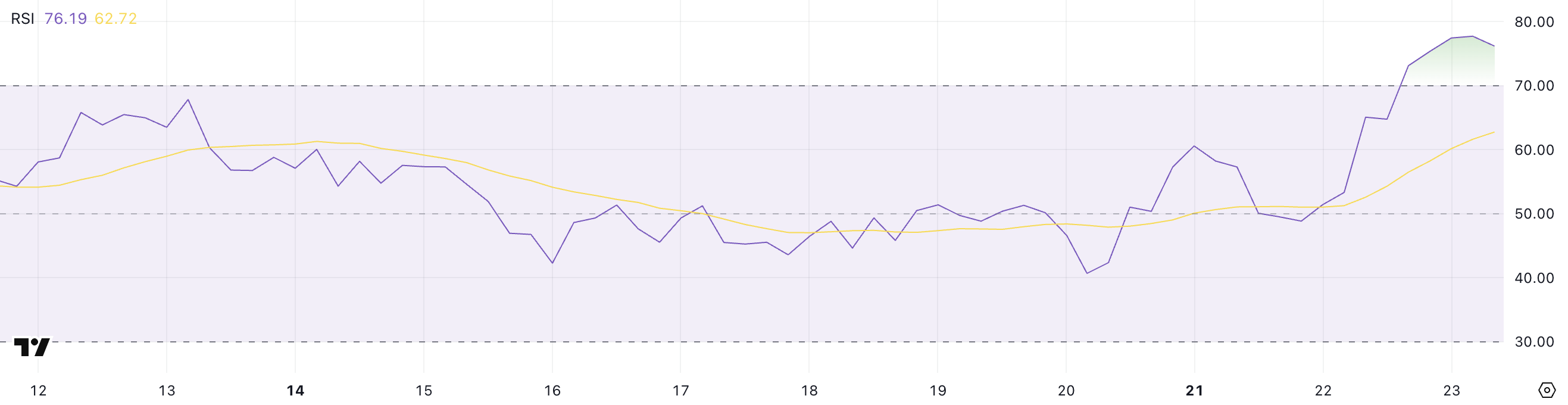

XRP is entering the Overbasht zone for the first time since March

The relative force index of XRP (RSI) increased to 76.19, climbing above the threshold 70 for the first time since March 19 – more than a month ago.

Yesterday, his RSI was at 51.4, reporting a strong increase in the purchasing momentum in a short period of time.

This jump suggests that XRP is entering an excessive area, a level where prices often starts to slow or reverse, depending on the broader feeling of the market.

RSI is a momentum indicator which varies from 0 to 100 and helps merchants to assess if an asset is exaggerated or occurred. Reading greater than 70 generally indicates over -rascal conditions, which suggests that the asset may be due to a decline.

Reading less than 30 years, on the other hand, indicates the conditions of exceeding and the rebound potential. With XRP now at 76.19, traders can start monitoring signs of weakening of the momentum or consolidation. Despite this, some analysts claim that XRP market capitalization could soon exceed that of Ethereum.

However, strong ascending RSI movements can also point out the start of a break if it is supported by a wider volume and feeling.

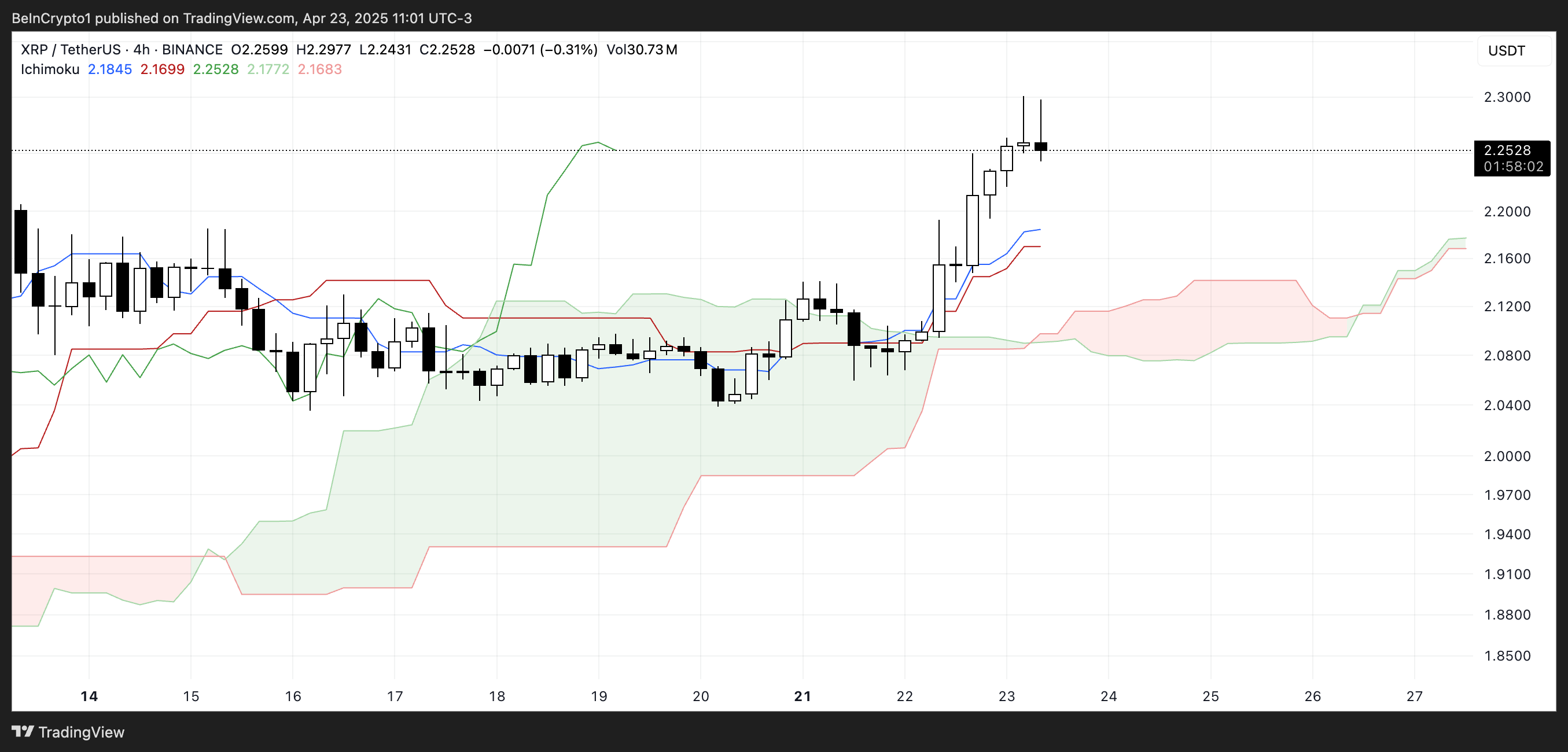

Ichimoku’s signals align for XRP while the cloud becomes bullish

XRP’s Ichimoku Cloud remains in an upward configuration, with the price clearly positioned above the Kumo (Cloud), formed by the Senkou Span A (Green Line) and Senkou Span B (red line).

This indicates a continuation of the ascending impulse, although the green cloud to come is narrower than before, which suggests that the upward conviction may not be as strong as in the anterior phases of the trend.

However, being above the cloud generally promotes short-term buyers.

Tenkan-Sen (blue line) is above the Kijun-Sen (red line), signaling a bullish impulse in the short term through a positive crossing.

Meanwhile, the Chikou Span (Green Lagging Line) is well above the cloud, confirming that the current momentum is supported by force of past prices.

However, the slim to come to come for a certain caution – while the trend remains optimistic, a lower cloud can suggest reduced support if the price turns.

For the moment, XRP has a positive technical structure, but traders will monitor any sign of weakness.

XRP creates momentum on golden crosses – reversal or rally?

The exponential mobile average lines of XRP (EMA) have formed consecutive gold crossings since yesterday, a strong bull signal which indicates a momentum up.

This model suggests that short -term averages cross those in the longer term, often considered as a sign of a trend reversal or the start of a new upward trend.

If this momentum continues, the XRP price could climb to test $ 2.50, with other resistance levels at $ 2.64, $ 2.74 and $ 2.83.

If the wider optimistic feeling returns, XRP can even try to recover the level of $ 2.99 – and possibly exceed $ 3 for the first time in months.

However, if the momentum fades and the trend is reversed, XRP could withdraw to test the support at $ 2.18. A loss of this level would open the door to a deeper correction to $ 2.03.

Continuous decrease pressure could push XRP below the $ 2 bar, with the next main levels of support at $ 1.90 and $ 1.61.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.