Tether Bought $65 Billion in US Treasury Bonds Last Quarter

Tether has just published his certificate report in the first quarter of 2025, describing a massive increase in American assets of the US Treasury. The company bought more than $ 65 billion in these assets between January 1 and the end of the quarter.

Tether’s report has also repeatedly mentioned a potential role in the world’s flows of the US dollar, calling the USDT “the main digital representation” of this currency. Treasury assets now represent more than 80% of its total assets.

Why does the attachment buy us cash obligations?

When Tether, the largest stablecoin issuer in the world, made public his certificate report from the fourth quarter 2024, he declared $ 33 billion in bonds of the US Treasury.

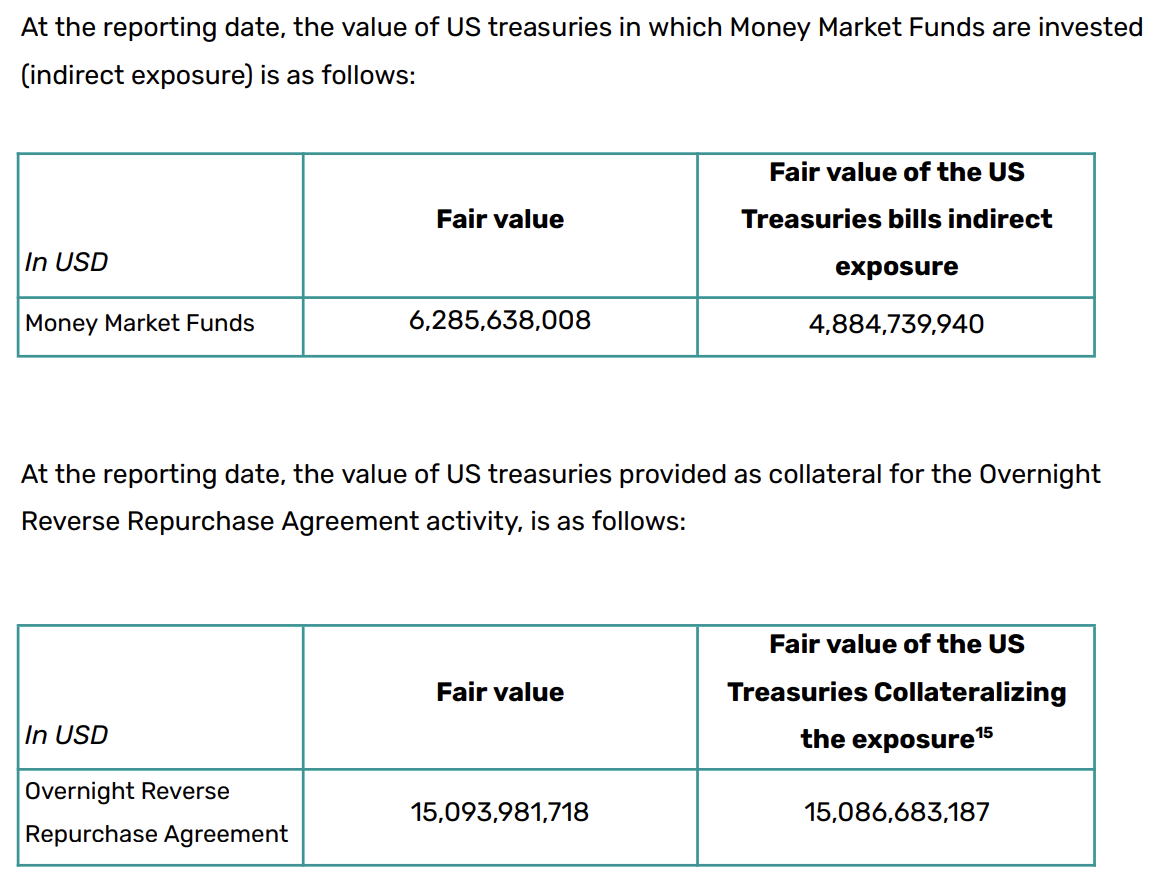

A whole quarter has since passed and the last report of the company details a massive model of acquisitions. On March 31, he held $ 98.5 billion in cash bonds, with $ 21.3 billion in indirect exposure.

The company’s report also states that its total assets amounted to $ 149.2 billion. In other words, more than 80% of Tether’s assets are directly and indirectly held in the US Treasury obligations.

Compared, it only contains $ 7 billion in BTC, which the company has always acquired in the past.

Rumors have suggested that the company would de-priritis Bitcoin to better align with the American Stablecoin regulations, and this event can take place. If the proposed legislation becomes the law, the United States will demand that Tether hold most of its reserve assets in the bonds of the Treasury. Thanks to these acquisitions, this requirement has been fulfilled.

Tether has reoriented its activities in a few key ways to facilitate compliance with American regulations. At the end of March, President Trump suggested that stablecoins could support the domination of the dollar, and Tether seems interested in this objective.

The report has repeatedly mentioned concepts such as “the growing role of the attachment in the distribution of liquidity denominated in dollars” and “Support the global relevance of the US dollar in a rapidly evolving economy.”

The company has described the USDT as “the main digital representation of the US dollar” and its CEO, Paolo Ardoino, echoes these feelings:

“Our mission is clear: to feed in a responsible manner and conforms the digital economy and to strengthen the role of the US dollar on the world scene,” he said.

If Tether wants to assume this transformative role, its American cash masses will considerably help this task. Its participations are largely greater than most governments, since it could move the world treasury market.

Overall, these purchases will probably soon stimulate Tether’s substantial commercial enterprises on the American market.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.