$3 Billion BTC and ETH Options Expiry Set to Impact Crypto Prices

Crypto merchants and investors will attend around $ 3 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today.

Expired options tend to cause significant price volatility, which means that participants in the cryptography market should closely monitor today’s developments and possibly adjust their trading strategies around 8:00 am UTC.

$ 2.95 billion in Bitcoin and Ethereum Expired options

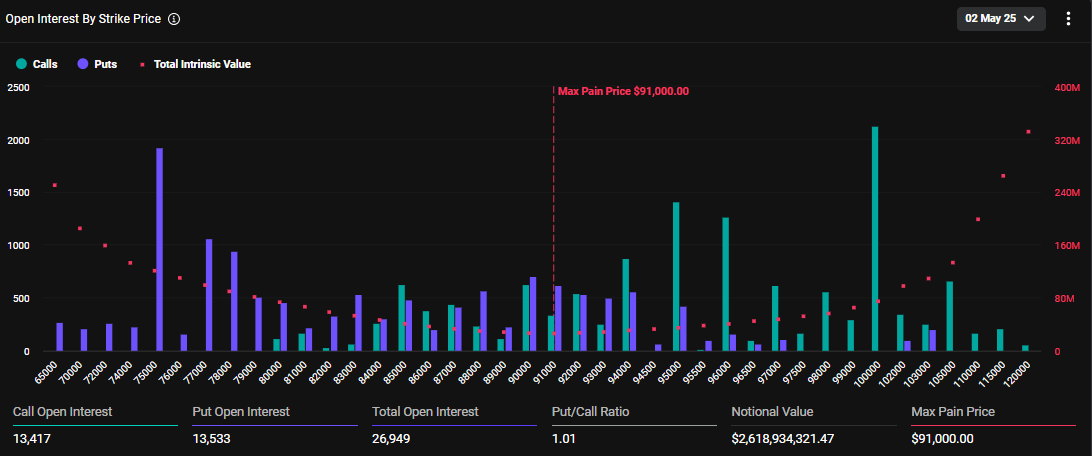

Data on Deribit show that 26,949 Bitcoin contracts will expire today. Expired options have a notional value of around 2.6 billion dollars.

The maximum point of pain to which the asset will result in financial losses to the greatest number of holders is $ 91,000. At this point, most contracts will expire without value.

The Put-/ Bitcoin call report is 1.01. This suggests a lowering feeling because investors make more sales (put) than purchase orders (call).

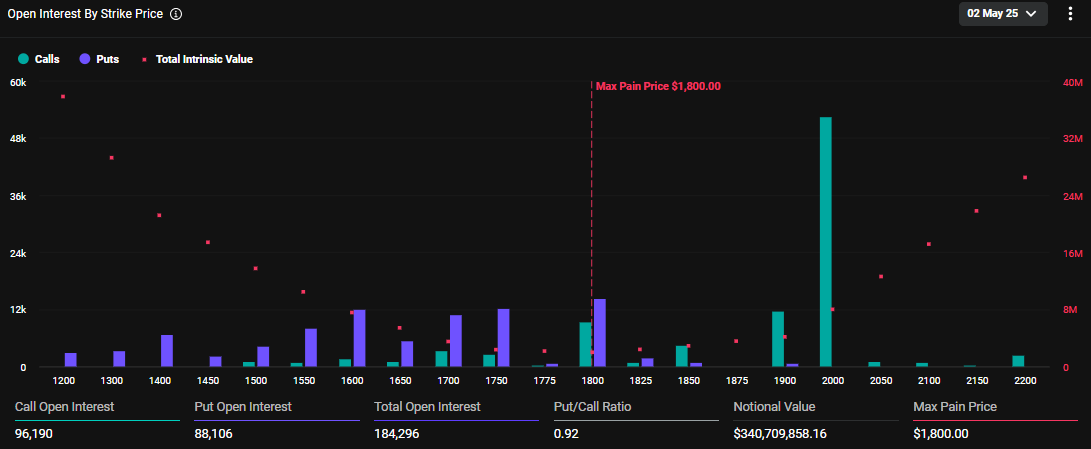

On the other hand, the Ethereum Put-TO-Call ratio is 0.92, indicating a generally optimistic market perspective for ETH. Based on the Denibute data, 184,296 Ethereum contracts will expire today. These expired contracts have a notional value of approximately $ 340.7 million and a maximum pain point of $ 1,800.

Ethereum has experienced a modest increase of 2.27% since the opening of the Friday session, to negotiate $ 1,848 to date.

Despite Bitcoin sales calls exceeding purchasing calls, Greeks.live analysts cite an optimistic predominance feeling on the market. They also note that many traders expect a thrust to $ 100,000, citing low volatility and a market structure.

“The key levels are monitored include the NPOC of $ 96,000 [Naked Point of Control] It has just been touched and the rolling VWAP of $ 94,400 [Volume-Weighted Average Price]Although some express concerns about the sale in May and travel the seasonality, “wrote Greeks.live.

With low volatility, traders see possibilities for long positions. According to Greeks.live, market manufacturers sell 30% implicit volatility (IV) to collect gamma, while the lever effect remains low. This suggests increasing potential with traders anticipating more rate drops.

Gamma collection means selling options to take advantage of stable prices, manage small price passages and earn bonuses on a low volatility market.

With the underperforming ethn compared to the BTC, some traders short-circuit it. Meanwhile, others focus on the constant rise of the BTC and examine the volatility positions of July for Vega gains. This reflects a strategic split in market orientation.

Vega gains occur when the prices of options increase due to the increase in market volatility, benefiting traders holding options with higher vega sensitivity.

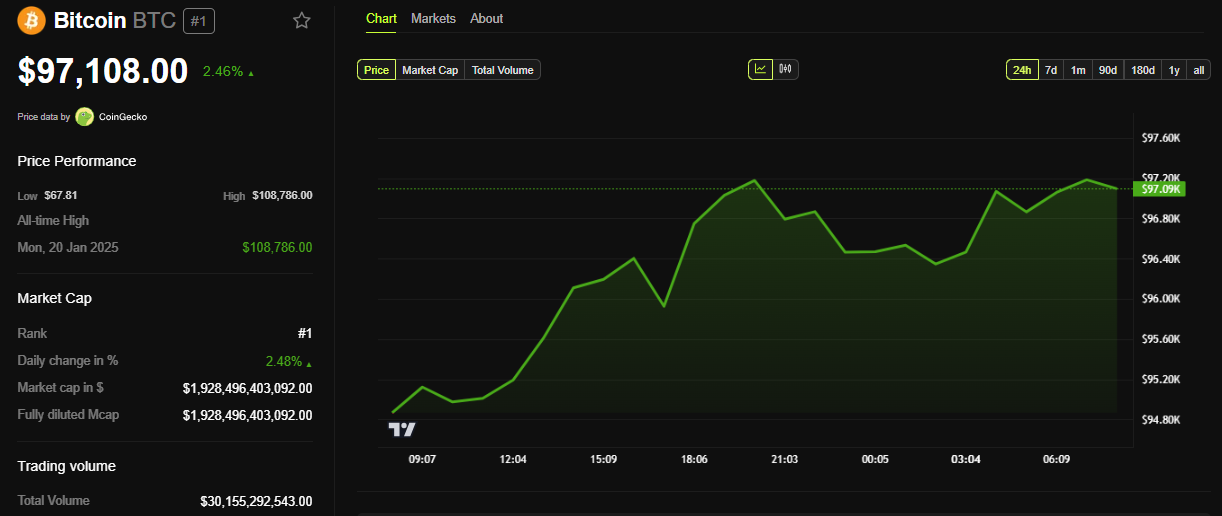

Meanwhile, deribit analysts agree that some traders focus on the constant rise of Bitcoin. In this context, there is a significant BTC stack over $ 95,000.

“The market shows a strong BTC call stack over $ 95,000, what impact does the expiration make?

When writing these lines, Bitcoin was negotiated at $ 97,108, with almost 3% gains in the last 24 hours.

Consequently, the Bitcoin Lourdes call options accumulating above $ 95,000 points to the optimism of the trader for a price overvoltage.

Notwithstanding, it is imperative to note that the expired options can trigger volatility, as shown in the expiration of options of $ 8.05 billion from last week, which caused a short -term consolidation of prices. Nevertheless, volatility around the expiration of options tends to relax once the contracts are set around 8:00 am UTC on Deribit.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.