Solana Long-Term Holders Bet on Rally Amid Market Correction

Solana decreased sharply in last week, losing 15% in the middle of a wider decline which struck most major altcoins. The layer 1 is now negotiated at $ 153.53, down from last week’s summit nearly $ 180.

Although the correction reflects weakness on the cryptography market, chain metrics suggest that this slowdown can approach its end.

Solana’s long -term holders show confidence while the market cools

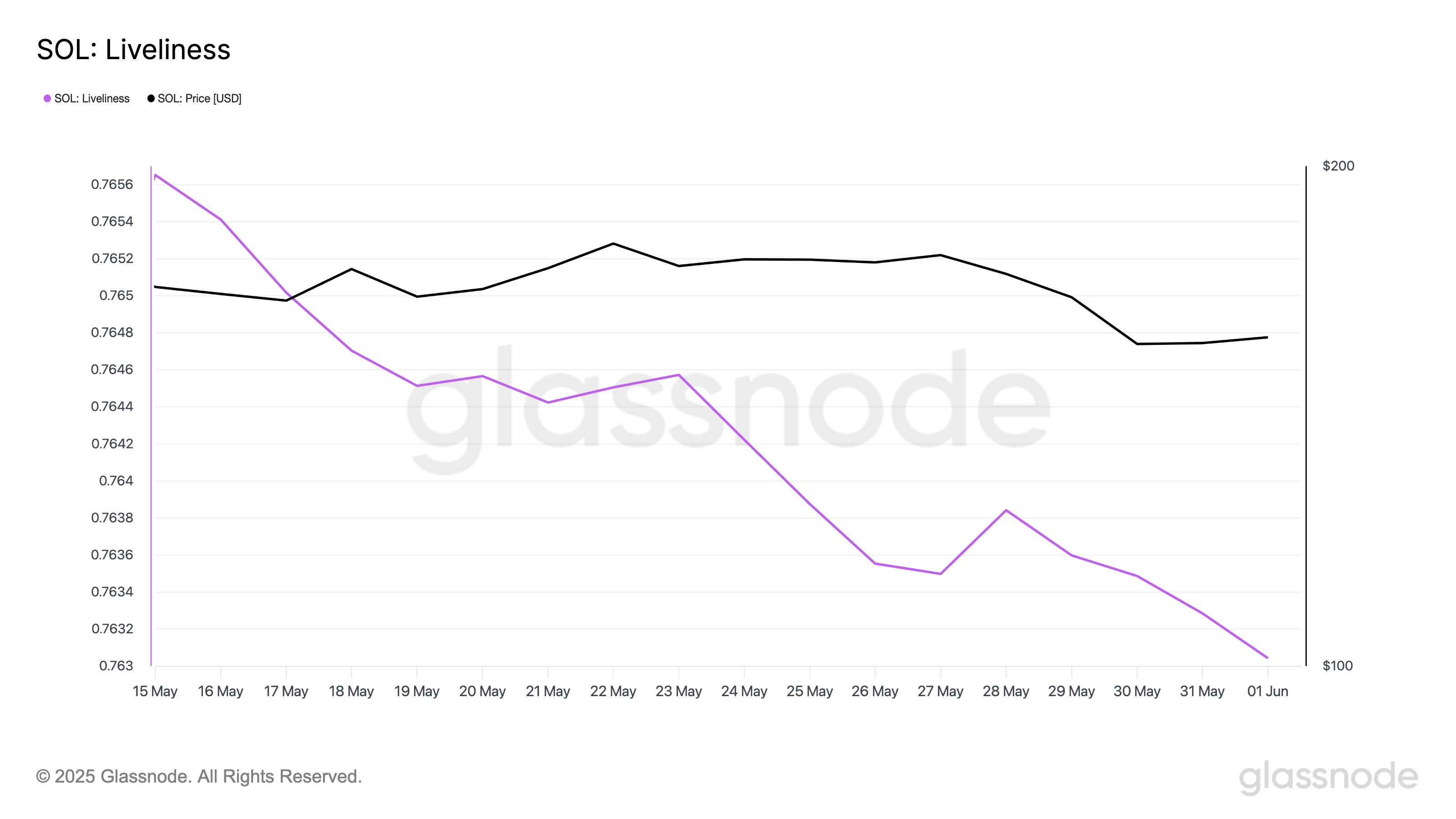

Solana’s liveliness has dropped in particular in recent days, which indicates that long -term holders (LTH) consider the recent drop in prices as a strategic purchase opportunity. According to Glassnode, it is currently 0.76, its lowest in the last 14 days.

The liveliness measures the report of the currency of an assets destroyed in total days of currency accumulated to follow the activity of LTHs. When he climbs, this suggests that more dormant parts are moved or sold, reporting an increase in profits by long -term holders.

On the other hand, liveliness decreases when dormant wallets begin to accumulate. This trend indicates that the soil LTH move the assets of the exchanges, a bull sign of accumulation.

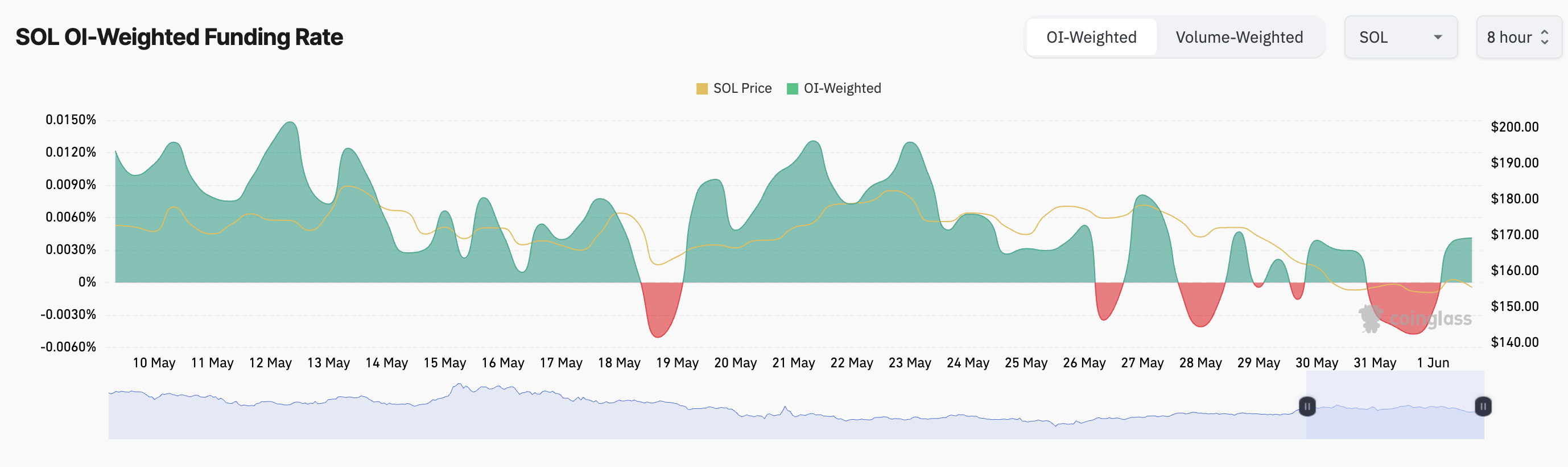

In addition, the part of the room funding has overturned positive and is currently 0.0041%. This indicates a preference for long positions among long -term merchants.

The financing rate is recurrent fees paid between long and short traders in perpetual term contracts to maintain the price of the contract aligned with the cash price. When they are positive, long traders pay shorts, indicating that the bullish feeling dominates and that more and more traders expect prices to increase.

Floor could drop to $ 195 if the support holds

Solana’s price could bounce back to the bar of $ 171.88 if its LTH continues to double the accumulation of wider parts and market conditions. If this price area is solidified as a support floor, it could still propel soil to the level of $ 195.55.

However, sellers could drive a floor at $ 142.59 if the lower time is intensifying.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.