Institutional Risk Aversion Drives $218 Million Bitcoin ETF Outflows

The FNB Bitcoin (funds negotiated on the stock market) continue to record negative flows this week while the countdown of the release of President Trump continues.

The feeling is cautious in cryptographic markets, traders and investors adopting a waiting approach.

Bitcoin ETF See the outings in the middle of the prudence of investors

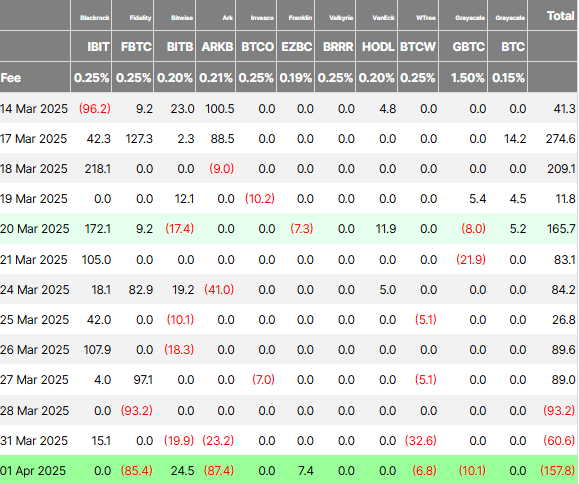

Data on distant investors show two consecutive days of net outputs for Bitcoin ETF since Monday. Bitwise (BitB), Ark Invest (ARKB) and Wisdomtree (BTCW) financial instruments were on the front line for $ 60.6 million on Monday, with only Blackrock Ibit who saw positive flows.

Meanwhile, Tuesday saw even more outings, approaching $ 158 million, with Bitwise and Ark Invest leading the charge. Then, on April 1, the Ibit of BlackRock recorded zero flow. Meanwhile, ETFE ETHEREUM recorded net outputs of $ 3.6 million, data on Farside emissions. This suggests a prudent feeling among institutional investors.

“The FNB Bitcoin Spot saw $ 157.8 million outings yesterday. The Ethereum ETHEREM SPOT experienced $ 3.6 million. Institutions reduce risks before today’s announcement,” noted analyst Crypto Rover.

Indeed, the feeling suggests that traders show caution, choosing to stay in “waiting” mode. Caution comes before the announcement of Trump’s release day, which was later due to the day on April 2.

With Potus ready to reveal new prices, traders and investors through financial playgrounds are waiting to see the scope of an assault that could trigger a world trade war. More specifically, there is generally very little information on the details of the prices, which creates an uncertainty concerning their impact on the wider economy and the crypto market.

“The White House did not make a firm decision on their price plan,” reported Bloomberg, citing people nearby.

Despite the lack of clarity, it is understandable that investors would be careful given the impact of previous price announcements on the price of Bitcoin. Meanwhile, analysts predict extreme market volatility, with potential accidents and crypto accidents reaching 10 to 15% if Trump applies large prices.

“April 2 is similar to the electoral evening. It is the biggest event of the year in order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen, ”predicted economic analyst Alex Krüger.

Although the feeling is cautious in the cryptography market, some investors channence gold as a safe refuge. A Bank of America survey has shown that 58% of fund managers prefer gold as a trade war refuge, while only 3% Bitcoin return.

These results have come as institutional investors cite the volatility of Bitcoin and limited liquidity in times of crisis as key obstacles to its security adoption. Trade tensions have historically led capital to safety assets.

With the announcement of Trump’s release day that is looming, investors are positioned again in a preventive way, promoting Bitcoin gold.

However, despite Bitcoin’s struggle to capture institutional safety flow flows, its long -term story remains intact. This shows with the Bitcoin supply on exchanges falling at only 7.53%, the lowest since February 2018.

When the supply of an asset on reduced exchanges, investors are not willing to sell, suggesting a strong confidence of long -term holders.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.