GENIUS Act Sparks Hopes for a Stablecoin Summer Surge

With positive developments concerning the Act on Engineering, many industry experts have expressed optimistic predictions on a “summer of stablecoin” in the near future.

Will a “summer of stable summer” bring important opportunities for investors and businesses?

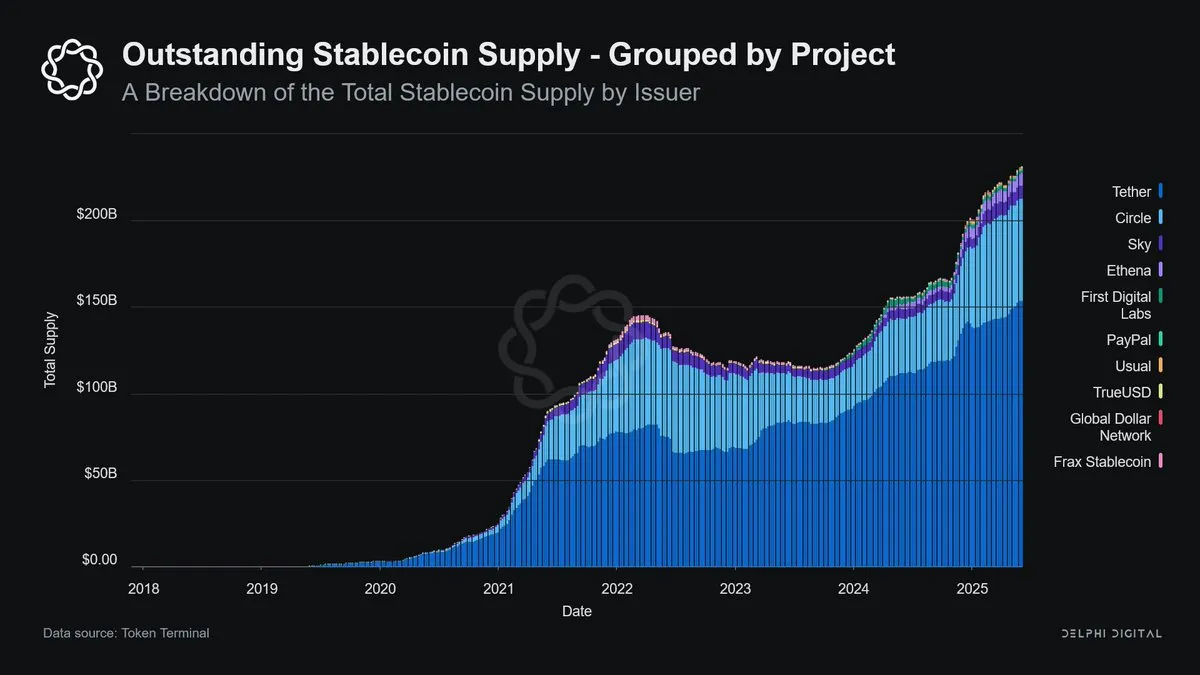

Stablecoin’s offer exceeds $ 250 billion

According to a Delphi Digital report, the Stablecoin offer exceeded $ 250 billion, Tether and Circle representing 86% of the market share. More than $ 120 billion in US Treasury bonds are locked in various stabbed.

With the increase in the diversification of transmitters, more than 10 Stablecoins now have a circulating value exceeding $ 100 million. This indicates a fiercely competitive but very promising market.

The founder of 1 Confirmation even predicted that the market value of Stablecoin could increase ten times after the approval of the Act on Engineering. If this prediction is carried out, the market capitalization of Stablecoins could potentially reach 2.5 billions of dollars.

“The Genius Act is ideal for the market capitalization of the crypto and the stable will be 10x from here as soon as possible because of this,” said Nick Tomaino.

Stablecoins now represent more than 60% of the entire volume of cryptographic transactions, against 35% in 2023, despite the lack of clear federal regulations. In this context, the CEO of Coinbase, Brian Armstrong, expressed its optimism, calling the Stablecoins a “viral loop” which allows users to grasp the cryptocurrency field more easily.

Meanwhile, Eric Golden of Canopy Capital stressed that the stablecoins will become the main transaction mechanism for all types of payments, gradually replacing traditional methods.

Challenges in a new era

However, support challenges cannot be ignored. The locking of more than $ 120 billion in the US Treasury bonds in the stabbed creates a “liquidity well” outside the traditional financial system, as Delphi Digital pointed out. This raises questions about risk management and long -term stability, especially since new stablescoins like Ethena and First Digital Labs are always at their stages of development.

The main stablecoins have always represented at least 4% of the total market capitalization of the cryptocurrency in 2024 and 2025. In addition, while the domination of Tether and Circle offers temporary stability, it makes the market depends on these two “giants”, placing potential risks in the event of disturbances.

Nevertheless, the “Stablecoin Summe” promises important opportunities for investors and businesses. The approval of the Act on Engineering establishes a clear regulatory framework and promotes innovation.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.