ADA Price Jumps 6% Despite Whale Accumulation Slowdown

Cardano’s price (ADA) has increased by 6% in the last 24 hours, bringing market capitalization to $ 34 billion while it tries to recover the level of $ 1. Despite this short -term gain, the ADA trend remains uncertain, with technical indicators showing mixed signals.

The ADX suggests a weak momentum, while the accumulation of whales has remained stable, indicating a lack of high purchase pressure. The fact that ADA continues its recovery or another decline will depend on key support and resistance levels in the coming days.

Cardano lacks clear trend

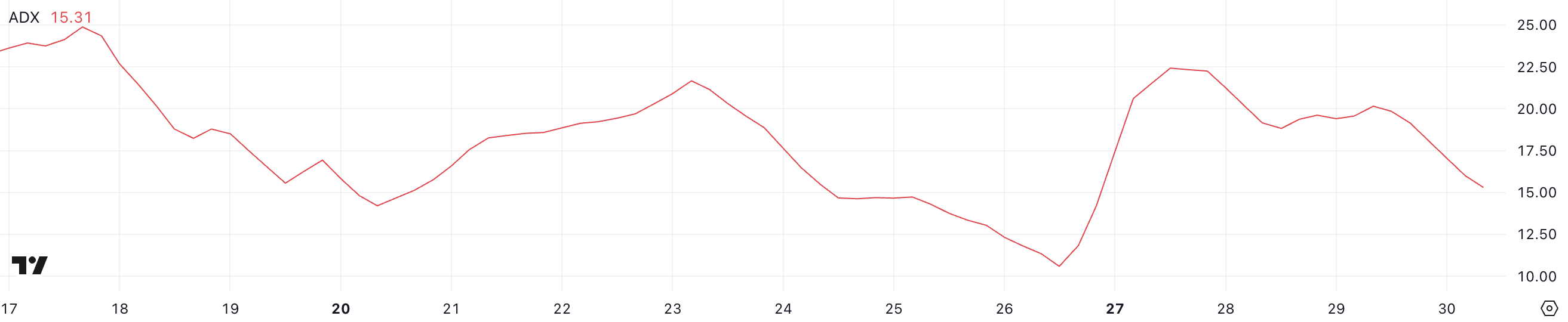

Cardano Adx is currently at 15.3, against 22.2 three days ago after announcing a roadmap for future changes. The ADX (average directional index) measures the trend trend, with values below 20 low or non -existent trends, while readings greater than 25 indicate a development trend.

When Adx rises above 40, it reflects a strong momentum in both directions, but the current decline suggests that Ada’s trend has lost its strength and enters a more indecisive phase.

With ADX at 15.3, ADA is in a period of consolidation without burst or light drop. This suggests that price movements can remain linked to the beach until the ADX starts to increase.

If Momentum strengthens and Adx goes up above 25, this could indicate the start of a new trend. However, as long as IDX remains low, Ada Price is likely to continue to exchange laterally without a strong directional movement.

Ada whales have stopped accumulating

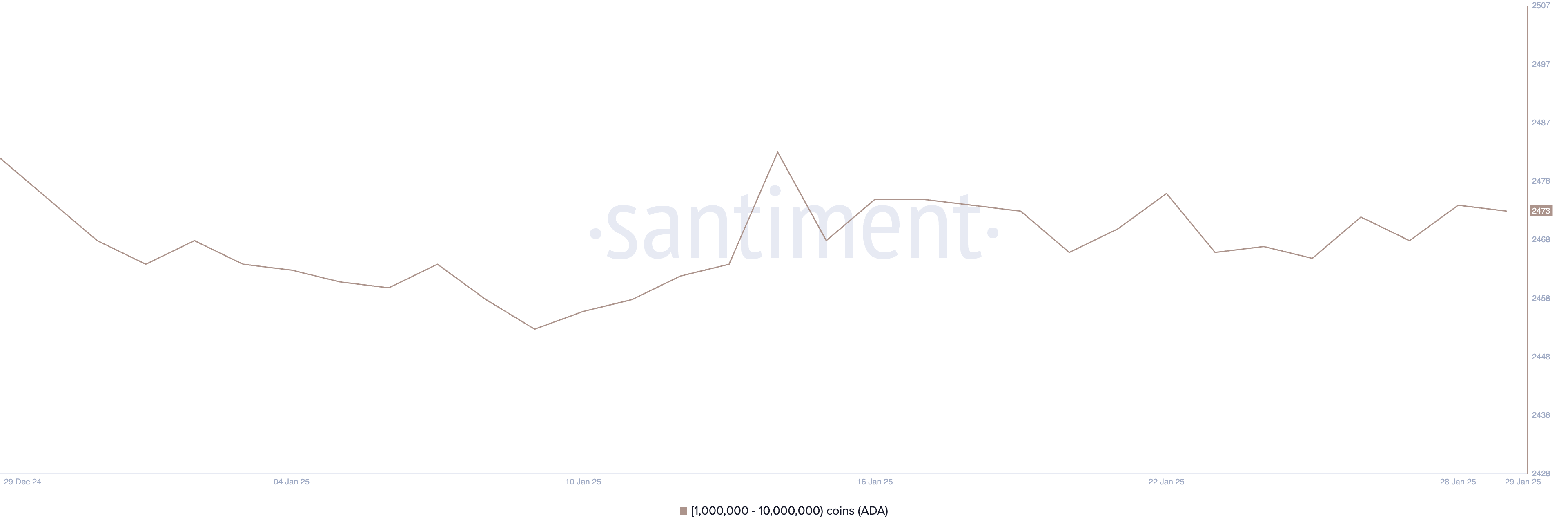

The number of Ada whale addresses – portfolios holding between 1 million and 10 million ADA – is currently 2,473, remaining in a tight range from 2465 to 2476 in the last 15 days.

Monitoring these whales is important because major holders can have a significant impact on market liquidity and prices’ action. An increase in the addresses of whales often signals the accumulation, while a drop may indicate the distribution or the sale pressure.

Stability in the addresses of the Cardano whale suggests that major holders do not accumulate neither aggressively nor to unload their positions. This follows an increase of 2,453 to 2,483 between January 9 and 14, indicating that the whales have previously increased their assets before leveling.

Current consistency can involve a waiting approach, where whales are positioned for the next major movement rather than actively moving their exhibition. If this number starts to increase, it could suggest a renewed confidence in ADA’s price potential.

Price prediction ADA: will it increase by 20%?

Ada Price currently oscillates near her support at $ 0.95, a critical level that could determine her next movement. If this support is tested and does not hold, the sales pressure could increase, pushing ADA to $ 0.87.

A rupture below this level would point out a continuation of the downward trend, strengthening the downward momentum.

However, its EMA lines suggest that a golden cross could be formed soon, which would indicate the strengthening of the bullish momentum. If this crossing occurs, Ada Price could test the resistance of $ 0.99, which can push it to $ 1.03, a potential advantage of 20%.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.