ADA Whales Fuel Bullish Momentum by Acquiring 190 Million Coins

Cardano noted a significant whale activity in the last 24 hours, corresponding to the broader market resumption. During this period, the total market capitalization of cryptography added an additional $ 50 billion, reporting a renewal of the bullish impetus.

While the upward pressure is strengthened, Ada seems to recommend an upward trend.

Cardano sees a strong accumulation of whales

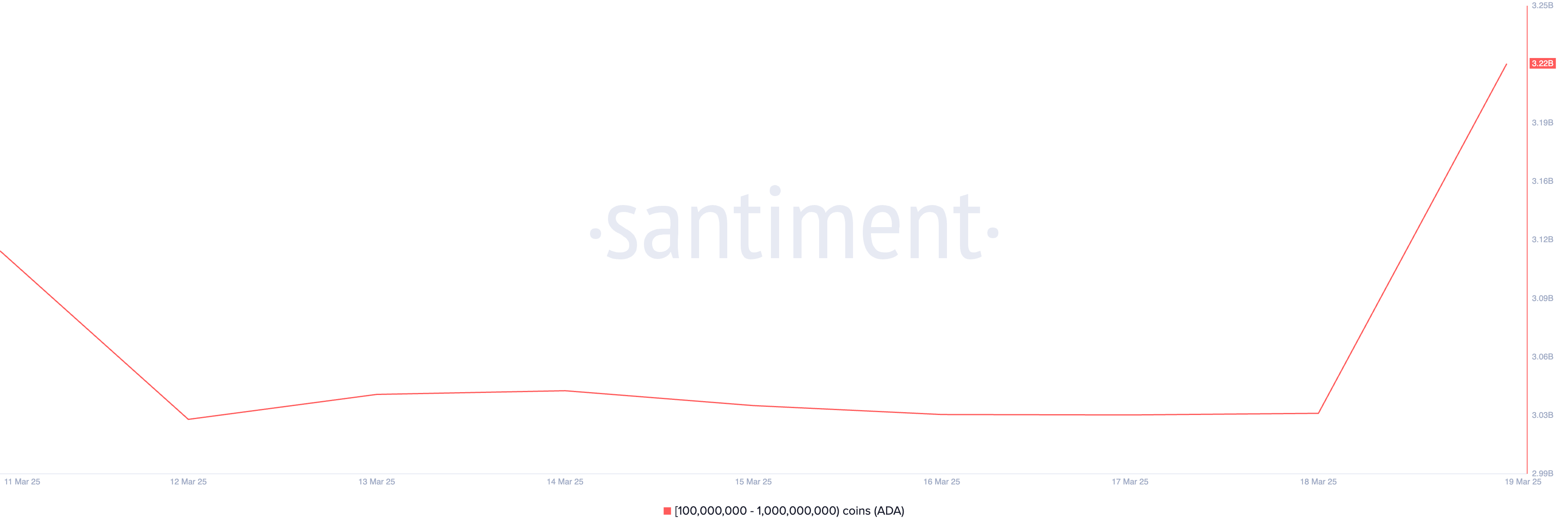

The data on the chain show that the cardano whales, holding between 100 million and 1 billion pieces, have acquired 190 million ADA in the last 24 hours. This cohort of large investors ADA currently has 3.22 billion parts.

When the whales increase their parts, this signals strong confidence in the future price potential of the asset.

A large-scale accumulation like this would reduce the available offer of ADA on the market, which can increase its price if demand remains stable. The trend indicates an optimistic perspective, as whales generally buy higher prices.

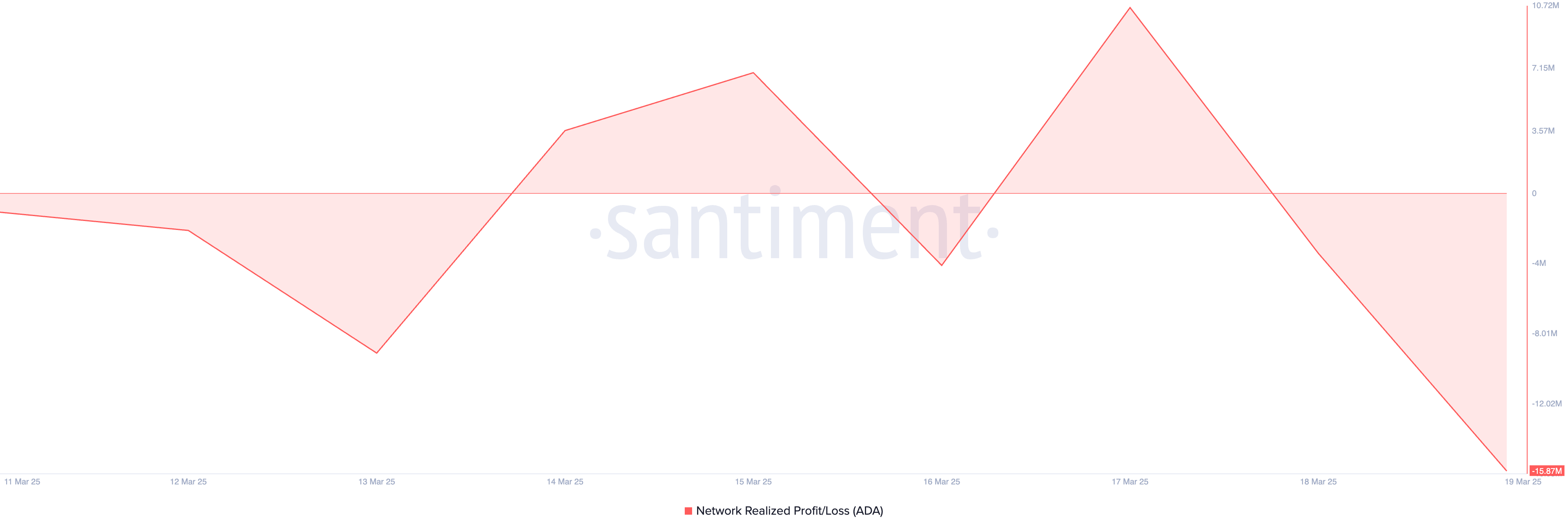

The ADA network has realized that profit / loss (NPL) also supports this upward perspective. At the time of the press, it rises to -15.87 million.

This metric measures net profit or the loss of all parts on the blockchain according to their acquisition cost. When the NPL of an asset is negative, many investors hold a loss.

This situation is known to reduce sales pressure on the market, because traders can choose to keep their assets instead of making losses, which could support a potential price rebound.

The constant drop in the NPL of ADA indicates that many carriers are seated on unrealized losses. To avoid selling at a loss, they can choose to keep their investments, by reducing sales pressure. The increase in maintenance time could, in turn, increase the price of ADA while the offer is tightening on the market.

Will ADA purchase pressure increases – will they feed an escape from prices?

At the time of the press, Ada is negotiated at $ 0.72. On the daily graphic, the chaikin monetary flow of the room (CMF) is in an upward trend and ready to cross the zero line, highlighting the increase in the purchase pressure.

The indicator measures the fund which takes place in and outside an asset. When he tries to break above the zero line, he signals a potential transition from the sale pressure to the purchase pressure.

If the escape is supported, it would confirm the strengthening of the bullish momentum on the ADA market and would suggest a potential price for prices. In this case, the price of the part could reach $ 0.82.

However, if sales are intensifying, this bullish projection will be invalidated. In this scenario, ADA’s price could fall to $ 0.60.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.