Alameda Unstakes $23 Million in Solana for 38 FTX Addresses

Alameda Research has unlocked the Solana tokens worth almost $ 23 million today. Despite this notable release, this barely affected the dynamics of the price or the underlying demand for soil.

The FTX reimbursement process began and the company unlocked a floor worth $ 1.57 billion. There is a relatively small unlock of Alameda in the context of lower market factors that have a considerable impact on demand.

How will Alameda use his non-accomplice Solana tokens?

According to data on the chain of Arkham Intelligence, Alameda Research distributed the soil not plunged to 38 addresses linked to 38 FTX. As recycling, Alameda was the commercial company linked to the collapse of the FTX, operated by Caroline Ellison.

“Alameda address just bare $ 23 million Sol at 38 new addresses. An FTX / ALAMEDA stridge address received $ 22.9 million Sol from an implementation address unlocking and comes from these funds to 37 addresses which previously received Sol from this address. These addresses currently hold $ 178.82 million Sollars, “said Arkham via social media.

Since its fall, Alameda has moved huge amounts of assets on several occasions. For example, Alameda’s bankruptcy deals with $ 10 million in MATIC token at the end of 2023 and moved Ethereum worth $ 14.75 million at the start of 2024.

However, these two incidents caused significant price fluctuations in relevant assets.

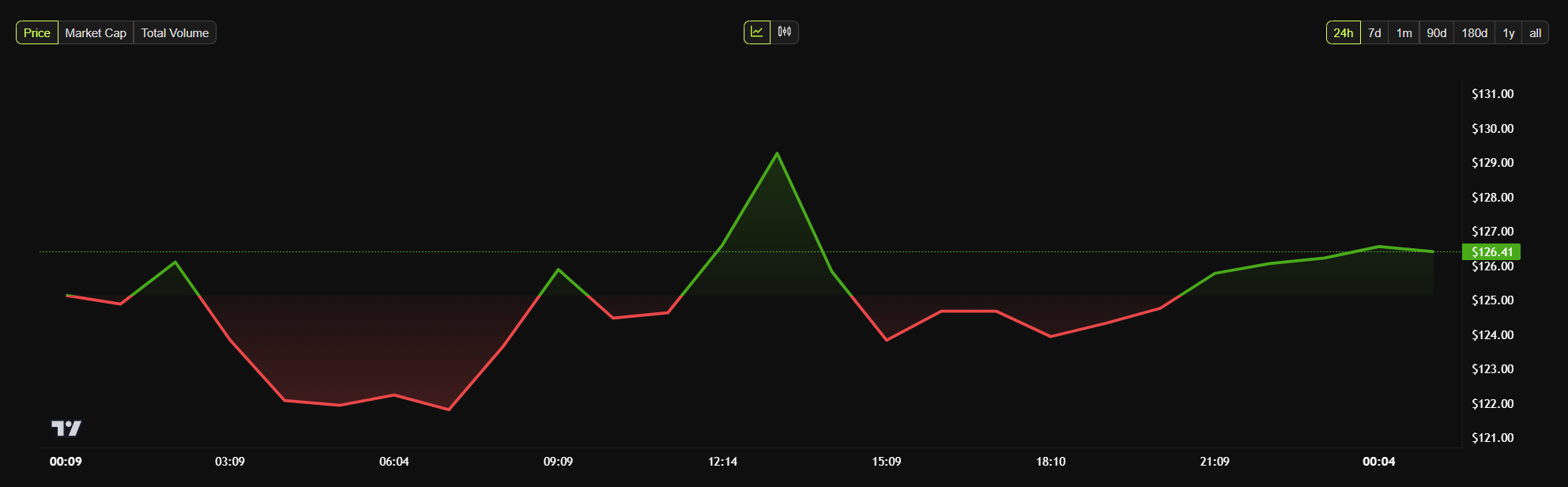

Solana’s price, on the other hand, barely moved since these Alameda transactions took place. Yesterday, the SEC delayed several applications from Solana ETF, which had a slightly downwall impact on the price of Altcoin.

Despite this, ETH jumped 10% when Alameda moved an offer worth 14.75 million dollars. It has evolved much more soil today, but it did not even cause the biggest price movement of the day.

Solana refused and increased in a short time, but it all happened before the announcement. Compared, the unlocking of Alameda had practically no effect.

Until now, it is not clear what Alameda plans exactly to do with these solara token unlocked. Last month, FTX began the first cycle of reimbursement of creditors, but it will be a long process. Earlier this month, FTX also unlocked the Solana tokens worth $ 1.57 billion.

In other words, Alameda can plan to use these tokens as part of the FTX’s reimbursement process, but that may not change the solana request.

The cryptography market is currently in a state of extreme fear, and most major assets see major outings. Alameda’s shares are just a drop in a very large bucket.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.