ALPACA Price Soars 1,000% After Binance Delisting: Here’s Why

After the announcement of Binance’s cancellation, Alpaga Finance (ALPAGA) experienced a quadruple price rally in last week.

This counter-intuitive behavior of the market has triggered an intense discussion between analysts and traders. Many experts suggest that this could be a case of market manipulation.

Why the ALPACA price pump despite Binance’s radiation?

Usually, a list of binances is a bullish signal for tokens, which often causes prices upwards due to increased visibility and liquidity. However, recent trends indicate a reversal of this model.

On April 24, Binance announced the radiation of four tokens, including Alpaca. While the value of all the other tokens has decreased, the price of alpaca has increased. Beincryptto data have shown that the token was enjoying more than 1,000% in the last seven days.

Nevertheless, the momentum seems to have slowed down somewhat while alpaca approaches its radiation on May 2. During the last day, its value fell by 34.5%. At the time of writing the editorial staff, he was negotiating $ 0.55.

However, the unusual rise of alpaca drew the attention of market observers.

“Alpaca is the worst manipulation of crypto that I have seen lately. How to pump a token from 0.02 to 0.3, then sell it to 0.07 and pump it from 0.07 to 1.27 then go back to 0.3,” wrote a user.

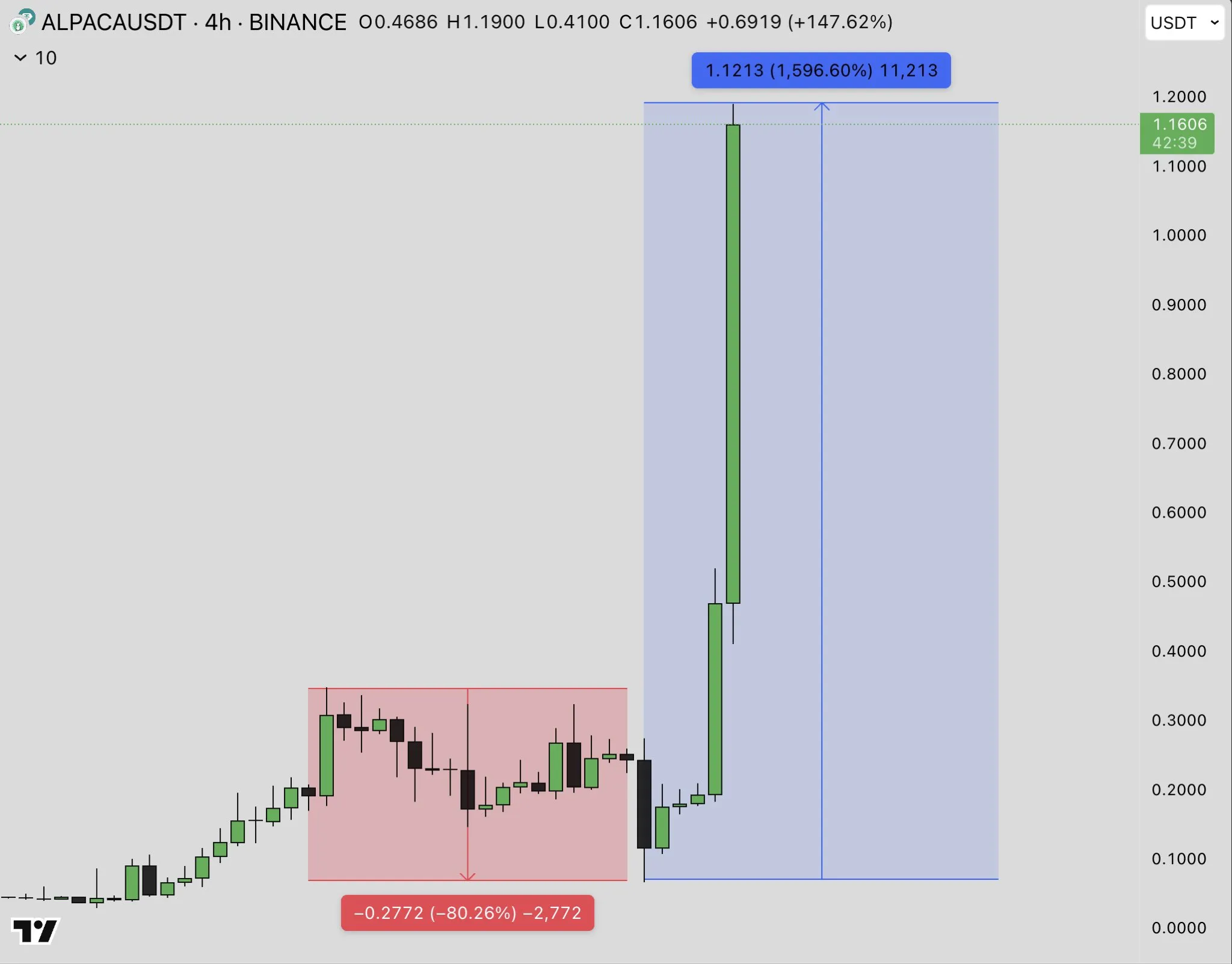

Analyst Budhil Vyas described it as “hunting for liquidity of the manual”. He explained that the major market players, or whales, initially reduced the price by 80%, triggering panic and liquidations. Then, just before the deadline for radiation of 2 hours, they quickly pumped the price of 15 times.

Vyas believes that it was a strategic decision to extract the liquidity of the market, because these whales were desperate to guarantee positions before the asset was removed from the exchange. He also pointed out that no real accumulation was in progress.

The analyst said that pricing was purely tactical. It was designed to drain the liquidity left on the market.

“It’s Crypto in 2025. Stay vigilant,” warned Vyas.

Meanwhile, Johannes also provided detailed ventilation of mechanics behind these price manipulations. In the latest article X (formerly Twitter), he developed that the sophisticated parties exploit the low liquidity following the announcements.

The strategy is to dominate a large part of the token supply. Merchants take on significant positions in perpetual term contracts, betting on the increase in the price of the token, because these contracts are more liquid than cash markets.

They then buy the token on the cash market, increasing demand and price. With most of the controlled offer, there is little sales pressure, allowing the price to increase.

Once the radiation has occurred, the perpetual term positions are forced to close with a minimal shift. This allows traders to lock substantial benefits.

Defi Analyst Ignas also weighed on the situation. According to Ignas, this scheme was observed before, especially during broadcasting announcements on the South Korean exchange Upbit.

In fact, he noted that crimes were used to receive similar speculators, if not more, like new announcements in the country.

“A radiation window requires ending the deposits, so with an influx of new restricted tokens, degens pump the price to obtain the last Hourra before an inevitable discharge,” he wrote.

Ignas referenced Bitcoin Gold (BTG) as an example. The price of Altcoin increased by 112% after Upbit announced its radiation, which shows that this price pumping behavior still occurs.

These cases triggered a debate on the question of whether the “Pump → Delist” model becomes a new trend. As the cryptography market matures, these handling practices highlight the urgent need for research, vigilance and stronger regulatory monitoring to protect investors against predatory strategies.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.