Altcoin Season Is Here – But Not As Expected

The long -awaited Altcoin season (Alt season) has arrived, according to the CEO of cryptocurrency Ki Young Ju.

However, the analyst says that he plays by different rules, unlike the previous cycles driven by a Bitcoin-to-Altcoin Claire capital rotation.

The analyst calls the Altcoin season – but not as expected

JU’s latest observations suggest that stablescoin holders, not bitcoin traders, selective fuel altcoin gains while market liquidity remains limited.

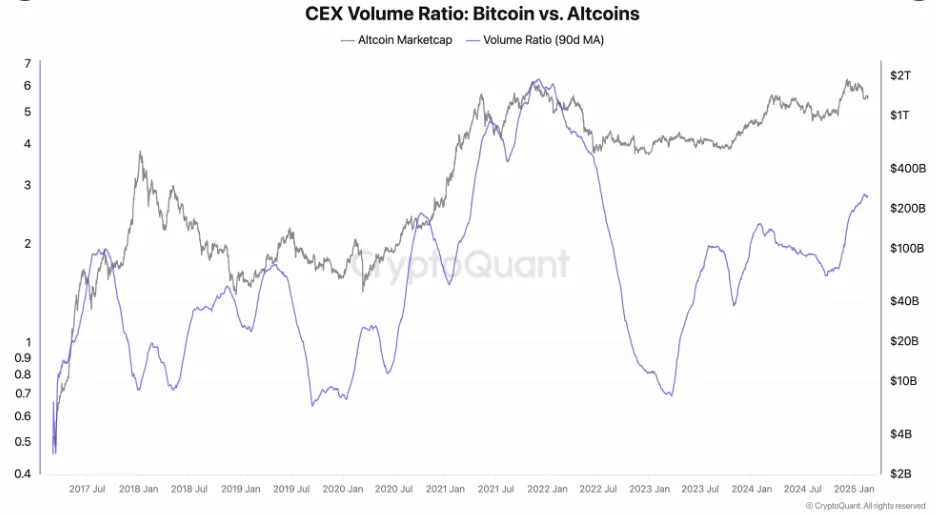

In a recent post on X (formerly Twitter), JU said that the Alt season had started, citing a sharp increase in Altcoin trading volumes. According to the analyst, the volume of altcoin trading is now 2.7 times that of Bitcoin. However, Ju also noted that it was not a large rally.

“It’s a very selective Alt season … Only a few pieces pump. Without any fresh liquidity, it looks like a PVP against a fixed pie, “he wrote.

This assertion aligns with its previous warnings. In January, Ki warned that the Altcoin market remains a zero -sum game, the capital circulating between assets rather than seeing new entries. In December, he also predicted that this Alt season would be “strange and stimulating”, promoting only selected assets.

“Altcoins moved together according to their correlation with BTC, but this model has now broken. Only a few are starting to show independent trends because they attract new liquidity, “wrote Ki.

Although some traders are excited, others are not convinced. Robw, a user on X, questioned the definition of Ju of the Alt season.

“Some tokens pump, so it must be the Alt season?” None of the usual measures applies, but it’s the Alt season if you choose very carefully, does not look like an alt season, “Robw challenged.

Likewise, Deimosweb3 has suggested that if some altcoins work well, the market has not yet entered an ALT season in its own right.

China’s budgetary movements and cryptographic markets

A parallel discussion in the cryptographic community implies the recent tax maneuvers of China. Some speculate that China’s economic policies could inject liquidity into the world markets, benefiting the crypto.

However, analysts invite prudence, stressing that China has not injected new capital but has recalculated its M1 money mass to include demand deposits and prepaid funds.

“They have not injected new capital. They “recalculated” it to include other deposits and funds. There is no fresh impression ”, a user on articulated X.

Local media confirm this, indicating that the Popular Banque of China, the central bank of the country, will include these elements from 2025.

The Crypto and Defi researcher NFT Bear stressed that this change led to a spectacular increase of 67.59% of the M1 supply. However, he stressed that he was not equivalent to fresh liquidity hitting the financial markets.

Historical comparisons with the frenzy printed in 2020 of the United States also surfaced. The United States quickly increased its M1 money supply at the time, feeding an increase of 16x in the market capitalization of Altcoin.

Although China’s current actions differ, some traders speculate that even a new liquidity fraction that flows into the crypto could trigger another bull.

“Whether or not this translates into another gathering of explosive cryptography remains to be seen. But one thing is certain: when a great world economy requires liquidity – no matter how it is measured – the financial markets tend to take note of it, and the crypto is often at the center of this conversation, “said NFT Bear.

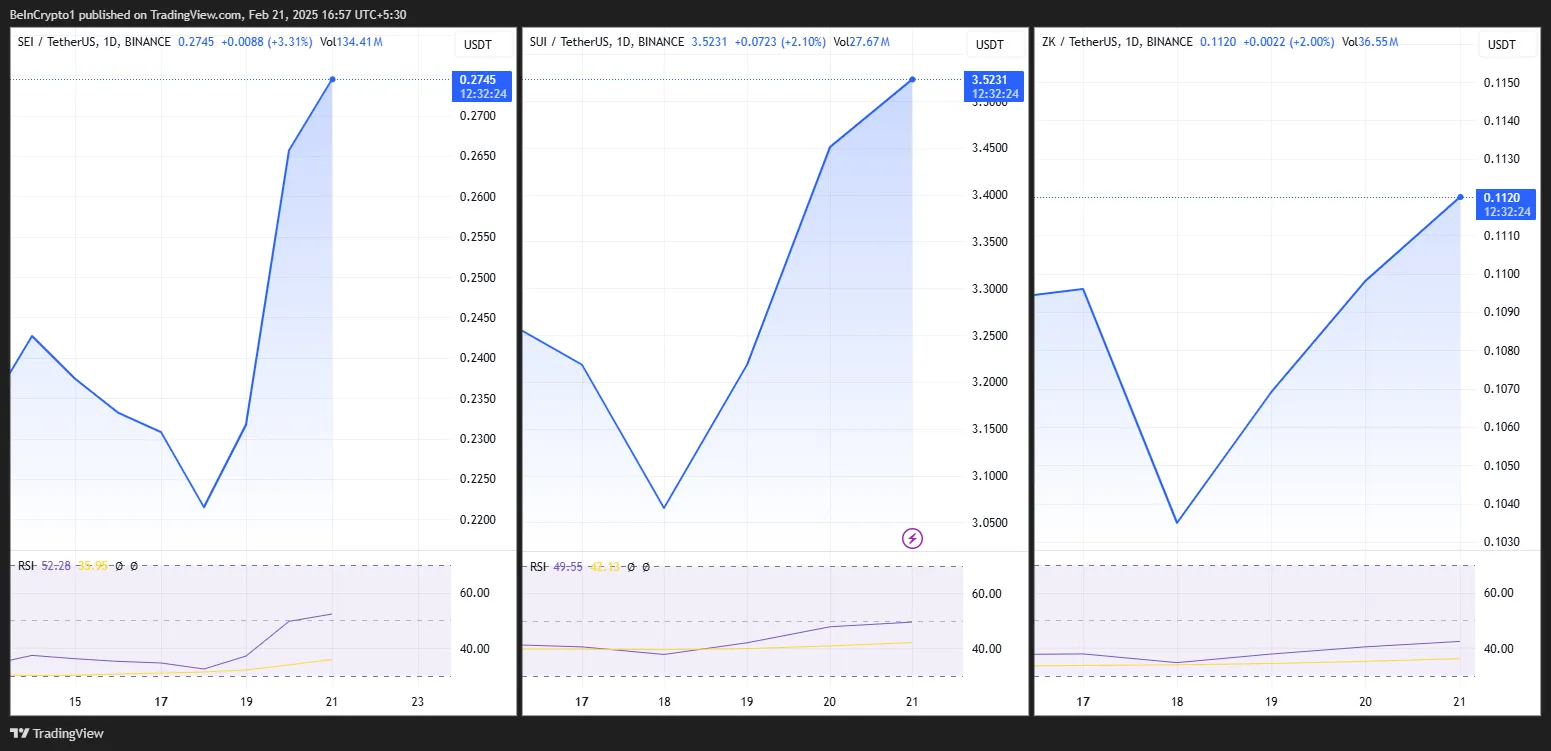

Despite uncertainty, some altcoins have surpassed. Projects like SEI (SEI), SUP (SUI), ZKSYNC (ZK) and Story (IP) have attracted attention, perhaps signaling emerging stories in space.

It remains to be seen that these gains are durable or simply temporary in a fragmented market. However, analysts agree that the traditional measures of the Altcoin season no longer apply.

The cryptography market is changing, Bitcoin acting as a paper asset via FNB (Stock Exchange Funds) and institutional funds. Instead of a large rotation of BTC-to-Al capital, Altcoins seem to develop independent accounts and a public service to attract capital.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.