Bitcoin Regains $90,000 Ahead of Key White House Crypto Summit

Bitcoin (BTC) jumped almost 8% on Wednesday, recovering the levels above $ 90,000 after having briefly dropped below $ 80,000 five days ago. These net recovery signals have renewed the bullish momentum while investors react to speculation surrounding the American cryptography reserve plan proposed by Trump.

Key technical indicators, such as the DMI and the Ichimoku Cloud, suggest that buyers have regained control. Whether the BTC can maintain this momentum and push towards $ 100,000 or cope with renewed volatility depends largely on the developments in the upcoming market, including the top of white house cryptography.

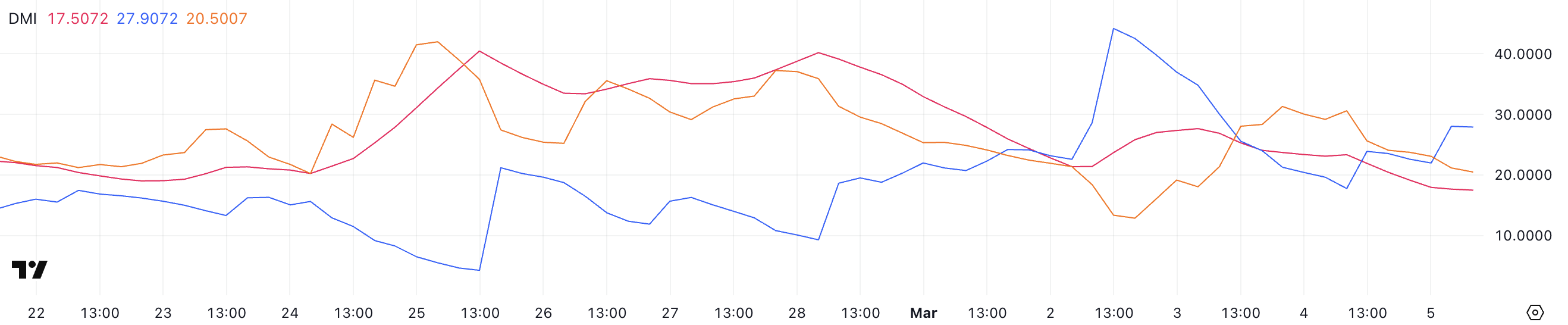

Bitcoin DMI shows that buyers have recovered control

The Bitcoin Directory Movement Index (DMI) shows that ADX fell to 17.5, down considerably compared to 27.6 only two days ago. An ADX declining indicates a weakening of the strength of trends, which means that the previous decline trend has lost the momentum.

At the same time, the + DI increased to 27.9 from 17.7 yesterday, while the -Di went from 30.5 to 20.5. This change suggests that the bullish momentum increases while the pressure of the sale fades.

Bitcoin is currently trying to drop from a downward trend to an upward trend, and these movements in the DMI lines indicate that buyers are starting to take control.

ADX, or the average directional index, measures resistance to trend rather than management. The values above 25 generally point out a strong trend, while the values below 20 indicate a low or undecided market.

With ADX now at 17.5, the action of the current Bitcoin prices lacks solid trend confirmation, which makes its next movement critical.

However, the increase + DI and the fall -Di suggest that the bull’s bull’sity increases. If ADX starts to climb next to an extended gap between + DI and -DI in favor of buyers, Bitcoin could establish a new upward trend.

Conversely, if ADX remains low, prices’ action can remain jerky, lacking in force necessary for a decisive break.

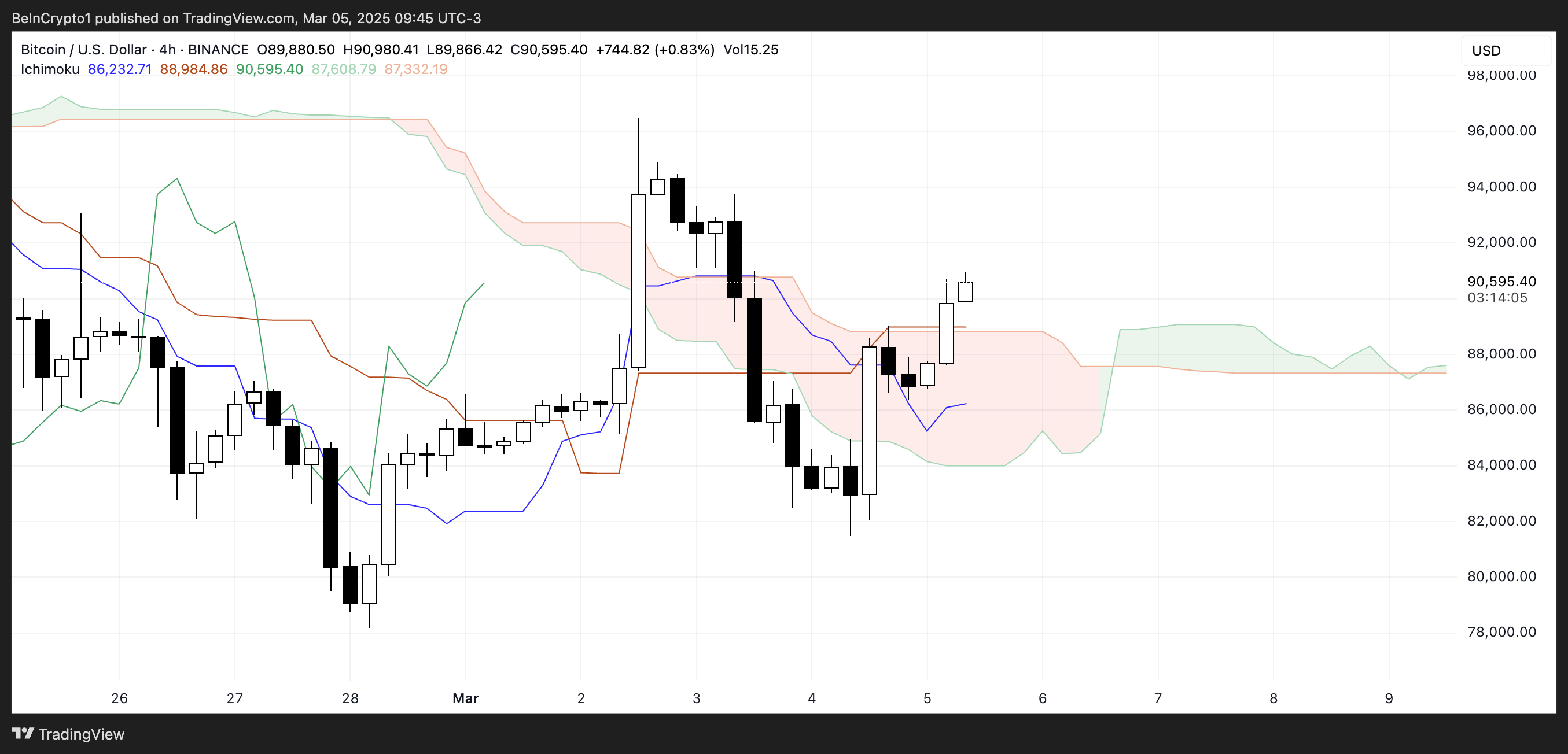

The BTC Ichimoku cloud shows a change of momentum

Bitcoin’s Ichimoku cloud structure suggests a potential change in momentum as the price exceeds key levels. The price recently exceeded the red basic line, indicating an increasing upward pressure. However, he always interacts with the cloud, which represents an area of uncertainty where trends are often tested.

The green range of management has started to go down. On the other hand, the scope of the orange head B remains relatively flat, showing that the cloud to come goes to a possible support area.

In addition, the duration of delay (green line) is approaching the price action there are 26 periods, which suggests that Bitcoin determines if this escape has enough strength to continue.

The Ichimoku cloud is a dynamic indicator that highlights the trend direction, momentum and key support and resistance areas. A decisive decision above the cloud would confirm a stronger upward trend, allowing Bitcoin to establish a more defined upward trend.

However, if the price does not hold above the red basic line and enters the cloud, it could indicate a period of consolidation or even a lower level retest.

The current configuration suggests that Bitcoin is at a critical point. The continuous momentum could lead to an escape, but a hesitation near the cloud could lead to a lateral movement before a clearer trend emerges.

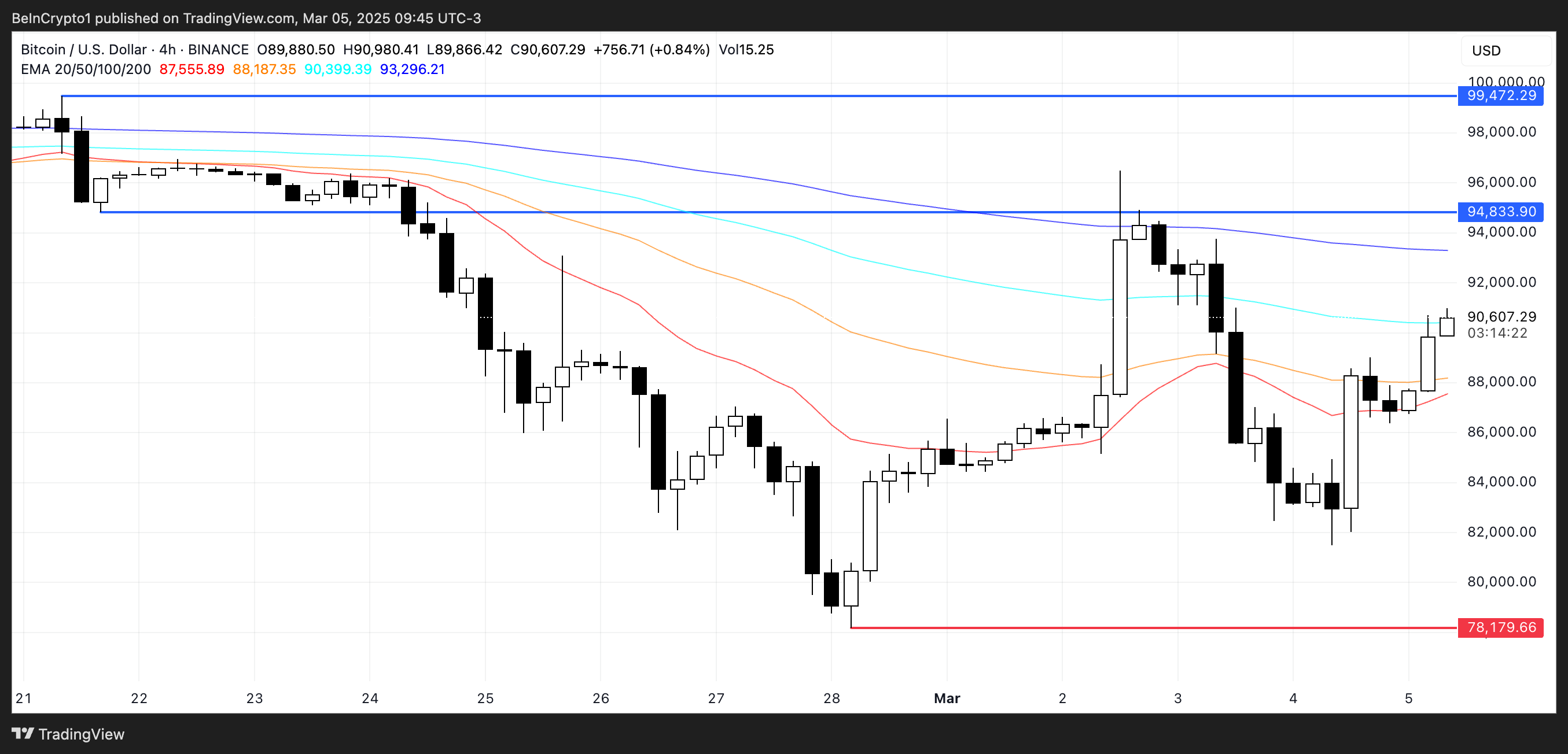

How will Bitcoin react after the summit of white house cryptography?

Bitcoin has recovered the level of $ 90,000 as speculation develops on a special potential treatment in the American crypto reserve plan proposed by Trump.

This renewed bullish momentum puts BTC in a position to test the resistance of the keys to $ 94,833. An escape above this level could potentially lead to a rally around $ 99,472.

If the bullish feeling continues to build, Bitcoin could exceed $ 100,000 for the first time since February 3, marking an important step.

The overall trend will depend on the question of whether the purchase pressure remains strong enough to maintain the current momentum and exceed these critical levels.

However, the recent Bitcoin price action has been very volatile, with high fluctuations in both directions in recent weeks.

The uncertainty of the market surrounding the next summit of white house cryptography on March 7 adds additional risks, because all developments that are not below investors’ expectations could trigger a renewed decrease trend.

If the bearish pressure is intensifying, the BTC could face a sharp decline, which is potentially lowering as low as $ 78,179.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.