Top 5 Made in USA Cryptos to Watch This Week

Made in USA Cryptos to look at this week Include XRP, Pi Network (PI), Story (IP), Jupiter (JUP) and Aerodrome Finance (Aero). XRP is in the lead in market capitalization, while Pi comes out of one of the greatest launches of tokens in recent history.

IP was one of the best performers recently, while JUP and Aero are under pressure despite fundamental solids. Here is a ventilation of how these five cryptos have made cryptos in the United States for the third week of March.

Xrp

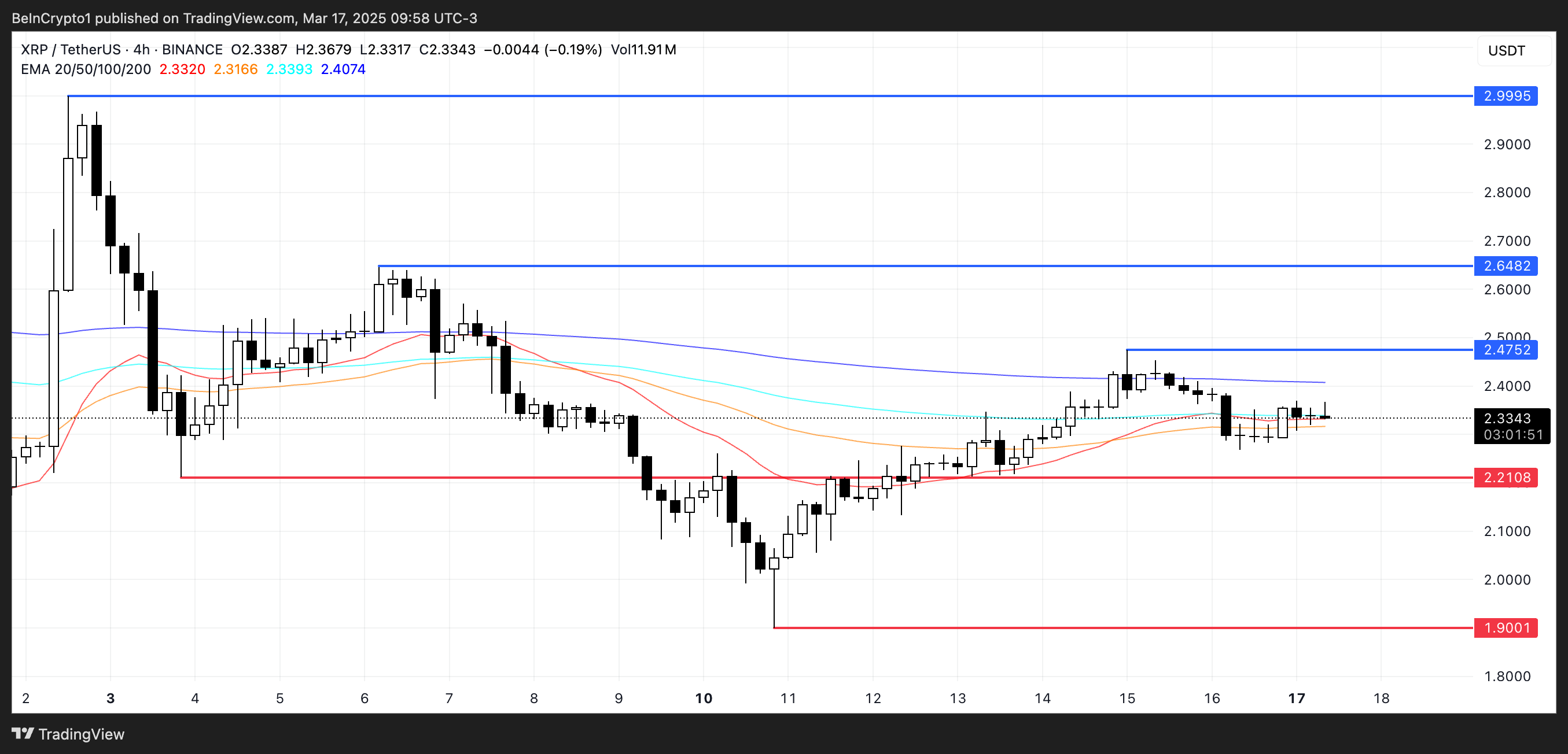

XRP is currently one of the largest manufactured in American cryptos by market capitalization. During the last month, its price fell by almost 17%, but it rebounded last week with a gain of almost 6%. This recent recovery attracts attention as traders ensure signs of a sustained trend reversal.

There are growing speculations that the dry could reclassify XRP as a commodity. Any positive development in the SEC VS XRP case could serve as a major bullish trigger.

A few months ago, similar news sparked a rally in XRP and increased activity through its ecosystem, including net gains in the same related parts.

If XRP can maintain this momentum and create an upward trend, it could target resistance at $ 2.47. An escape above this level could open the door to a movement around $ 2.64, and potentially even $ 3 if the bullish feeling is strengthened.

Upon decrease, a return to the lowering conditions could postpone XRP to the support of $ 2.21, and if they are broken, other losses at $ 1.90 are possible.

Pi Network (PI)

PI was one of the largest crypto launches in recent history, quickly reaching market capitalization nearly $ 20 billion. However, the token has been under pressure, correcting more than 20% in the last 30 days. Its market capitalization has now fallen below 10 billion dollars while the bassessing feeling continues to weigh on price action.

In recent days, Pi has faced growing criticism after the deployment of its areas. PI, which some members of the community have interviewed.

In addition, a large sale took place after the migration of the token token, adding additional drop pressure and contributing to its recent drop.

If the current downward trend persists, Pi Price could test the support at $ 1.23 and ventilation could push it below $ 1.20, marking its lowest level since February 22.

However, if the token manages to reverse the momentum and find an upward trend, it could question resistance to $ 1.57, with another upward potential for $ 1.82. A strong rally could even see Pi test $ 1.98 and possibly $ 2.35, exceeding $ 2 for the first time since March 1.

History (IP)

IP is currently one of the most efficient altcoins in the last 30 days, its price increasing by almost 235%. The rally pushed its market capitalization to nearly $ 1.4 billion, making it one of the remarkable tokens on the market during this period.

In the past few days, IP has entered a consolidation phase, with slowing prices after its impressive race. However, if the momentum returns and a bullish trend is established, the IP could question the levels of resistance of the keys to $ 6.66 and $ 6.96.

An escape above these levels could open the door to a thrust to $ 7.95 and perhaps beyond $ 8, fixing new peaks of all time.

On the other hand, if the sales pressure increases and a correction sets in, IP could first retain the support level of $ 5. If this level is not, more downwards could cause a drop to $ 4.49, and in a deeper decline, the price could even fall to $ 3.65.

Jupiter (JUP)

Jupiter, like most of the main tokens based on Solana and other Made in USA Cryptos, has experienced a clear correction in the last 30 days, its price down almost 45%. This drop reflects the wider sale observed through the Solana ecosystem while market conditions remain difficult.

Even with the recent decline, Jupiter continues to be one of the most profitable companies in cryptographic space. As one of the largest aggregators on the market, he generated $ 27 million in income in the last seven days, ranking just behind Tether and Circle as one of the most remunerated protocols.

If Solana’s ecosystem features a recovery, JUP could significantly benefit, with price targets at $ 0.54, $ 0.598 and $ 0.63 as key resistance levels.

A strong upward trend could even push the token around $ 0.86. However, if the downward trend persists, JUP can retain support for $ 0.48 and $ 0.44, and a new decline could see it fall below $ 0.40 for the first time.

Aerodrome finance (aero)

Aero is the largest Dex focused on the basic chain ecosystem and recently benefited from the growing interest in this network.

During last week, the aerodrome generated $ 1 million in fees, surpassing notable players such as Trokan, Bonkbot and GMGN, solidifying its position as a key director in the basic ecosystem.

However, despite its solid fundamentals, the Aero price has been under pressure, correcting more than 38% in the last 30 days. The token has now been negotiated at its lowest level since October 2024, reflecting broader volatility on the market.

If the downward trend persists, Aero could soon resume the level of support at $ 0.48.

On the other hand, if the purchase of return and Aero establishes an upward trend, it could evolve towards resistance at $ 0.56 and $ 0.61. An escape above these levels could open the door to a rally to $ 0.67 and potentially $ 0.739.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.