Analyst Breaks Down the Real Reason Why

The Bitcoin Prize (BTC) has reached a three-month hollow, reversing its post-electoral earnings after Donald Trump’s victory.

While the initial feeling of the market blamed the slowdown in the prices of American president Donald Trump and the recent recourse hack, analysts are now pointing towards a more structural cause.

Why Bitcoin blocks, the analyst offers a new perspective

CRypto analyst, Kyle Chasse, attributes the in progress crash on the cryptography market to relax cash and transport that has removed the BTC price for months. He explains that hedge funds have exploited a low -risk arbitration trade involving FNB Bitcoin Spot (negotiated stock market funds) and future CMEs.

“Bitcoin blocks. Wondering why? The cash and transport trade which removes the BTC price is taking place now, “he said.

The strategy concerned the purchase of FNB Bitcoin Spot such as those of Blackrock (Ibit) and Fidelity (FBTC). It also involved short-circuiting the contracts on the BTC on the CME and cultivating the spread for an annualized return of approximately 5.68%.

According to the analyst, some funds have used the leverage to increase two -digit yields. However, this trade is collapsing now, causing massive liquidity withdrawal from the market and sending the price of Bitcoin in free fall.

The collapse of cash and transport trade led to more than $ 1.9 billion in Bitcoin sold last week. This marks a significant decrease in the open interest of the CME as the hedge funds relax the positions. He also caused a two -digit percentage drop in the Bitcoin price in a few days.

According to Hunting, hedge funds never bet on the appreciation of long -term Bitcoin prices. Instead, they cultivated a risk -free yield using arbitration. Now that trade is dead, they quickly draw liquidity, intensifying the sale of bitcoin.

“Why is it going?” Because hedge funds do not care about Bitcoin. They don’t bet on the BTC moon. They cultivated low risk yield. Now that trade is dead, they are liquidity – leaving the market in free fall, “added the analyst.

Before the identification of The Cash and Carry, many traders blamed Trump’s aggressive prices. More recently, prices against the European Union have sparked fears of the market. Bybit’s recent hack also contributed to the feeling of bitter investors.

While Bitcoin remains under pressure, Kyle Chasse sees a way forward. More liquidity and transport are expected, which means that the forced sale will continue until all hedge funds are eliminated. Volatility will probably increase as lever effects will be liquidated, resulting in net fluctuations in the price of Bitcoin.

If the analyst’s point of view is true, Bitcoin would need real long -term holders to intervene and absorb sales pressure. According to technical analysis, the next Bitcoin target could be around $ 70,000, a key support that could stabilize the market.

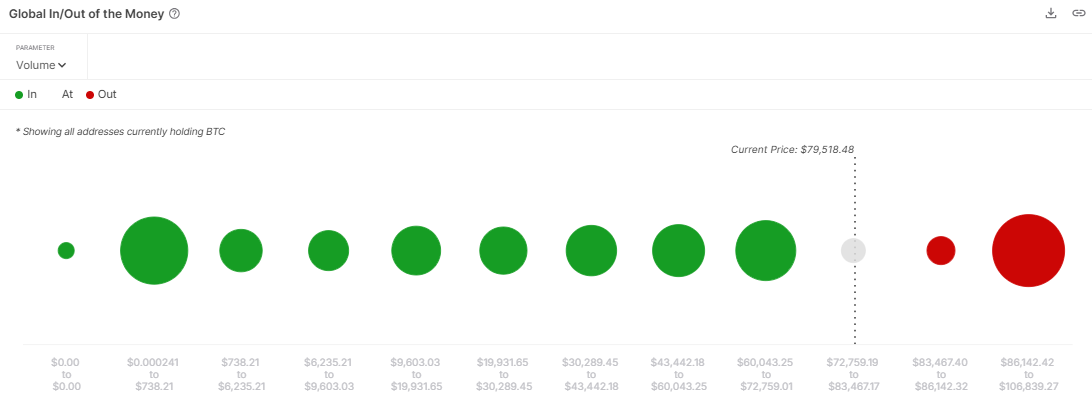

Towards this level, 6.76 million addresses hold approximately 2.64 million BTC tokens acquired at an average price of $ 65,296. Therefore, this area can provide significant support for the price of Bitcoin, as holders prevent new losses.

The analyst acknowledges that the FNB -focused demand was partly real but strongly influenced by arbitration players looking for rapid benefits. For the moment, the market undergoes painful but necessary reset. With him, traders and investors should prepare for volatility in what could lay the foundations for the following directional biases of Bitcoin.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.