Analyst Warns of a Massive Bitcoin Short Squeeze, Here’s Why

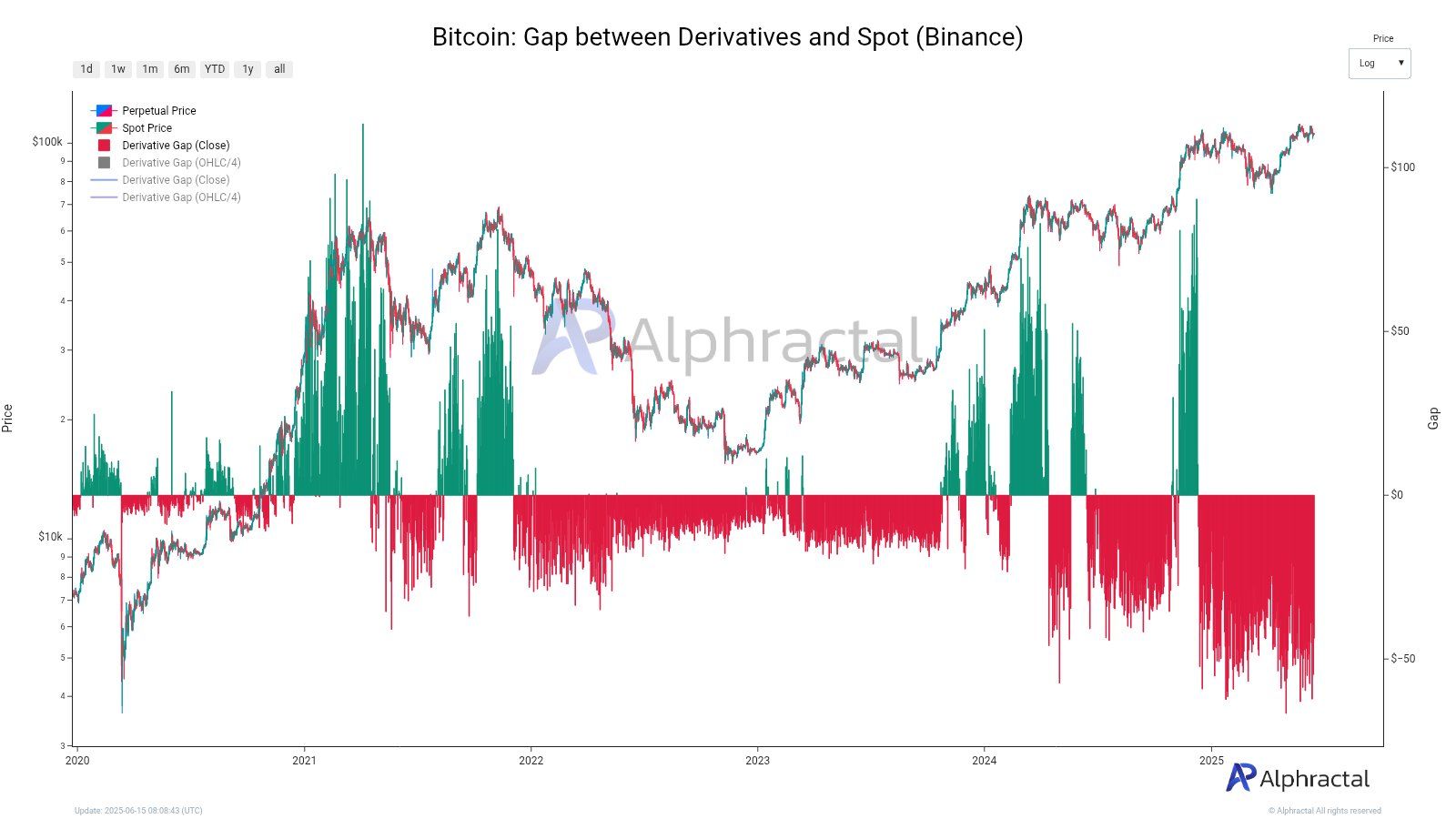

Bitcoin prices in derivative contracts on Binance are currently $ 40 to $ 50 lower than cash prices. This spread is much wider than in previous market cycles, even if Bitcoin is negotiated near its top of all time (ATH).

This marks a notable gap in relation to past trends and raises questions among investors about what it means in the environment of the current market.

Why are Bitcoin derivatives lower than the place?

During 2021-2022, when derivative prices dropped below punctual prices, he often marked a lower market. At that time, this type of propagation had generally come with high price reductions, reflecting the lowering feeling and the sales pressure of traders.

On the other hand, when the derivatives exchanged higher than spot, it generally indicated a bull market. Bitcoin would then continue to reach new heights.

However, the current situation is very different. Although Bitcoin reaches high levels of all time, derivative prices still decrease below the place. This suggests that new market forces could now be at stake.

Alphractal believes that a possible reason behind this phenomenon is the pressure of institutional players.

“This can reflect institutional coverage, arbitration or ETF dynamics,” said Alphractal.

João Wedson, the founder of Alphractal, added that this situation could lead to a short pressure. Short pressure occurs when the price of Bitcoin suddenly increases, forcing the sellers uncovered to buy BTC to cover their positions. Their urgent purchase increases market demand.

“If the difference in perpetual BTC price on the Binance becomes positive again, it is a sign that the price is about to explode. Until it happens, we can say that many institutions already exert pressure by shorts, which could be good for a possible short pressure because they go against OG whales,” said Joao Wedson.

Crypto rover predicts a short pressure massive bitcoin

In his latest analysis video, Crypto Rover also stressed that the greatest Bitcoin pressure is about to take place.

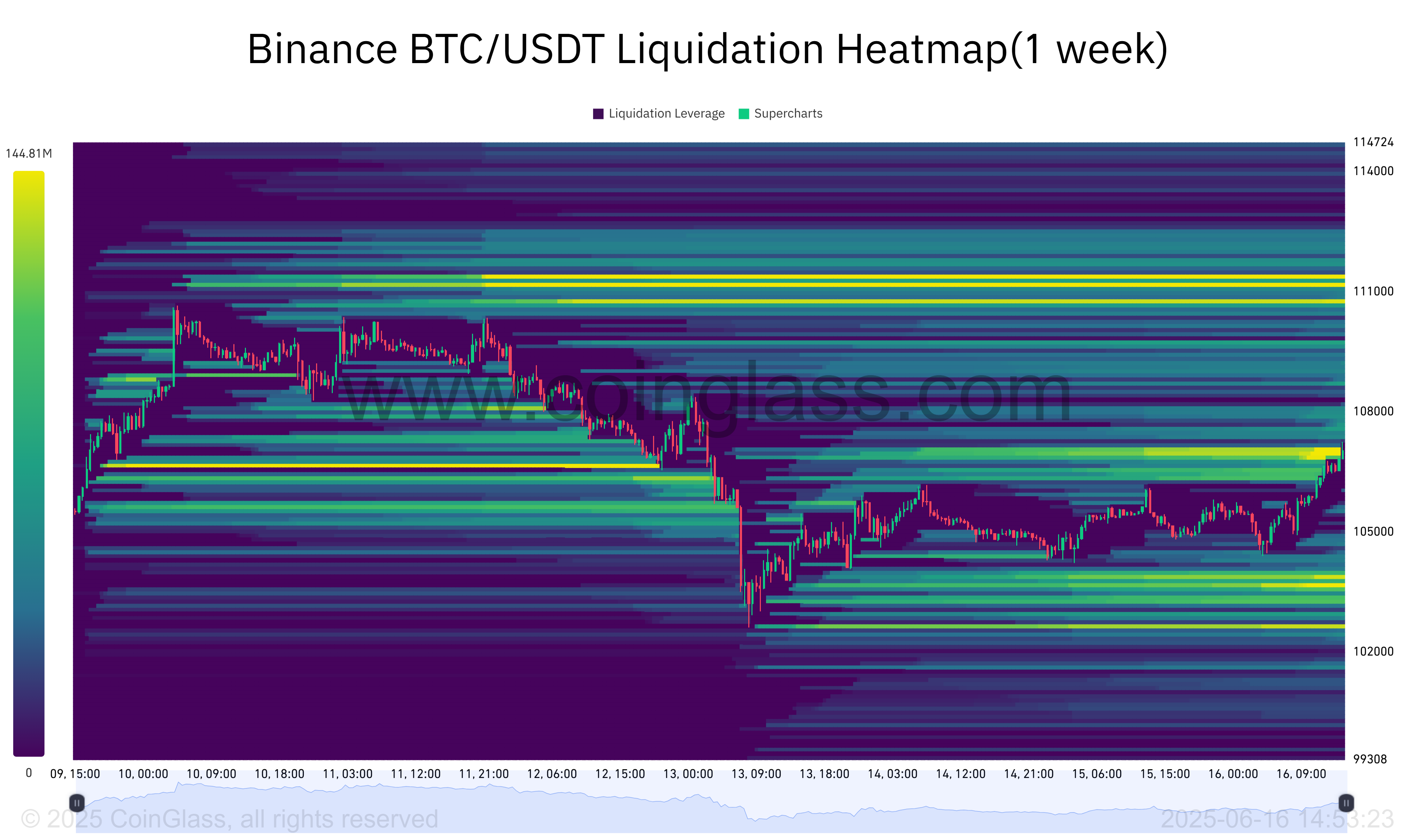

According to him, the sensitive Bitcoin price area is around $ 110,000 at $ 111,000. This is where a large amount of liquidity is concentrated. If the Bitcoin price crosses this area, many short positions will be liquidated. This could trigger a new wave of explosive momentum.

“It is therefore very important to break above this top here. And each time we do, we will probably go up quickly again … I see major liquidity quantities at that time, above us, around $ 110,000 at $ 111,000. There are just major quantities of Bitcoin liquidation that accumulates here,” predicted crypto rover.

The explanation of João Wedon and the prediction of Crypto Rover both suggest that the current prices propagation could be a bull’s bitcoin signal. However, this view diverges from historical models.

It shows that the market enters an unprecedented new phase. This change complicates short and long -term forecasts, which makes price movements more difficult to predict than ever.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.