Analysts Give Dead Market Warning

Welcome to the US Crypto News Morning Briefing, your essential overview of the most important crypto developments for the day ahead.

Grab a coffee as the crypto market becomes eerily quiet. ETF inflows have dried up, digital asset treasuries are unwinding, and traders appear to have lost their spark. As sentiment stagnates and altcoins lag, analysts say this lull could mask deeper structural and psychological fatigue.

Sponsored

Today’s Crypto News: DAT Unwinding, ETF Outflows Leave Stocks Lagging Market

Crypto market momentum has hit a wall, with analysts attributing the latest wave of weakness to structural and psychological factors.

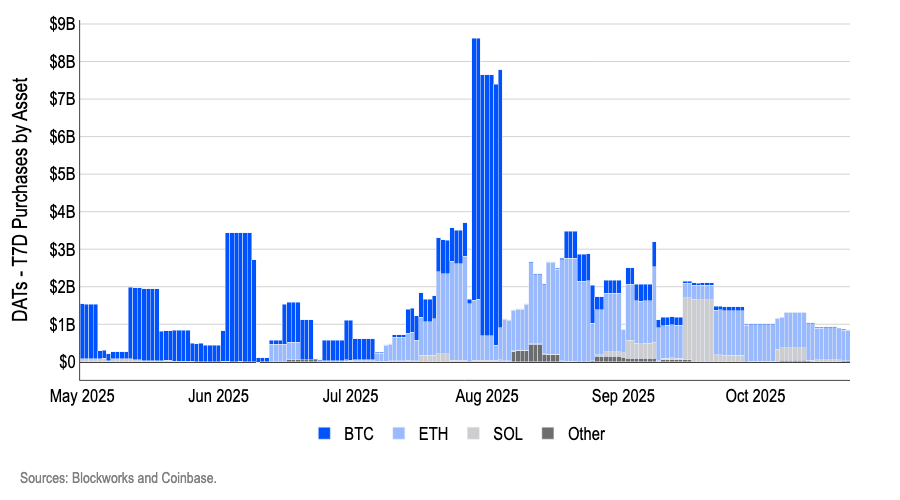

Demand for ETFs has dried up, digital asset trusts (DATs) are reducing their exposure, and traders are struggling to find conviction as crypto continues to underperform stocks. Market analyst Miles Deutscher said several forces are converging to put pressure on Bitcoin and Ethereum.

According to Deutscher, although most large trusts remain stable, smaller ones are acting to protect their net asset value.

“ETF demand has dried up (there have been net outflows over the past few weeks)…There is some DAT unwinding for $BTC and $ETH,” he explained.

Deutscher also cited the October 10 market shock, a day of vast crypto selloffs, as a lingering overhang.

“October 10th did a lot of damage on multiple fronts… Psychologically, it’s a bad look for crypto and it’s the nail in the coffin after weeks of stocks underperforming. Materially, market makers are still unwinding. I don’t think we fully understand the extent of the damage,” he said.

Sponsored

The result was widespread retailer burnout, with prolonged price stagnation that exhausted even seasoned traders.

As unwinds continue and ETF spot flows turn negative, Deutscher says it’s not surprising that prices are falling. Nonetheless, Deutscher believes sentiment could change quickly if Bitcoin breaks through a surge.

“There is one thing that can change this whole dynamic: a good $BTC pump. Even in August we saw BTC/ETH completely reverse sentiment… It doesn’t really need a reason. It’s Bitcoin,” he wrote.

Altcoin lethargy deepens as analysts urge patience and research

Meanwhile, altcoins continue to stagnate, reflecting broader risk aversion. Analyst Daan Crypto Trades pointed out that only 29% of the top 50 altcoins have outperformed BTC this year.

Sponsored

The indicator has not risen above 39% for six months, a stark contrast to the 2020-2021 cycle, when altcoins outperformed for extended periods.

“All that followed were short periods of outperformance, never lasting more than two to three months,” Daan noted.

Therefore, the best solution for investors is to focus on research rather than short-term trading, identifying emerging themes such as AI agents, RWAs and prediction markets.

As Bitcoin consolidates below major resistance and traditional stocks reach new highs, crypto’s next move could depend less on fundamentals and more on whether the market can regain its confidence.

Sponsored

Chart of the day

Byte-sized alpha

Here’s a roundup of other US crypto news to follow today:

Pre-Market Overview of Crypto Stocks

| Business | At the close of October 30 | Pre-market preview |

| Strategy (MSTR) | $254.57 | $270.00 (+6.06%) |

| Coinbase (COIN) | $328.51 | $343.14 (+4.45%) |

| Galaxy Digital Funds (GLXY) | $34.13 | $35.42 (+3.78%) |

| MARA Holdings (MARA) | $17.76 | $18.26 (+2.82%) |

| Riot Control Platforms (RIOT) | $21.09 | $21.94 (+4.03%) |

| Basic Scientist (CORZ) | $20.74 | $21.94 (+5.79%) |