Andrew Tate’s Risky 25x Leverage Echoes James Wynn’s Loss

The controversial celebrity Andrew Tate learns that high -level trading on decentralized platforms like hyperliquid is not for the low hearts.

His experience only occurs days after James Wynn has made the headlines like a unlucky whale taking lever effects on the hyperliquid.

Andrew Tate’s hyperliquid game reflects James Wynn’s expensive collapse

According to data on the Lookonchain chain, the influencer and former Kickboxer lost $ 583,000. The losses were occurred after having placed more than 76 trades, but managing only 27 victories, which results in a victory rate of 35.53%.

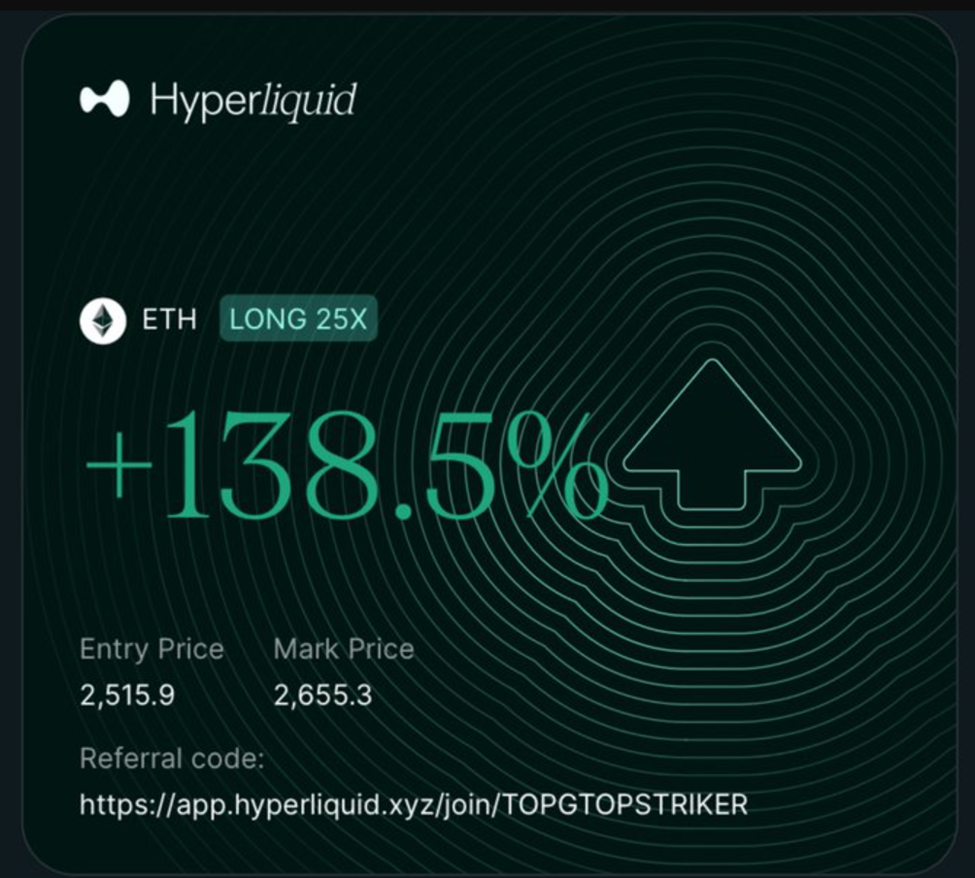

His last blow? A 25x lever long on ETH. This position hausses the eyebrows because it strangely recalls the disastrous strategies deployed by the infamous hyperliquid whale, James Wynn.

The risky lever effect puts it in risking serious liquidation, a reality that James Wynn knows only too well. Wynn, who once raised $ 87 million in commercial gains, saw the majority of it evaporate in a series of poorly timed trades.

Among them were a long 100 million dollars in BTC and an exchange of 10x pepe which cost him $ 858,580.

Beincrypto documented Wynn’s decline, showing how the high -flying trader became a lesson while hyperliquid trading volumes exploded at $ 8.6 billion a day, fueled by its viral losses.

The recipes of Blockchain Crash Bravade reveal an outbid pain

Tate, which recently removed a position offering a profit of 138.5% to promote its reference link, was quickly exposed when blockchain detectives discovered its real portfolio performance.

“Andrew Tate has just shown his hyperliquidal business which was profitable by 138.5%… His portfolio was quickly found and discovered that it was $ 600,000 in red,” said Daniel de Ccpool.

This last part, promising to do everything in a single job, is the place where the red flags multiply. Analysts warn that any lever effect greater than 10x increases the risk of liquidation by more than 40%, especially on volatile markets.

The ONESAFE financial technology company revealed a March 2025 incident where a hyperliquidal whale had an ETH position of $ 200 million destroyed after the maintenance of the margins has failed.

This merchant has used a 50x lever effect, indicating that things can be in a spiral.

“LEVER effect trading can be a double -edged sword … It offers an attractive opportunity for profit, but … can cause fairly devastating losses,” noted ONESAFE analysis.

The collapse triggered questions about risk protocols and even saw the native hyperliquidal token, media threshing, a drop of 8.5%. These episodes prompted the dex hyperliquid to reduce maximum leverage. The Bitcoin cap went from 50x to 40x and Ethereum from 33x to 25x.

These incidents show that transparency and monitoring of real -time liquidation are essential for decentralized exchanges (DEX) To avoid explosions.

Beyond the merchants themselves, however, these public effits offer a broader lesson on decentralization and transparency.

“This is a lesson in the advantages of decentralization. Everything is on the blockchain. So, no matter the lies that someone says, just try to confirm,” noted King Crypto.

The Tate portfolio would now have only $ 4, which prompted online jokes.

Tate and Wynn incidents are more symbolic than strategic. They show two high -level traders taken from a lever effect, which is undoubtedly the most treacherous trap of Defi.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.