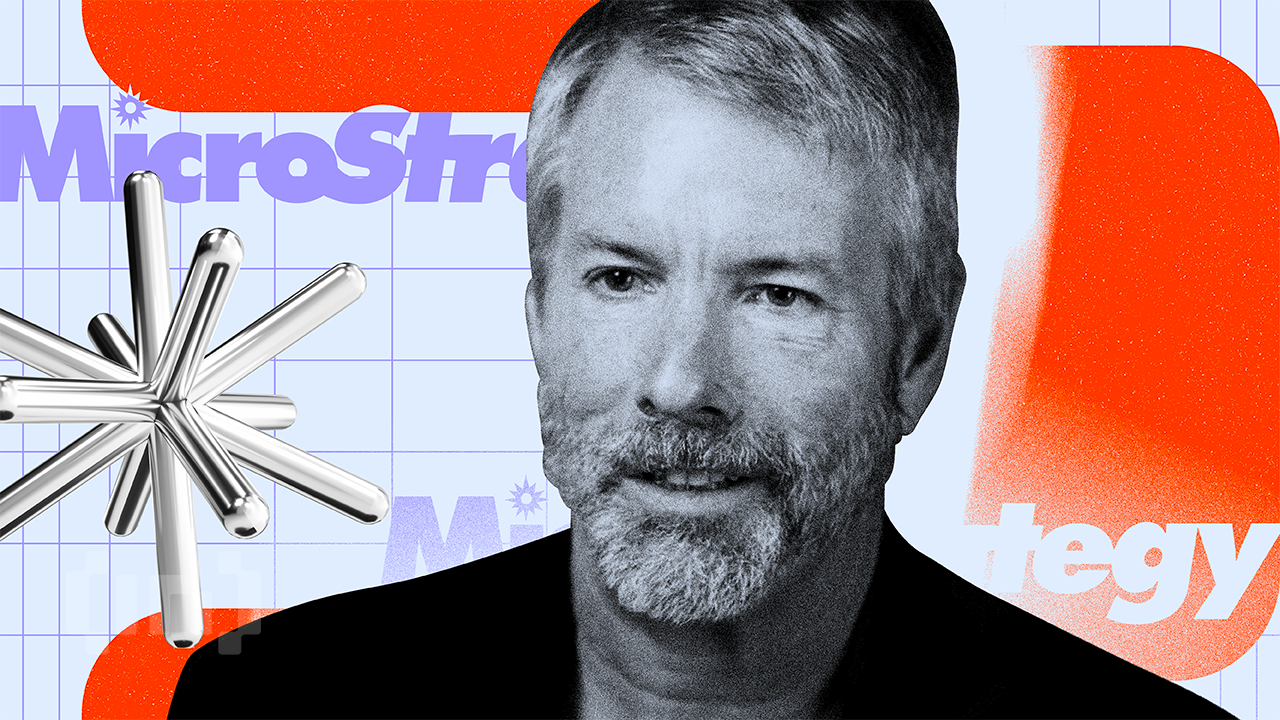

Arkham Under Fire for Doxxing Michael Saylor’s BTC Wallets

Arkham Intelligence is under fire because he continues to reveal what he claims to represent 97% of the Bitcoin holdings by Michael Saylor and Microstrategy.

Given Saylor’s weight on the cryptography market, exposure has raised fears of centralization, operational risk and market collapse.

Arkham under fire to expose the Bitcoin portfolios of the strategy

Beincrypto reported the initial discovery of Arkham on Thursday, May 29, connecting 70,816 BTC tokens to Microstrategy (now strategy). This discovery violated the president of the strategy, Michael Saylor, Secrecy Stance.

“The current conventional way of publishing proofs of reservations is proof of insecurity reserve. No institutional or business security analyst would think that the publication of portfolios is an excellent idea, “said Saylor.

Despite the mixed feelings exhibited on display, the blockchain analysis company has proceeded to another revelation, extending its discovery of 87.5% to 97% of Bitcoin holdings of all strategies.

More specifically, Arkham Intelligence identified 53,833 additional BTC, valued at around 5.75 billion dollars. This brings their Bitcoin Holdings coverage of Saylor to 59.92 billion.

According to the blockchain expert, the effort is part of a push towards the free and public proof of the reserves (POR).

However, while Arkham celebrates its stage of transparency, being the first to identify these assets publicly, many members of the cryptographic industry see it as a dangerous violation of privacy.

Michael Saylor and are the strategy only one point of failure?

More specifically, the votes of the industry arouse concerns about the consequences of such a large concentration of Bitcoin holders linked to a single entity. This is particularly true given the weight of Michael Saylor on the cryptography market.

“If they move this BTC of portfolios, expect a collapse of the market. We have just discovered a new failure point,” warned Markus, a veteran of Crypto Nomad and Bitcoin, in a post.

Others have echoed concerns about the risk of doxxing. Among them, there is even trader madpunk corners, who reiterated the concerns of a market sale

“You think you are doing something very cool after equipping its secret wallets, if it was trying to sell a bitcoin. The whole market will block,” wrote the merchant.

The revelation sparked a hard debate on the compromise between transparency, operational security and the influence of market players. For some, the public blockchain public data must be used to guarantee responsibility for an era of undertaken corporate complaints.

“For people who ask why Arkham would do this … Have you forgotten why the 2009 accident happened? Have you heard of Bitcoin in gold and paper? Do you know that companies lie to get glory and money? If you boast of buying 60 billion bitcoin … show receipts,” noticed the modern investor, a popular user on X, noted.

Meanwhile, some see the assets of a leading individual as undergoing resistance to Bitcoin censorship and personal pharmacy.

The feeling is that it endangers the larger market, since the strategy commands a substantial part of the circulating offer of Bitcoin.

Saylor has long argued that Bitcoin is the Apex asset, converting the famous microstrategy cash reserves and increasing the debt to acquire BTC.

“The only thing better than Bitcoin is more bitcoin,” wrote Saylor in an article.

However, with most of his now exposed wallets, analysts say that Michael Saylor could be cashed. Meanwhile, others insist that Bitcoin Maxi may not intend to sell BTC.

“Lol, Saylor does not want to sell. He already holds the Apex asset. Selling for what? He sold Fiat for Bitcoin. Do you want to sell USD for Indian rupees? The answer is no, sell BTC for USD is the same thing,” said Josef Rakich, another popular user on X (Twitter).

However, concerns are rising. If one of these portfolios shows an outgoing activity, the markets could interpret it as a liquidation signal, triggering panic.

With such a massive concentration of participations now publicly linked to traceable addresses, some say that bad actors could also target Saylor or the strategy directly. It is with priority, given that the United States leads in cases of abduction of cryptography and the rise of cryptographic crimes in France.

While Arkham’s campaign tests the limits of the crop of transparency of cryptography, it also exposed how fragile market is in the blockchain arena. The Saylor BTC, formerly a symbol of conviction, is now a global risk variable.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.